Question

Robin Company acquires a piece of land on which it intends to build a factory to produce its primary product. The land is listed

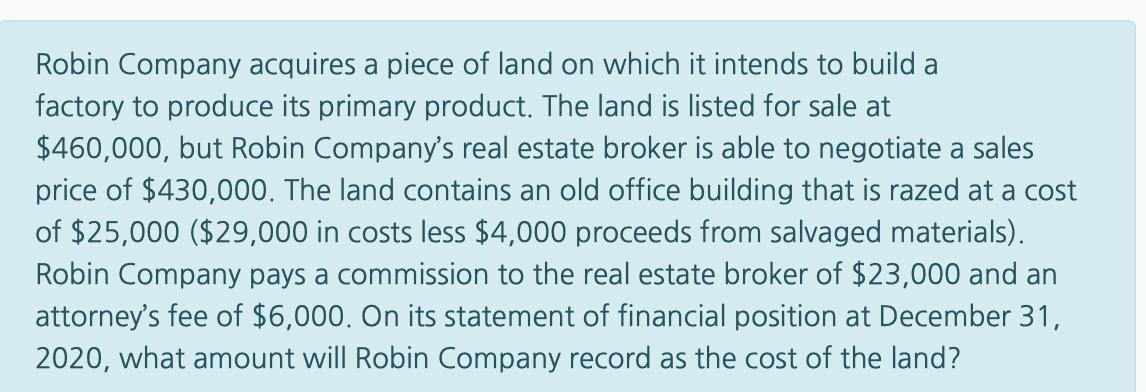

Robin Company acquires a piece of land on which it intends to build a factory to produce its primary product. The land is listed for sale at $460,000, but Robin Company's real estate broker is able to negotiate a sales price of $430,000. The land contains an old office building that is razed at a cost of $25,000 ($29,000 in costs less $4,000 proceeds from salvaged materials). Robin Company pays a commission to the real estate broker of $23,000 and an attorney's fee of $6,000. On its statement of financial position at December 31, 2020, what amount will Robin Company record as the cost of the land?

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Purchase price of Land 43000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Statistics For Business And Economics

Authors: David Anderson, Thomas Williams, Dennis Sweeney, Jeffrey Cam

7th Edition

1305081595, 978-1305081598

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App