Answered step by step

Verified Expert Solution

Question

1 Approved Answer

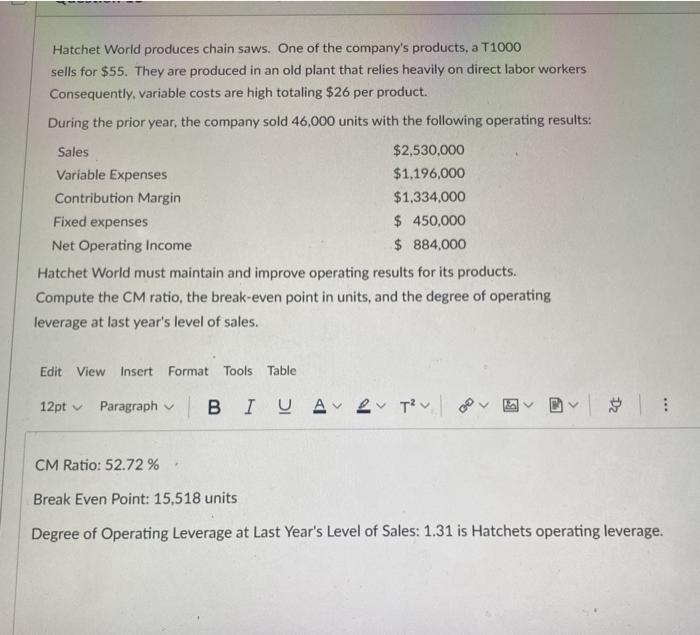

Hatchet World produces chain saws. One of the company's products, a T1000 sells for $55. They are produced in an old plant that relies

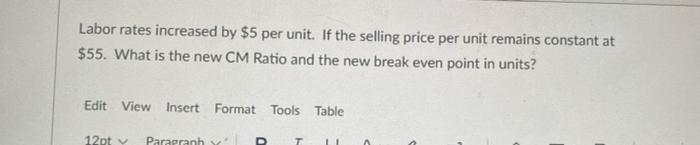

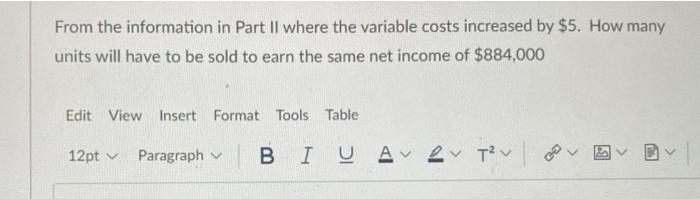

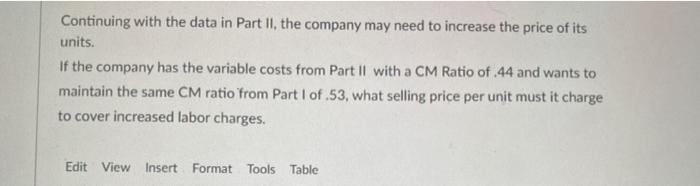

Hatchet World produces chain saws. One of the company's products, a T1000 sells for $55. They are produced in an old plant that relies heavily on direct labor workers Consequently, variable costs are high totaling $26 per product. During the prior year, the company sold 46,000 units with the following operating results: Sales $2,530,000 Variable Expenses $1,196,000 Contribution Margin $1,334,000 $ 450,000 $ 884,000 Fixed expenses Net Operating Income Hatchet World must maintain and improve operating results for its products. Compute the CM ratio, the break-even point in units, and the degree of operating leverage at last year's level of sales. Edit View Insert Format Tools Table 12pt v Paragraph v BIUAv2 Tv CM Ratio: 52.72 % Break Even Point: 15,518 units Degree of Operating Leverage at Last Year's Level of Sales: 1.31 is Hatchets operating leverage. Labor rates increased by $5 per unit. If the selling price per unit remains constant at $55. What is the new CM Ratio and the new break even point in units? Edit View Insert Format Tools Table 12pt v Paragranh From the information in Part II where the variable costs increased by $5. How many units will have to be sold to earn the same net income of $884,000 Edit View Insert Format Tools Table 12pt v Paragraph v BIUA 2 Tv Continuing with the data in Part II, the company may need to increase the price of its units. If the company has the variable costs from Part II with a CM Ratio of .44 and wants to maintain the same CM ratio from Part I of .53, what selling price per unit must it charge to cover increased labor charges. Edit View Insert Format Tools Table

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

CM ratio Contribution sales 100 13340002530000100 52...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started