Question

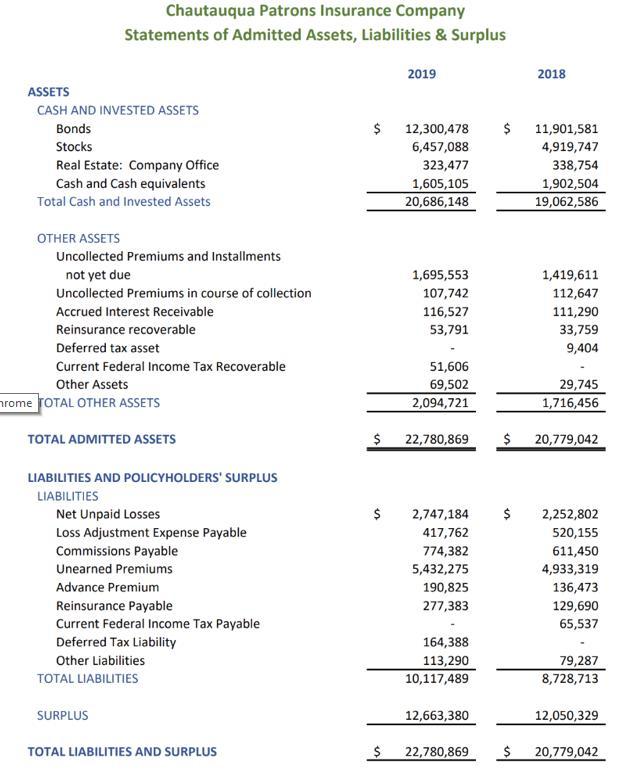

Based upon the information contained in this financial statement, calculate the following for 2019: Written Premium _________________________________ Earned Premium __________________________________ Loss Ratio using GAP _______________________________

Based upon the information contained in this financial statement, calculate the following for 2019:

Written Premium _________________________________

Earned Premium __________________________________

Loss Ratio using GAP _______________________________

Expense Ratio using GAP ____________________________

Combined Ratio ___________________________________

Investment Income Ratio ____________________________

Operating Ratio ____________________________________

Percentage of assets invested in Bonds _________________

Percentage of assets invested in the stock market ________

Did the company have a profitable year? Yes or no? Explain your answer.

Chautauqua Patrons Insurance Company Statements of Admitted Assets, Liabilities & Surplus 2019 2018 ASSETS CASH AND INVESTED ASSETS Bonds $ 12,300,478 $ 11,901,581 Stocks 6,457,088 4,919,747 Real Estate: Company Office Cash and Cash equivalents 323,477 338,754 1,605,105 20,686,148 1,902,504 19,062,586 Total Cash and Invested Assets OTHER ASSETS Uncollected Premiums and Installments not yet due 1,695,553 1,419,611 Uncollected Premiums in course of collection 107,742 112,647 Accrued Interest Receivable 116,527 111,290 Reinsurance recoverable 53,791 33,759 Deferred tax asset 9,404 Current Federal Income Tax Recoverable 51,606 Other Assets 69,502 2,094,721 29,745 hrome TOTAL OTHER ASSETS 1,716,456 TOTAL ADMITTED ASSETS 22,780,869 20,779,042 LIABILITIES AND POLICYHOLDERS' SURPLUS LIABILITIES $ $ Net Unpaid Losses Loss Adjustment Expense Payable Commissions Payable 2,747,184 2,252,802 417,762 520,155 774,382 611,450 Unearned Premiums 5,432,275 4,933,319 Advance Premium 190,825 136,473 Reinsurance Payable Current Federal Income Tax Payable Deferred Tax Liability 277,383 129,690 65,537 164,388 Other Liabilities 113,290 10,117,489 79,287 TOTAL LIABILITIES 8,728,713 SURPLUS 12,663,380 12,050,329 TOTAL LIABILITIES AND SURPLUS 22,780,869 20,779,042

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Before moving on to the answer lets look at some of the definitions for a better understanding and analysis 1 WRITTEN PREMIUM This describes the total amount that the customers are required to pay for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started