Answered step by step

Verified Expert Solution

Question

1 Approved Answer

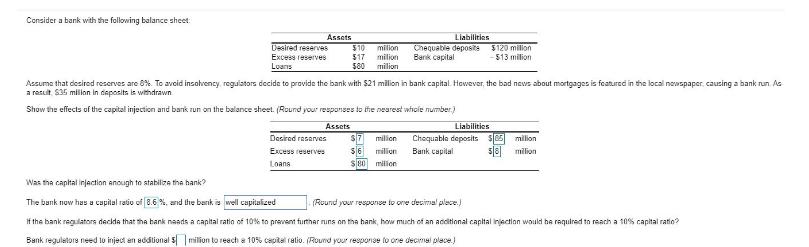

Consider a bank with the following balance sheet: Assets Liabiliries Desired resenves Excess reserves Loans 510 517 580 milion milion milion Chequable deposits Bark

Consider a bank with the following balance sheet: Assets Liabiliries Desired resenves Excess reserves Loans 510 517 580 milion milion milion Chequable deposits Bark capital $120 millon $13 milion Assuma that desired reserves are 8%. To avcid insohvency, reguiators decide to provide the bank with $21 milion in bank capital. Hovwever, the bad news about mortgages is featured in the local newspaper, causing a bank run. Aa a rasuit. S35 milion in deposits is withdrawn Show the effects of the capital injection and bank run on the balance sheet. (Round your responses to the nearest whole number) Assets Liabilities $7 $6 S80 milion Choquable deposits $ Bank capital Desired raserves milion million Excess reserves milion milion Loans Was tha capital injaction anough to stabiliza tha hank? The bank now has a capital ratio of 8.6 %, and the bank is well capitalized (Round your response to one desimal plece.) If the bank regulators deckda that tha bank naads a capital ratio of 10% to prevent furthar nuns on tha hank, how much of an additional capital injectian would he requlred to reach a 10% capital ratio? Bank reguletore need to inject en addlional 5 milion to reach a 10% capital ratio. (Round your resporae to one decimal plece.)

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started