Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Cycle Culminating Project Connie Rosenblatt, M.D. recently graduated from medical school and decided to establish her practice in Vancouver, British Columbia. The year

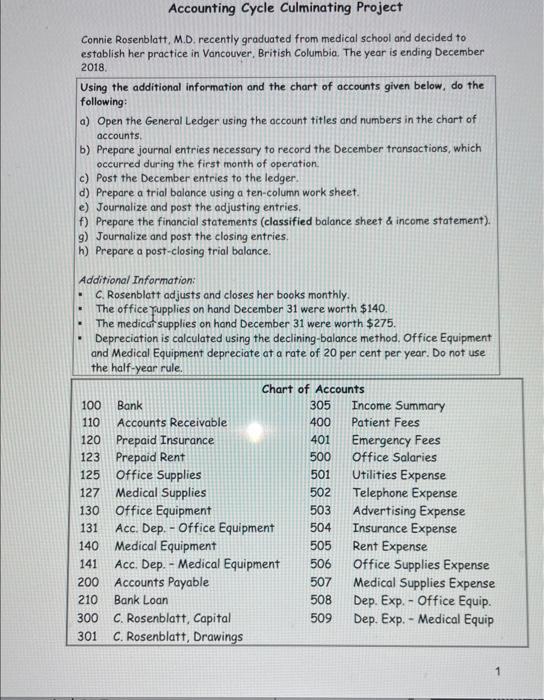

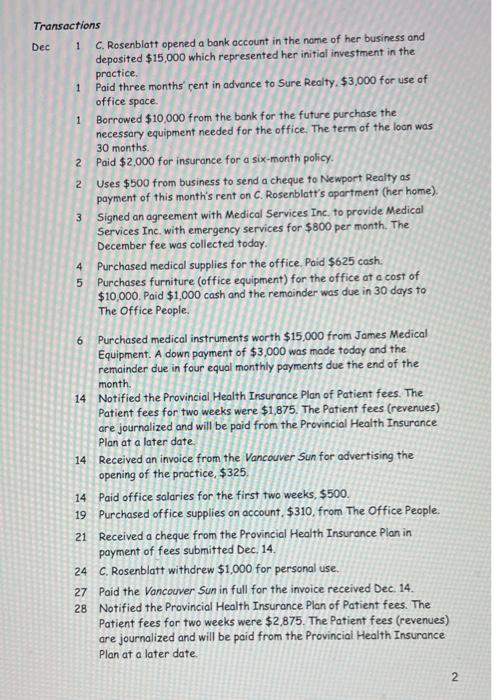

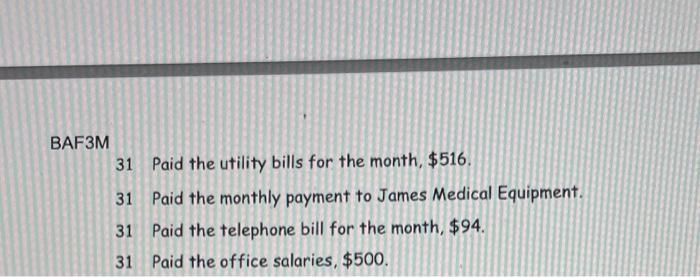

Accounting Cycle Culminating Project Connie Rosenblatt, M.D. recently graduated from medical school and decided to establish her practice in Vancouver, British Columbia. The year is ending December 2018. Using the additional information and the chart of accounts given below, do the following: a) Open the General Ledger using the account titles and numbers in the chart of accounts. b) Prepare journal entries necessary to record the December transactions, which occurred during the first month of operation. c) Post the December entries to the ledger. d) Prepare a trial balance using a ten-column work sheet. e) Journalize and post the adjusting entries. f) Prepare the financial statements (classified balance sheet & income statement). 9) Journalize and post the closing entries. h) Prepare a post-closing trial balance. Additional Information: C. Rosenblatt adjusts and closes her books monthly. The office Tupplies on hand December 31 were worth $140. The medical supplies on hand December 31 were worth $275. . Depreciation is calculated using the declining-balance method. Office Equipment and Medical Equipment depreciate at a rate of 20 per cent per year. Do not use the half-year rule. 100 Bank 110 Accounts Receivable 120 123 Prepaid Rent 125 Prepaid Insurance Office Supplies 127 Medical Supplies 130 Office Equipment 131 140 141 Acc. Dep. - Office Equipment Medical Equipment Acc. Dep. - Medical Equipment 200 Accounts Payable 210 Bank Loan 300 301 Chart of Accounts 305 400 401 500 501 502 503 504 C. Rosenblatt, Capital C. Rosenblatt, Drawings 505 506 507 508 509 Income Summary Patient Fees Emergency Fees Office Salaries Utilities Expense Telephone Expense Advertising Expense Insurance Expense Rent Expense Office Supplies Expense Medical Supplies Expense Dep. Exp. - Office Equip. Dep. Exp. Medical Equip 1 Transactions 1 C. Rosenblatt opened a bank account in the name of her business and deposited $15,000 which represented her initial investment in the practice. Dec 1 1 2 2 Paid three months' rent in advance to Sure Realty, $3,000 for use of office space. Borrowed $10,000 from the bank for the future purchase the necessary equipment needed for the office. The term of the loan was 30 months.. Paid $2,000 for insurance for a six-month policy. Uses $500 from business to send a cheque to Newport Realty as payment of this month's rent on C. Rosenblatt's apartment (her home). 3 Signed an agreement with Medical Services Inc. to provide Medical rvices Inc. with emergency services for $800 per month. The December fee was collected today. 4 Purchased medical supplies for the office. Paid $625 cash. 5 Purchases furniture (office equipment) for the office at a cost of $10,000. Paid $1,000 cash and the remainder was due in 30 days to The Office People. 6 Purchased medical instruments worth $15,000 from James Medical Equipment. A down payment of $3,000 was made today and the remainder due in four equal monthly payments due the end of the month. 14 Notified the Provincial Health Insurance Plan of Patient fees. The Patient fees for two weeks were $1,875. The Patient fees (revenues) are journalized and will be paid from the Provincial Health Insurance Plan at a later date. 14 Received an invoice from the Vancouver Sun for advertising the opening of the practice, $325, 14 Paid office salaries for the first two weeks, $500. 19 Purchased office supplies on account, $310, from The Office People. 21 Received a cheque from the Provincial Health Insurance Plan in payment of fees submitted Dec. 14. 24 C. Rosenblatt withdrew $1,000 for personal use. 28 27 Paid the Vancouver Sun in full for the invoice received Dec. 14. Notified the Provincial Health Insurance Plan of Patient fees. The Patient fees for two weeks were $2,875. The Patient fees (revenues) are journalized and will be paid from the Provincial Health Insurance Plan at a later date. 2 BAF3M 31 Paid the utility bills for the month, $516. 31 Paid the monthly payment to James Medical Equipment. 31 Paid the telephone bill for the month, $94. 31 Paid the office salaries, $500. Accounting Cycle Culminating Project Connie Rosenblatt, M.D. recently graduated from medical school and decided to establish her practice in Vancouver, British Columbia. The year is ending December 2018. Using the additional information and the chart of accounts given below, do the following: a) Open the General Ledger using the account titles and numbers in the chart of accounts. b) Prepare journal entries necessary to record the December transactions, which occurred during the first month of operation. c) Post the December entries to the ledger. d) Prepare a trial balance using a ten-column work sheet. e) Journalize and post the adjusting entries. f) Prepare the financial statements (classified balance sheet & income statement). 9) Journalize and post the closing entries. h) Prepare a post-closing trial balance. Additional Information: C. Rosenblatt adjusts and closes her books monthly. The office Tupplies on hand December 31 were worth $140. The medical supplies on hand December 31 were worth $275. . Depreciation is calculated using the declining-balance method. Office Equipment and Medical Equipment depreciate at a rate of 20 per cent per year. Do not use the half-year rule. 100 Bank 110 Accounts Receivable 120 123 Prepaid Rent 125 Prepaid Insurance Office Supplies 127 Medical Supplies 130 Office Equipment 131 140 141 Acc. Dep. - Office Equipment Medical Equipment Acc. Dep. - Medical Equipment 200 Accounts Payable 210 Bank Loan 300 301 Chart of Accounts 305 400 401 500 501 502 503 504 C. Rosenblatt, Capital C. Rosenblatt, Drawings 505 506 507 508 509 Income Summary Patient Fees Emergency Fees Office Salaries Utilities Expense Telephone Expense Advertising Expense Insurance Expense Rent Expense Office Supplies Expense Medical Supplies Expense Dep. Exp. - Office Equip. Dep. Exp. Medical Equip 1 Transactions 1 C. Rosenblatt opened a bank account in the name of her business and deposited $15,000 which represented her initial investment in the practice. Dec 1 1 2 2 Paid three months' rent in advance to Sure Realty, $3,000 for use of office space. Borrowed $10,000 from the bank for the future purchase the necessary equipment needed for the office. The term of the loan was 30 months.. Paid $2,000 for insurance for a six-month policy. Uses $500 from business to send a cheque to Newport Realty as payment of this month's rent on C. Rosenblatt's apartment (her home). 3 Signed an agreement with Medical Services Inc. to provide Medical rvices Inc. with emergency services for $800 per month. The December fee was collected today. 4 Purchased medical supplies for the office. Paid $625 cash. 5 Purchases furniture (office equipment) for the office at a cost of $10,000. Paid $1,000 cash and the remainder was due in 30 days to The Office People. 6 Purchased medical instruments worth $15,000 from James Medical Equipment. A down payment of $3,000 was made today and the remainder due in four equal monthly payments due the end of the month. 14 Notified the Provincial Health Insurance Plan of Patient fees. The Patient fees for two weeks were $1,875. The Patient fees (revenues) are journalized and will be paid from the Provincial Health Insurance Plan at a later date. 14 Received an invoice from the Vancouver Sun for advertising the opening of the practice, $325, 14 Paid office salaries for the first two weeks, $500. 19 Purchased office supplies on account, $310, from The Office People. 21 Received a cheque from the Provincial Health Insurance Plan in payment of fees submitted Dec. 14. 24 C. Rosenblatt withdrew $1,000 for personal use. 28 27 Paid the Vancouver Sun in full for the invoice received Dec. 14. Notified the Provincial Health Insurance Plan of Patient fees. The Patient fees for two weeks were $2,875. The Patient fees (revenues) are journalized and will be paid from the Provincial Health Insurance Plan at a later date. 2 BAF3M 31 Paid the utility bills for the month, $516. 31 Paid the monthly payment to James Medical Equipment. 31 Paid the telephone bill for the month, $94. 31 Paid the office salaries, $500. Accounting Cycle Culminating Project Connie Rosenblatt, M.D. recently graduated from medical school and decided to establish her practice in Vancouver, British Columbia. The year is ending December 2018. Using the additional information and the chart of accounts given below, do the following: a) Open the General Ledger using the account titles and numbers in the chart of accounts. b) Prepare journal entries necessary to record the December transactions, which occurred during the first month of operation. c) Post the December entries to the ledger. d) Prepare a trial balance using a ten-column work sheet. e) Journalize and post the adjusting entries. f) Prepare the financial statements (classified balance sheet & income statement). 9) Journalize and post the closing entries. h) Prepare a post-closing trial balance. Additional Information: C. Rosenblatt adjusts and closes her books monthly. The office Tupplies on hand December 31 were worth $140. The medical supplies on hand December 31 were worth $275. . Depreciation is calculated using the declining-balance method. Office Equipment and Medical Equipment depreciate at a rate of 20 per cent per year. Do not use the half-year rule. 100 Bank 110 Accounts Receivable 120 123 Prepaid Rent 125 Prepaid Insurance Office Supplies 127 Medical Supplies 130 Office Equipment 131 140 141 Acc. Dep. - Office Equipment Medical Equipment Acc. Dep. - Medical Equipment 200 Accounts Payable 210 Bank Loan 300 301 Chart of Accounts 305 400 401 500 501 502 503 504 C. Rosenblatt, Capital C. Rosenblatt, Drawings 505 506 507 508 509 Income Summary Patient Fees Emergency Fees Office Salaries Utilities Expense Telephone Expense Advertising Expense Insurance Expense Rent Expense Office Supplies Expense Medical Supplies Expense Dep. Exp. - Office Equip. Dep. Exp. Medical Equip 1 Transactions 1 C. Rosenblatt opened a bank account in the name of her business and deposited $15,000 which represented her initial investment in the practice. Dec 1 1 2 2 Paid three months' rent in advance to Sure Realty, $3,000 for use of office space. Borrowed $10,000 from the bank for the future purchase the necessary equipment needed for the office. The term of the loan was 30 months.. Paid $2,000 for insurance for a six-month policy. Uses $500 from business to send a cheque to Newport Realty as payment of this month's rent on C. Rosenblatt's apartment (her home). 3 Signed an agreement with Medical Services Inc. to provide Medical rvices Inc. with emergency services for $800 per month. The December fee was collected today. 4 Purchased medical supplies for the office. Paid $625 cash. 5 Purchases furniture (office equipment) for the office at a cost of $10,000. Paid $1,000 cash and the remainder was due in 30 days to The Office People. 6 Purchased medical instruments worth $15,000 from James Medical Equipment. A down payment of $3,000 was made today and the remainder due in four equal monthly payments due the end of the month. 14 Notified the Provincial Health Insurance Plan of Patient fees. The Patient fees for two weeks were $1,875. The Patient fees (revenues) are journalized and will be paid from the Provincial Health Insurance Plan at a later date. 14 Received an invoice from the Vancouver Sun for advertising the opening of the practice, $325, 14 Paid office salaries for the first two weeks, $500. 19 Purchased office supplies on account, $310, from The Office People. 21 Received a cheque from the Provincial Health Insurance Plan in payment of fees submitted Dec. 14. 24 C. Rosenblatt withdrew $1,000 for personal use. 28 27 Paid the Vancouver Sun in full for the invoice received Dec. 14. Notified the Provincial Health Insurance Plan of Patient fees. The Patient fees for two weeks were $2,875. The Patient fees (revenues) are journalized and will be paid from the Provincial Health Insurance Plan at a later date. 2 BAF3M 31 Paid the utility bills for the month, $516. 31 Paid the monthly payment to James Medical Equipment. 31 Paid the telephone bill for the month, $94. 31 Paid the office salaries, $500.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a opening ledgers account Investment by owner Loan from bank prepaid rent prepaid insurance owners personal use service revenue medical supplies office furniture medical instrument Patient fees office ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started