Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Catastrophe Management We actively monitor and manage our catastrophe risk accumulation around the world such as setting risk limits based on probable maximum loss

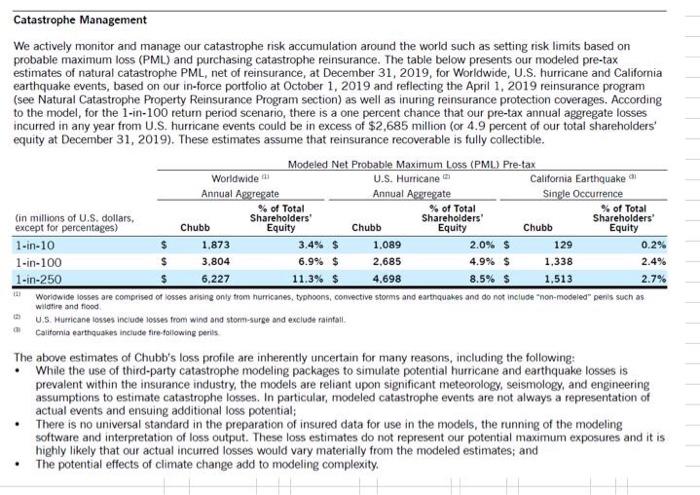

Catastrophe Management We actively monitor and manage our catastrophe risk accumulation around the world such as setting risk limits based on probable maximum loss (PML) and purchasing catastrophe reinsurance. The table below presents our modeled pre-tax estimates of natural catastrophe PML, net of reinsurance, at December 31, 2019, for Worldwide, U.S. hurricane and California earthquake events, based on our in-force portfolio at October 1, 2019 and reflecting the April 1, 2019 reinsurance program (see Natural Catastrophe Property Reinsurance Program section) as well as inuring reinsurance protection coverages. According to the model, for the 1-in-100 return period scenario, there is a one percent chance that our pre-tax annual aggregate losses incurred in any year from U.S. hurricane events could be in excess of $2,685 million (or 4.9 percent of our total shareholders' equity at December 31, 2019). These estimates assume that reinsurance recoverable is fully collectible. (in millions of U.S. dollars, except for percentages) 1-in-10 1-in-100 1-in-250 a . Worldwide Annual Aggregate $ $ Chubb Modeled Net Probable Maximum Loss (PML) Pre-tax U.S. Hurricane 1,873 3,804 6,227 % of Total Shareholders' Equity Annual Aggregate 3.4% $ 6.9% $ 11.3% $ Chubb % of Total Shareholders' Equity 1,089 2,685 4.698 Worldwide losses are comprised of losses arising only from hurricanes, typhoons, convective storms and earthquakes and do not include "non-modeled" penis such as wildfire and flood. U.S. Hurricane losses include losses from wind and storm-surge and exclude rainfall. California earthquakes include fire-following perils California Earthquake Single Occurrence 2.0% S 4.9% $ 8.5% $ Chubb % of Total Shareholders' Equity 129 1,338 1.513 0.2% 2.4% 2.7% The above estimates of Chubb's loss profile are inherently uncertain for many reasons, including the following: . While the use of third-party catastrophe modeling packages to simulate potential hurricane and earthquake losses is prevalent within the insurance industry, the models are reliant upon significant meteorology, seismology, and engineering assumptions to estimate catastrophe losses. In particular, modeled catastrophe events are not always a representation of actual events and ensuing additional loss potential; There is no universal standard in the preparation of insured data for use in the models, the running of the modeling software and interpretation of output. These loss estimates do not represent our potential maximum exposures and it is. highly likely that our actual incurred losses would vary materially from the modeled estimates; and The potential effects of climate change add to modeling complexity. H 3. What are the ranges of values? What statistic is tabulated? 4. How do potential loss amounts compare to total written premium and shareholder surplus? 5. What types of events potentially cause the greatest losses?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

3What are the ranges of values What statistic is tabulated The table provided in the Catastrophe Management section of the report presents Chubbs modeled pretax estimates of natural catastrophe Probab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started