Crane Company is a grocery wholesaler and is planning to expand its operations. The company has asked the bank for a loan to finance

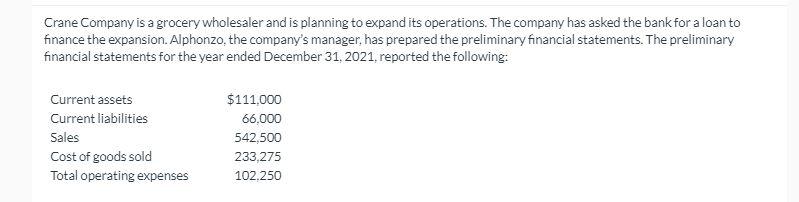

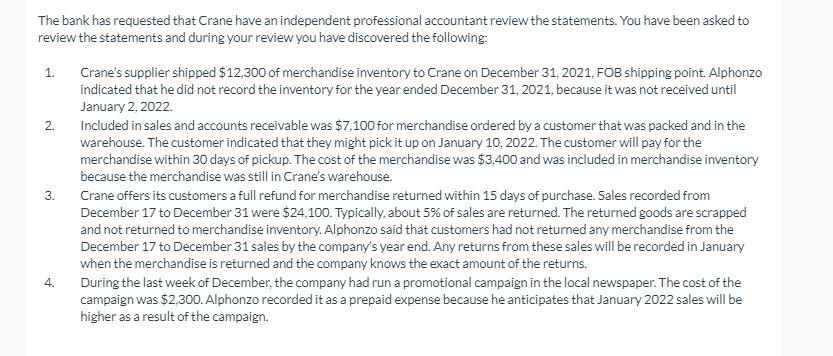

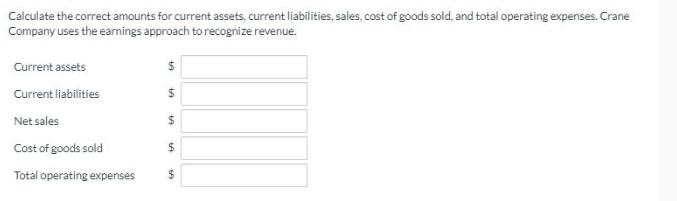

Crane Company is a grocery wholesaler and is planning to expand its operations. The company has asked the bank for a loan to finance the expansion. Alphonzo, the company's manager, has prepared the preliminary financial statements. The preliminary financial statements for the year ended December 31, 2021, reported the following: Current assets $111,000 Current liabilities 66,000 Sales 542,500 Cost of goods sold 233,275 Total operating expenses 102,250 The bank has requested that Crane have an independent professional accountant review the statements. You have been asked to review the statements and during your review you have discovered the following: Crane's supplier shipped $12,300 of merchandise inventory to Crane on December 31, 2021, FOB shipping point. Alphonzo indicated that he did not record the inventory for the year ended December 31, 2021, because it was not received until January 2, 2022. 1. Included in sales and accounts receivable was $7,100 for merchandise ordered by a customer that was packed and in the warehouse. The customer indicated that they might pick it up on January 10, 2022. The customer will pay for the merchandise within 30 days of pickup. The cost of the merchandise was $3,400 and was included in merchandise inventory 2. because the merchandise was still in Crane's warehouse. Crane offers its customers a full refund for merchandise returned within 15 days of purchase. Sales recorded from December 17 to December 31 were $24, 100. Typically, about 5% of sales are returned. The returned goods are scrapped and not returned to merchandise inventory. Alphonzo said that customers had not returned any merchandise from the December 17 to December 31 sales by the company's year end. Any returns from these sales will be recorded in January when the merchandise is returned and the company knows the exact amount of the returns. 3. During the last week of December, the company had run a promotional campaign in the local newspaper. The cost of the campaign was $2,300. Alphonzo recorded it as a prepaid expense because he anticipates that January 2022 sales will be higher as a result of the campaign. 4. Calculate the correct amounts for current assets, current liabilities, sales, cost of goods sold, and total operating expenses. Crane Company uses the earnings approach to recognize revenue. Current assets Current liabilities %24 Net sales %24 Cost of goods sold %24 Total operating expenses $4 %24

Step by Step Solution

3.25 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Adjustment Treatment 1 Increase current assets by 12300 Decrease COGS by 12300 Increase 12300 curr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started