Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corcoran Heavy Industries Company (CHIC) is organized into four divisions, each of which operates in a different industry. The types of customer served and

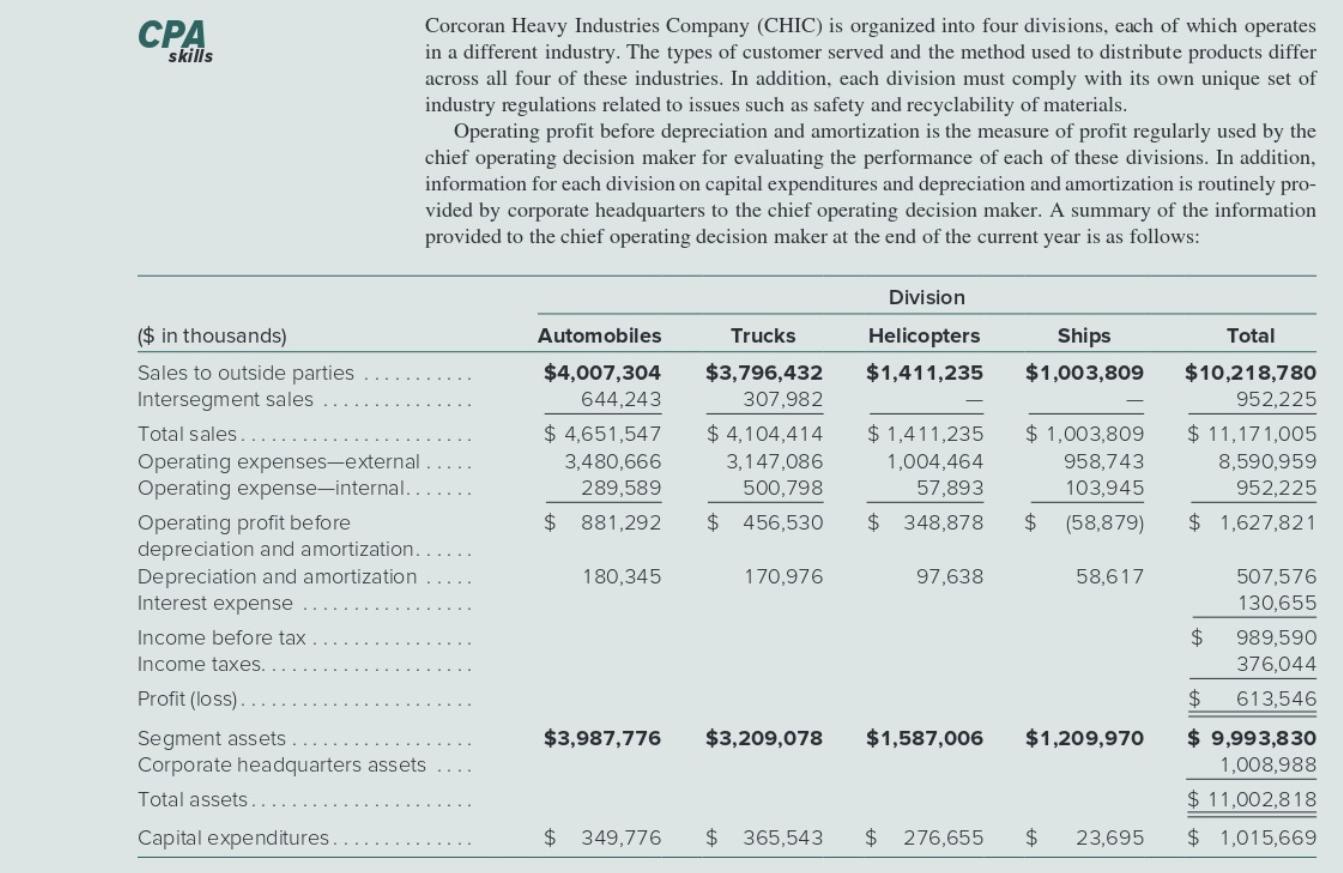

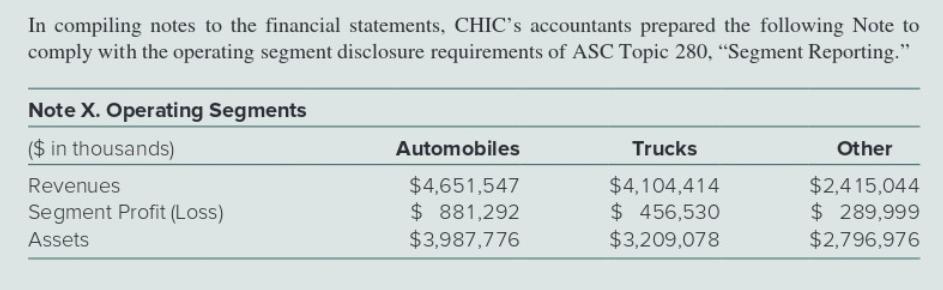

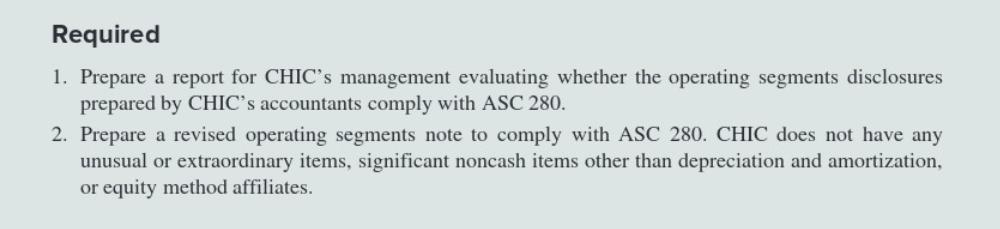

Corcoran Heavy Industries Company (CHIC) is organized into four divisions, each of which operates in a different industry. The types of customer served and the method used to distribute products differ across all four of these industries. In addition, each division must comply with its own unique set of industry regulations related to issues such as safety and recyclability of materials. Operating profit before depreciation and amortization is the measure of profit regularly used by the chief operating decision maker for evaluating the performance of each of these divisions. In addition, information for each division on capital expenditures and depreciation and amortization is routinely pro- vided by corporate headquarters to the chief operating decision maker. A summary of the information provided to the chief operating decision maker at the end of the current year is as follows: skills Division ($ in thousands) Automobiles Trucks Helicopters Ships Total Sales to outside parties Intersegment sales $4,007,304 $3,796,432 $1,411,235 $1,003,809 $10,218,780 644,243 307,982 952,225 $ 4,651,547 $ 4,104,414 3,147,086 Total sales. $ 1,411,235 $ 1,003,809 $ 11,171,005 Operating expenses-external Operating expense-internal... 3,480,666 1,004,464 958,743 8,590,959 289,589 500,798 57,893 103,945 952,225 $ 881,292 $ 456,530 $ 348,878 Operating profit before depreciation and amortization.... Depreciation and amortization Interest expense 24 (58,879) $ 1,627,821 180,345 170,976 97,638 58,617 507,576 130,655 24 376,044 Income before tax 989,590 Income taxes. Profit (loss).. 24 613,546 Segment assets. Corporate headquarters assets $3,987,776 $3,209,078 $1,587,006 $1,209,970 $ 9,993,830 1,008,988 Total assets. $ 11,002,818 Capital expenditures. $ 349,776 $ 365,543 24 276,655 24 23,695 $ 1,015,669 In compiling notes to the financial statements, CHIC's accountants prepared the following Note to comply with the operating segment disclosure requirements of ASC Topic 280, "Segment Reporting." Note X. Operating Segments ($ in thousands) Automobiles Trucks Other $4,651,547 $ 881,292 $3,987,776 $4,104,414 $ 456,530 $3,209,078 $2,415,044 $289,999 $2,796,976 Revenues Segment Profit (Loss) Assets Required 1. Prepare a report for CHIC's management evaluating whether the operating segments disclosures prepared by CHIC's accountants comply with ASC 280. 2. Prepare a revised operating segments note to comply with ASC 280. CHIC does not have any unusual or extraordinary items, significant noncash items other than depreciation and amortization, or equity method affiliates.

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Automobiles Trucks Helicopters Ships Total Sales to outside parties 4007304 3796432 1411235 1003809 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started