Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Catherine is a U.S. citizen who is employed by DSC, Inc., a global company. Beginning on August 1, 2020, Catherine began working in Augsburg,

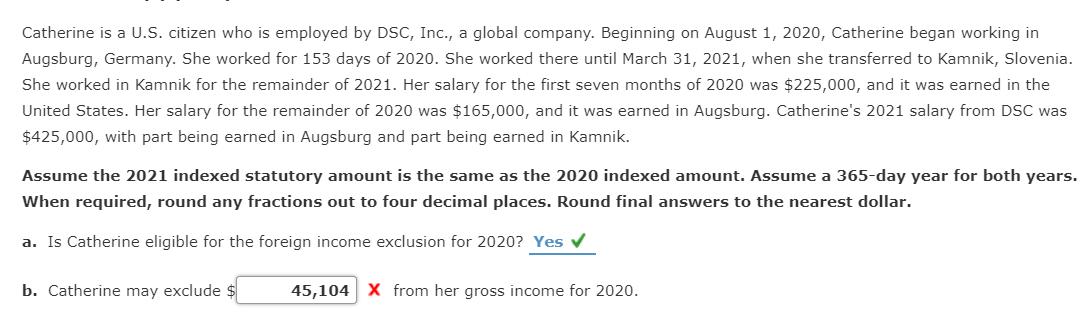

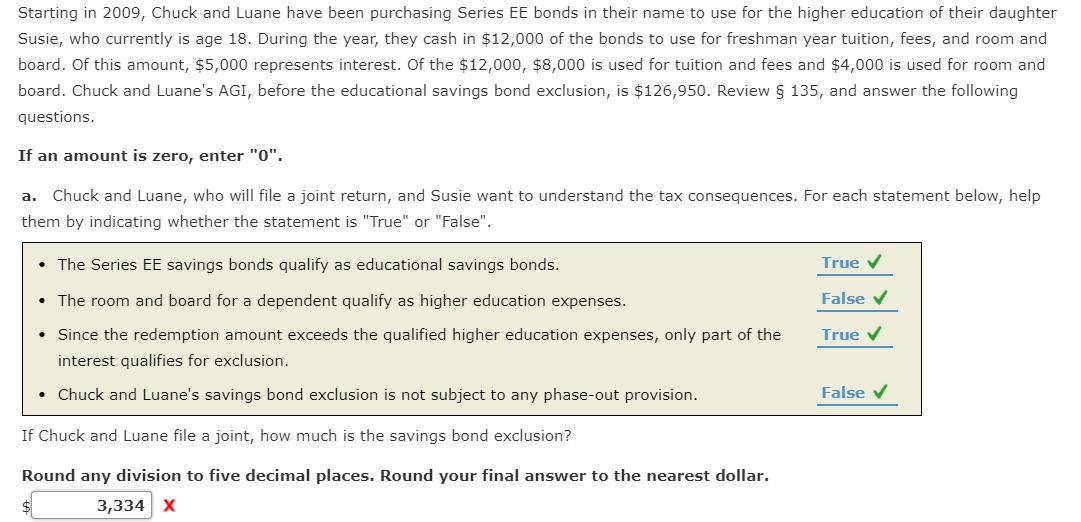

Catherine is a U.S. citizen who is employed by DSC, Inc., a global company. Beginning on August 1, 2020, Catherine began working in Augsburg, Germany. She worked for 153 days of 2020. She worked there until March 31, 2021, when she transferred to Kamnik, Slovenia. She worked in Kamnik for the remainder of 2021. Her salary for the first seven months of 2020 was $225,000, and it was earned in the United States. Her salary for the remainder of 2020 was $165,000, and it was earned in Augsburg. Catherine's 2021 salary from DSC was $425,000, with part being earned in Augsburg and part being earned in Kamnik. Assume the 2021 indexed statutory amount is the same as the 2020 indexed amount. Assume a 365-day year for both years. When required, round any fractions out to four decimal places. Round final answers to the nearest dollar. a. Is Catherine eligible for the foreign income exclusion for 2020? Yes v b. Catherine may exclude $ 45,104 X from her gross income for 2020. Starting in 2009, Chuck and Luane have been purchasing Series EE bonds in their name to use for the higher education of their daughter Susie, who currently is age 18. During the year, they cash in $12,000 of the bonds to use for freshman year tuition, fees, and room and board. Of this amount, $5,000 represents interest. Of the $12,000, $8,000 is used for tuition and fees and $4,000 is used for room and board. Chuck and Luane's AGI, before the educational savings bond exclusion, is $126,950. Review 135, and answer the following questions. If an amount is zero, enter "0". a. Chuck and Luane, who will file a joint return, and Susie want to understand the tax consequences. For each statement below, help them by indicating whether the statement is "True" or "False". The Series EE savings bonds qualify as educational savings bonds. True V The room and board for a dependent qualify as higher education expenses. False V Since the redemption amount exceeds the qualified higher education expenses, only part of the True interest qualifies for exclusion. Chuck and Luane's savings bond exclusion is not subject to any phase-out provision. False v If Chuck and Luane file a joint, how much is the savings bond exclusion? Round any division to five decimal places. Round your final answer to the nearest dollar. 3,334 x

Step by Step Solution

★★★★★

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Slution fteign Jocane Faclusion I sameane is a Us citizen or resi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started