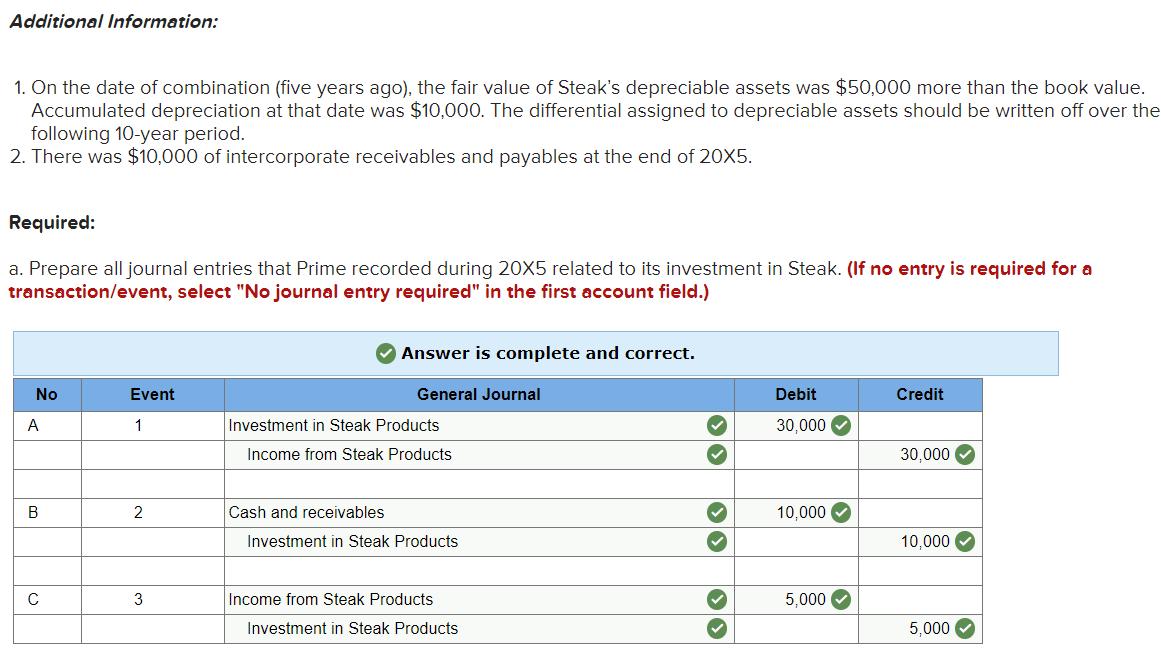

Question: b. Prepare all consolidating entries needed to prepare consolidated statements for 20X5. (If no entry is required for a transaction/event, select No journal entry required

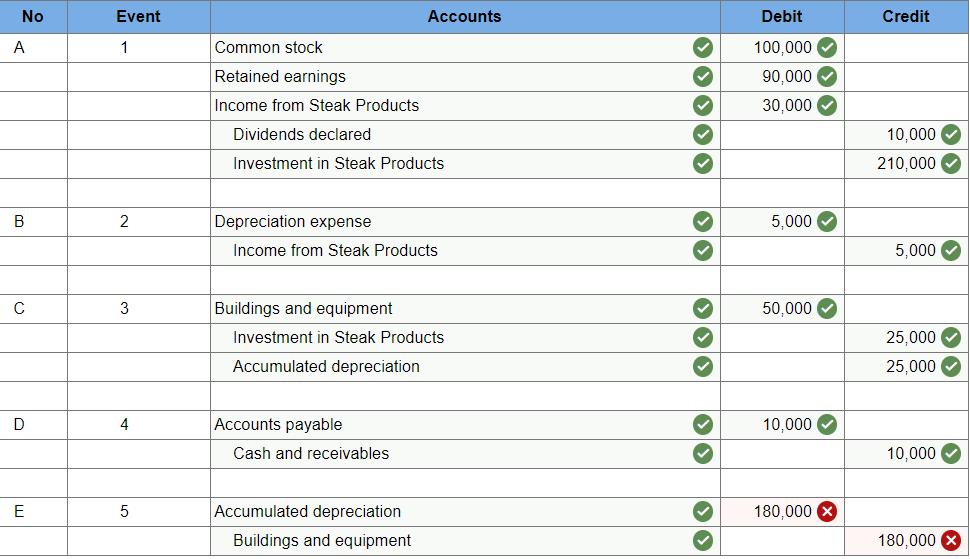

b. Prepare all consolidating entries needed to prepare consolidated statements for 20X5. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

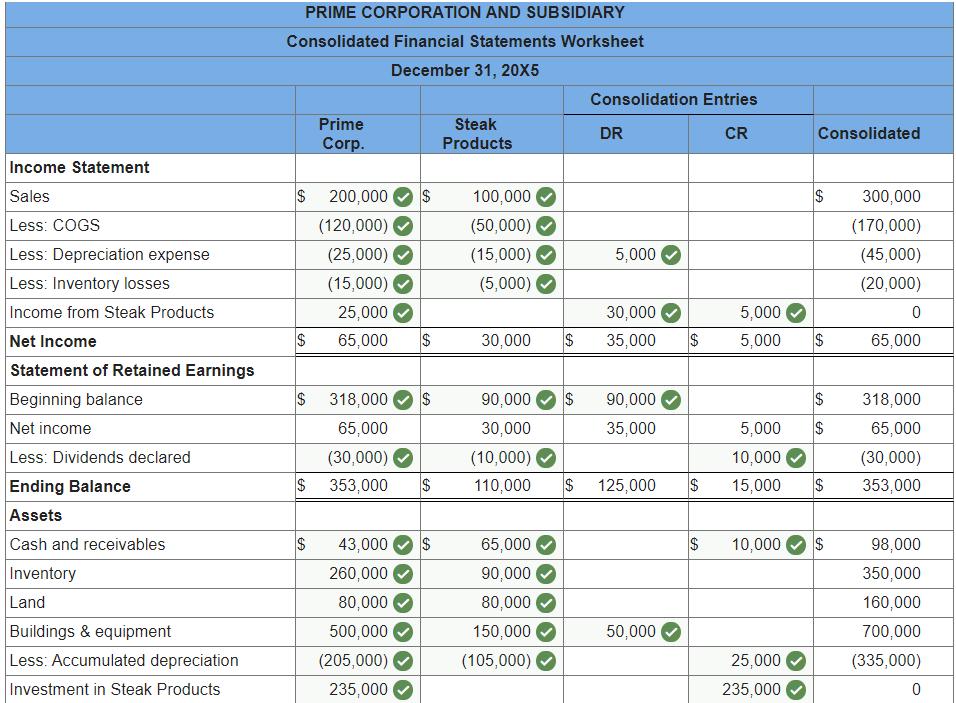

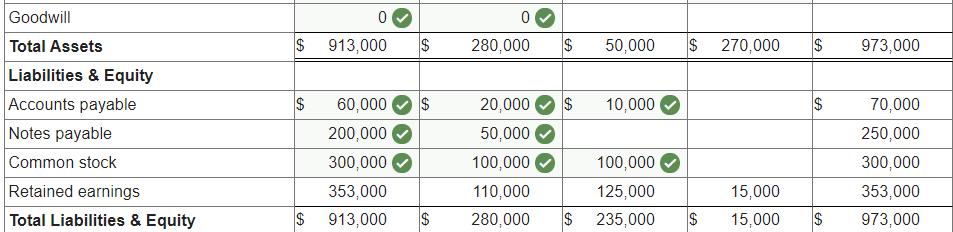

c. Prepare a three-part worksheet as of December 31, 20X5. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)

Part b): Record the optional accumulated depreciation consolidation entry.

Part c): What is missing?

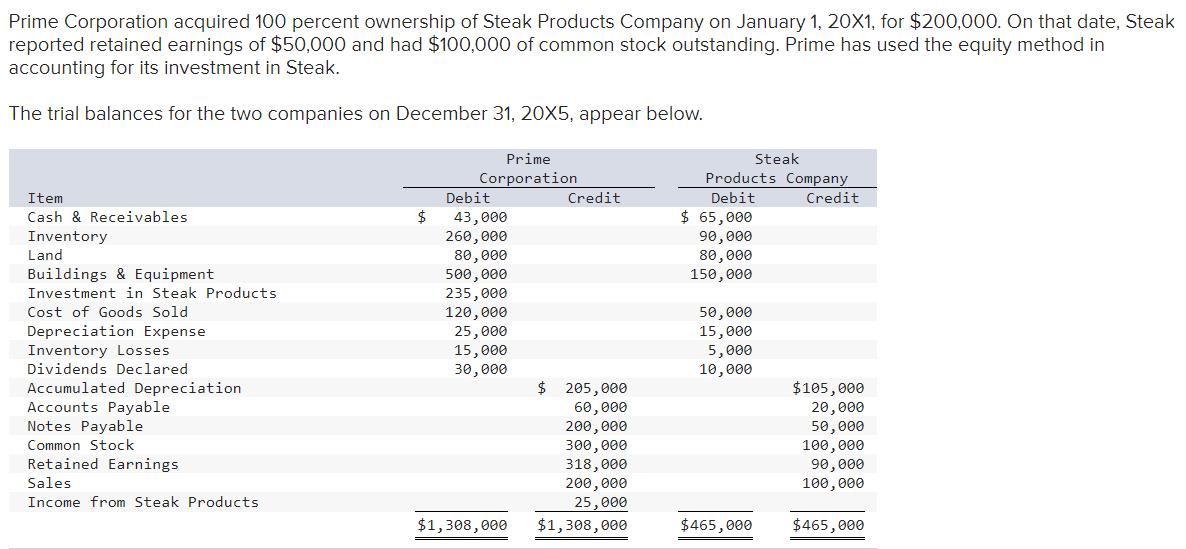

Prime Corporation acquired 100 percent ownership of Steak Products Company on January 1, 20X1, for $200,000. On that date, Steak reported retained earnings of $50,000 and had $100,000 of common stock outstanding. Prime has used the equity method in accounting for its investment in Steak. The trial balances for the two companies on December 31, 20X5, appear below. Prime Steak Corporation Debit Products Company Debit $ 65,000 90,000 80,000 Item Credit Credit Cash & Receivables 43,000 260,000 80,000 500,000 235,000 120,000 Inventory Land Buildings & Equipment Investment in Steak Products 150,000 Cost of Goods Sold Depreciation Expense Inventory Losses 25,000 15,000 30,000 50,000 15,000 5,000 Dividends Declared 10,000 $ 205,000 Accumulated Depreciation Accounts Payable Notes Payable $105, 000 60,000 200,000 300,000 318,000 200,000 25,000 20,000 50,000 100,000 90,000 100,000 Common Stock Retained Earnings Sales Income from Steak Products $1,308,000 $1,308,000 $465,000 $465,000

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Net asset value Common stock 100000 Retained earnings 50000 Net asset at book value 150000 Fair valu... View full answer

Get step-by-step solutions from verified subject matter experts