Answered step by step

Verified Expert Solution

Question

1 Approved Answer

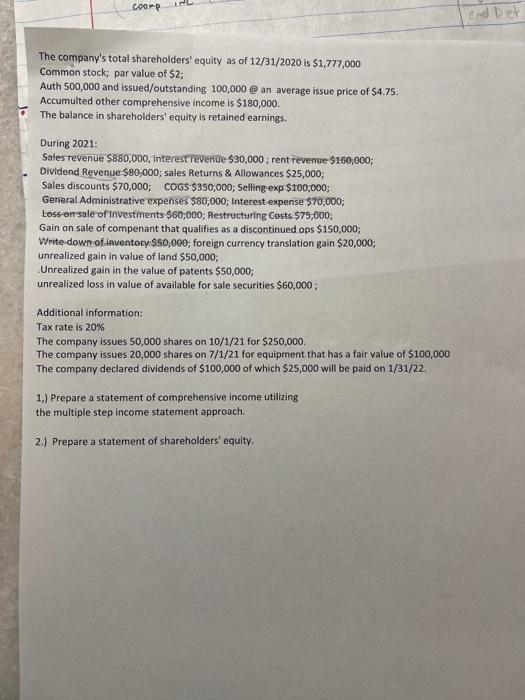

coomp The company's total shareholders' equity of 12/31/2020 is $1,777,000 Common stock; par value of $2; Auth 500,000 and issued/outstanding 100,000 @ an average

coomp The company's total shareholders' equity of 12/31/2020 is $1,777,000 Common stock; par value of $2; Auth 500,000 and issued/outstanding 100,000 @ an average issue price of $4.75. Accumulted other comprehensive income is $180,000. The balance in shareholders' equity is retained earnings. During 2021: Sales revenue $880,000, interest revenue $30,000; rent revenue $160,000, Dividend Revenue $80,000; sales Returns & Allowances $25,000; Sales discounts $70,000; COGS $350,000; Selling exp $100,000; General Administrative expenses $80,000; Interest expense $70,000; Loss on sale of Investments $60,000; Restructuring Costs $75,000; Gain on sale of compenant that qualifies as a discontinued ops $150,000; Write down of inventory $50,000; foreign currency translation gain $20,000; unrealized gain in value of land $50,000; Unrealized gain in the value of patents $50,000; unrealized loss in value of available for sale securities $60,000; Additional information: Tax rate is 20% The company issues 50,000 shares on 10/1/21 for $250,000. The company issues 20,000 shares on 7/1/21 for equipment that has a fair value of $100,000 The company declared dividends of $100,000 of which $25,000 will be paid on 1/31/22. 1,) Prepare a statement of comprehensive income utilizing the multiple step income statement approach. 2.) Prepare a statement of shareholders' equity. end bet

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 COMPREHENSIVE INCOME STATEMENT USING MULTIINCOME STATEMENT I II III IV V VI VII VIII IX X XI XII X...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started