Carla Vista Corporation, which uses ASPE, leased equipment it had manufactured at a cost of $143,000 for Sheridan, the lessee. The equipment's regular selling

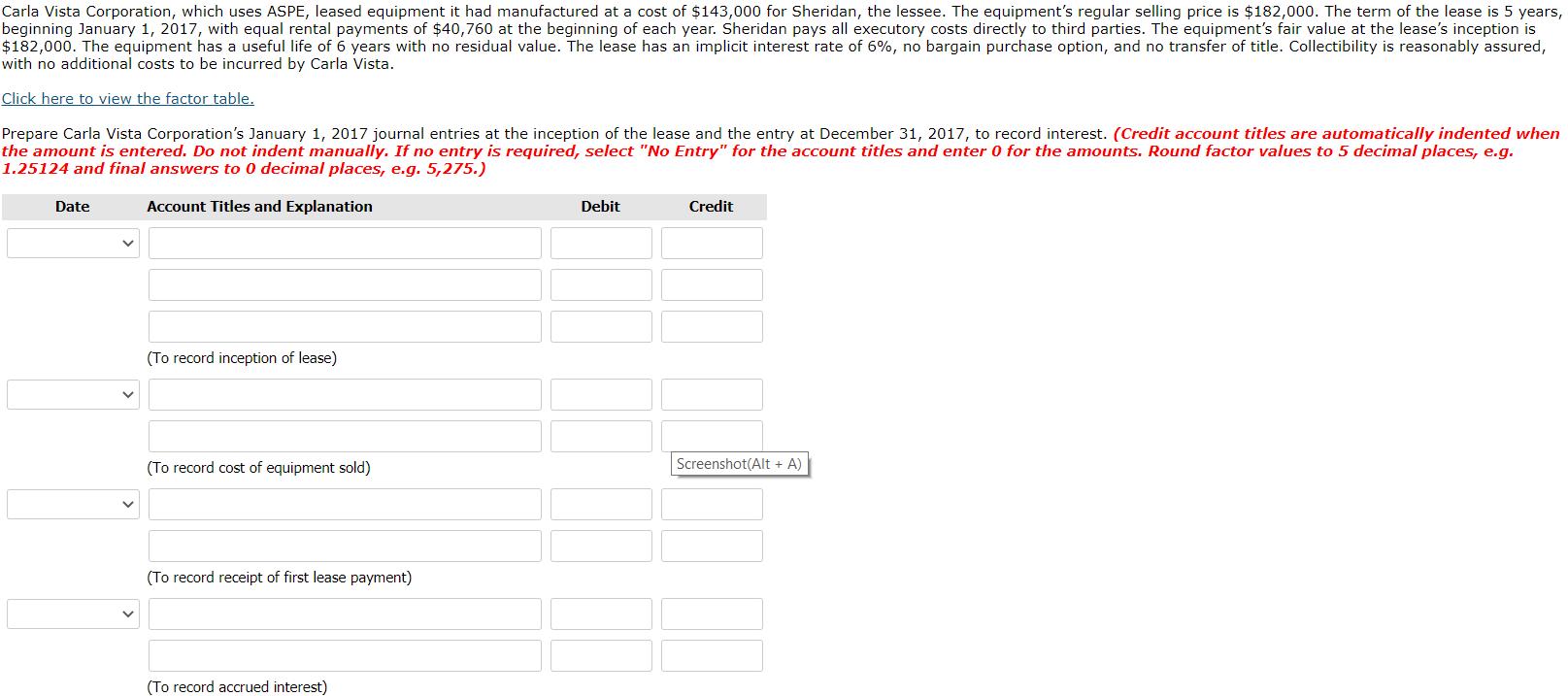

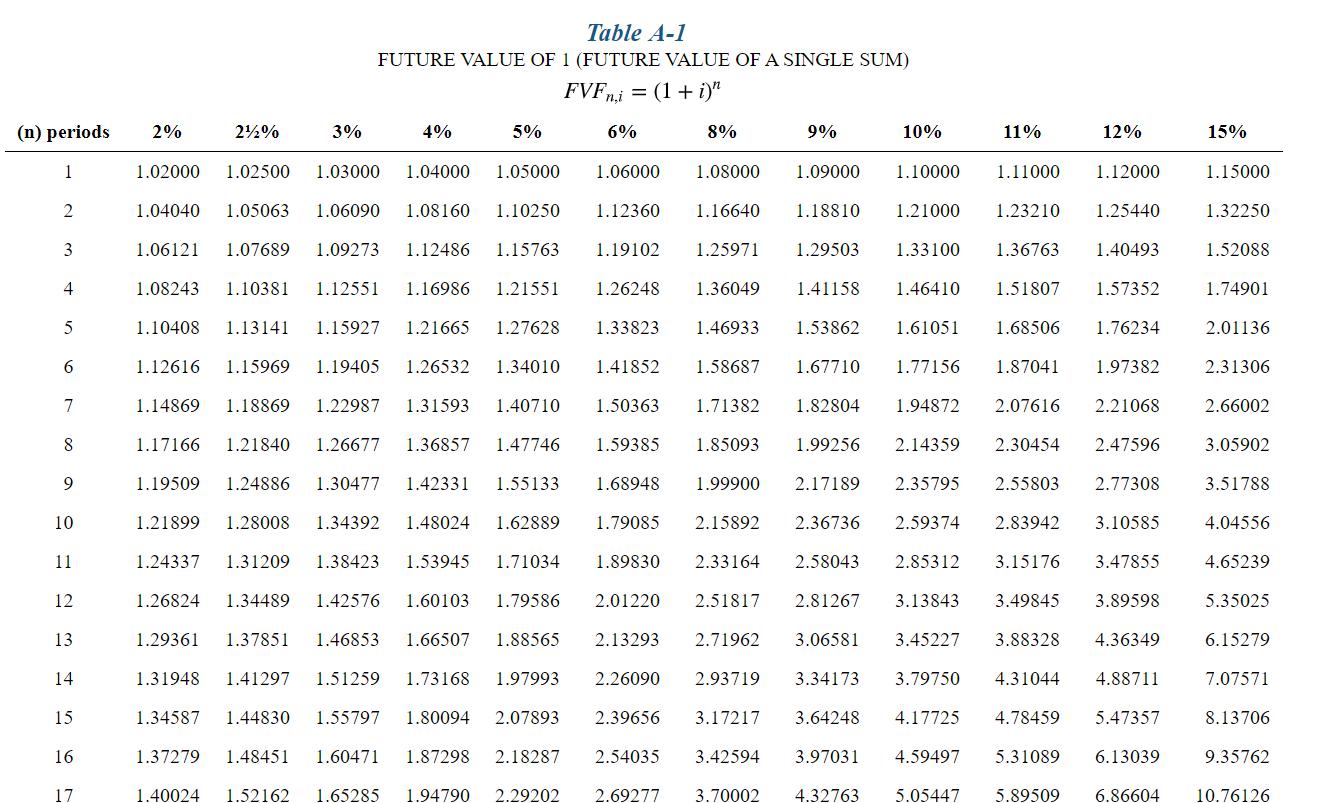

Carla Vista Corporation, which uses ASPE, leased equipment it had manufactured at a cost of $143,000 for Sheridan, the lessee. The equipment's regular selling price is $182,000. The term of the lease is 5 years, beginning January 1, 2017, with equal rental payments of $40,760 at the beginning of each year. Sheridan pays all executory costs directly to third parties. The equipment's fair value at the lease's inception is $182,000. The equipment has a useful life of 6 years with no residual value. The lease has an implicit interest rate of 6%, no bargain purchase option, and no transfer of title. Collectibility is reasonably assured, with no additional costs to be incurred by Carla Vista. Click here to view the factor table. Prepare Carla Vista Corporation's January 1, 2017 journal entries at the inception of the lease and the entry at December 31, 2017, to record interest. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit (To record inception of lease) (To record cost of equipment sold) Screenshot(Alt + A) (To record receipt of first lease payment) (To record accrued interest) Table A-1 FUTURE VALUE OF 1 (FUTURE VALUE OF A SINGLE SUM) FVFni = (1+ i)" (n) periods 2% 22% 3% 4% 5% 6% 8% 9% 10% 11% 12% 15% 1 1.02000 1.02500 1.03000 1.04000 1.05000 1.06000 1.08000 1.09000 1.10000 1.11000 1.12000 1.15000 2 1.04040 1.05063 1.06090 1.08160 1.10250 1.12360 1.16640 1.18810 1.21000 1.23210 1.25440 1.32250 3 1.06121 1.07689 1.09273 1.12486 1.15763 1.19102 1.25971 1.29503 1.33100 1.36763 1.40493 1.52088 4 1.08243 1.10381 1.12551 1.16986 1.21551 1.26248 1.36049 1.41158 1.46410 1.51807 1.57352 1.74901 5 1.10408 1.13141 1.15927 1.21665 1.27628 1.33823 1.46933 1.53862 1.61051 1.68506 1.76234 2.01136 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 1.58687 1.67710 1.77156 1.87041 1.97382 2.31306 7 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 1.71382 1.82804 1.94872 2.07616 2.21068 2.66002 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 1.85093 1.99256 2.14359 2.30454 2.47596 3.05902 1.19509 1.24886 1.30477 1.42331 1.55133 1.68948 1.99900 2.17189 2.35795 2.55803 2.77308 3.51788 10 1.21899 1.28008 1.34392 1.48024 1.62889 1.79085 2.15892 2.36736 2.59374 2.83942 3.10585 4.04556 11 1.24337 1.31209 1.38423 1.53945 1.71034 1.89830 2.33164 2.58043 2.85312 3.15176 3.47855 4.65239 12 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 2.51817 2.81267 3.13843 3.49845 3.89598 5.35025 13 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 2.71962 3.06581 3.45227 3.88328 4.36349 6.15279 14 1.31948 1.41297 1.51259 1.73168 1.97993 2.26090 2.93719 3.34173 3.79750 4.31044 4.88711 7.07571 15 1.34587 1.44830 1.55797 1.80094 2.07893 2.39656 3.17217 3.64248 4.17725 4.78459 5.47357 8.13706 16 1.37279 1.48451 1.60471 1.87298 2.18287 2.54035 3.42594 3.97031 4.59497 5.31089 6.13039 9.35762 17 1.40024 1.52162 1.65285 1.94790 2.29202 2.69277 3.70002 4.32763 5.05447 5.89509 6.86604 10.76126

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Calculation of Lease Receivables Residual Value Unguaranteed 0 Lease Payment 40760 No of pe...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started