Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You recently joined the staff of Bombay Corporation, a multi-national retail business. You have been asked to review the income statement and balance sheet

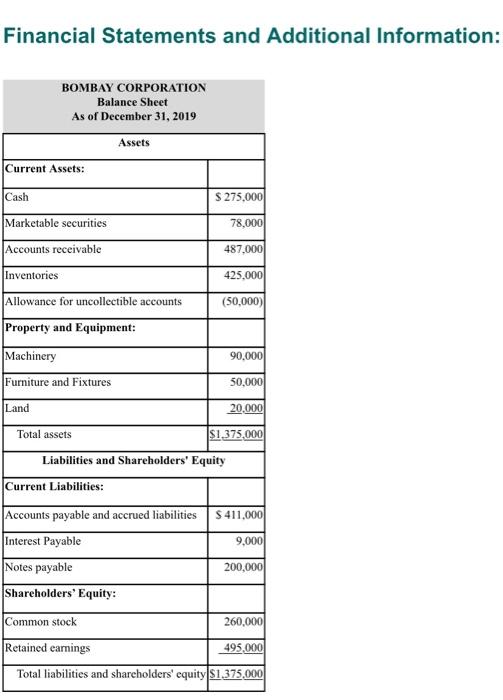

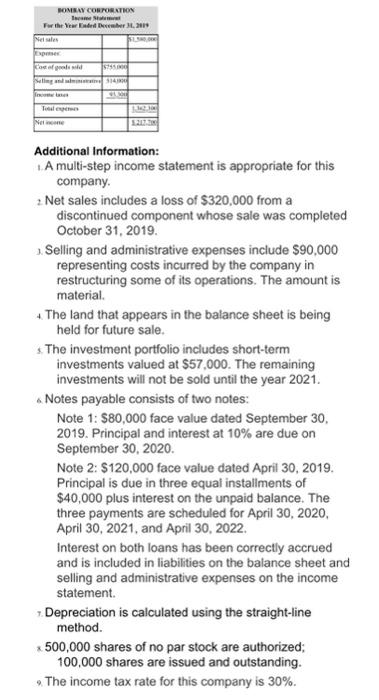

You recently joined the staff of Bombay Corporation, a multi-national retail business. You have been asked to review the income statement and balance sheet prepared by the previous staff accountant. The statements and additional information are found on pages 2-3. Required: 1. Discuss the purpose of a classified balance sheet. 2. Discuss the purpose of a multi-step income statement. Financial Statements and Additional Information: Current Assets: Cash BOMBAY CORPORATION Balance Sheet As of December 31, 2019 Marketable securities Accounts receivable Inventories Allowance for uncollectible accounts Property and Equipment: Machinery Furniture and Fixtures Land Assets Total assets $ 275,000 Current Liabilities: Accounts payable and accrued liabilities Interest Payable Notes payable Shareholders' Equity: 78,000 487,000 425,000 (50,000) Liabilities and Shareholders' Equity 90,000 50,000 20,000 $1,375,000 $411,000 9,000 200,000 Common stock Retained earnings Total liabilities and shareholders' equity $1,375,000 260,000 495,000 BOMBAY CORPORATION Income For the Year Ended December 31, 201 Net sales $1,500,000 Exposer Con of goods sold Seling and admin Total expenses Net $755.000 314,00 $1,300 362 Additional Information: 1.A multi-step income statement is appropriate for this company. 2 Net sales includes a loss of $320,000 from a discontinued component whose sale was completed October 31, 2019. Selling and administrative expenses include $90,000 representing costs incurred by the company in restructuring some of its operations. The amount is material. + The land that appears in the balance sheet is being held for future sale. The investment portfolio includes short-term investments valued at $57,000. The remaining investments will not be sold until the year 2021. & Notes payable consists of two notes: Note 1: $80,000 face value dated September 30, 2019. Principal and interest at 10% are due on September 30, 2020. Note 2: $120,000 face value dated April 30, 2019. Principal is due in three equal installments of $40,000 plus interest on the unpaid balance. The three payments are scheduled for April 30, 2020, April 30, 2021, and April 30, 2022. Interest on both loans has been correctly accrued and is included in liabilities on the balance sheet and selling and administrative expenses on the income statement. 7. Depreciation is calculated using the straight-line method. 500,000 shares of no par stock are authorized; 100,000 shares are issued and outstanding. The income tax rate for this company is 30%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Purpose of classified balance sheet clssified blnce sheet is finncil sttement tht presents the ssets libilities nd equity in relevnt subctegories th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started