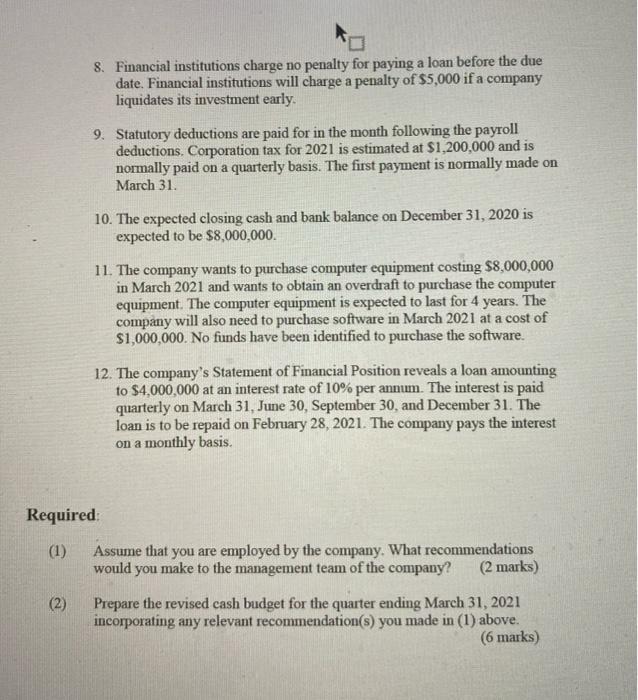

1) Assume that you are employed by the company. What recommendations would you make to the management team of the company? 2) Prepare the revised

1) Assume that you are employed by the company. What recommendations would you make to the management team of the company?

2) Prepare the revised cash budget for the quarter ending March 31, 2021 incorporating any relevant recommendation(s) you made in (1) above.

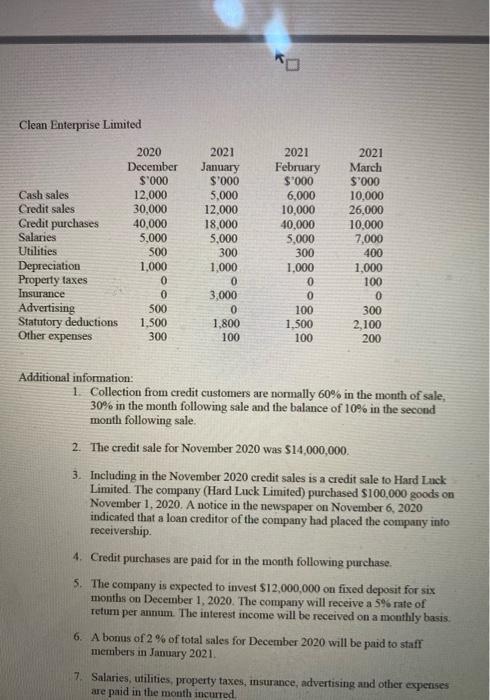

Clean Enterprise Limited Cash sales Credit sales Credit purchases Salaries Utilities. Depreciation Property taxes Insurance 2020 December $'000 12,000 30,000 40,000 5,000 500 1,000 0 0 Advertising 500 Statutory deductions 1,500 Other expenses 300 Additional information: 2021 January $'000 5,000 12,000 18,000 5,000 300 1,000 0 3,000 0 1,800 100 2021 February $'000 6,000 10,000 40,000 5,000 300 1,000 0 0 100 1,500 100 2021 March $'000 10,000 26,000 10,000 7,000 400 1,000 100 0 300 2,100 200 1. Collection from credit customers are normally 60% in the month of sale, 30% in the month following sale and the balance of 10% in the second month following sale. 2. The credit sale for November 2020 was $14,000,000. 6. A bonus of 2% of total sales for December 2020 will members in January 2021. 3. Including in the November 2020 credit sales is a credit sale to Hard Luck Limited. The company (Hard Luck Limited) purchased $100,000 goods on November 1, 2020. A notice in the newspaper on November 6, 2020 indicated that a loan creditor of the company had placed the company into receivership. 4. Credit purchases are paid for in the month following purchase. 5. The company is expected to invest $12,000,000 on fixed deposit for six months on December 1, 2020. The company will receive a 5% rate of return per annum. The interest income will be received on a monthly basis. paid to staff 7. Salaries, utilities, property taxes, insurance, advertising and other are paid in the month incurred. expenses

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Cash budget calculations Particulars DEC 2020000 JAN 2021000 FEB 2021000 MAR 2021000 cash sales 1200...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started