Answered step by step

Verified Expert Solution

Question

1 Approved Answer

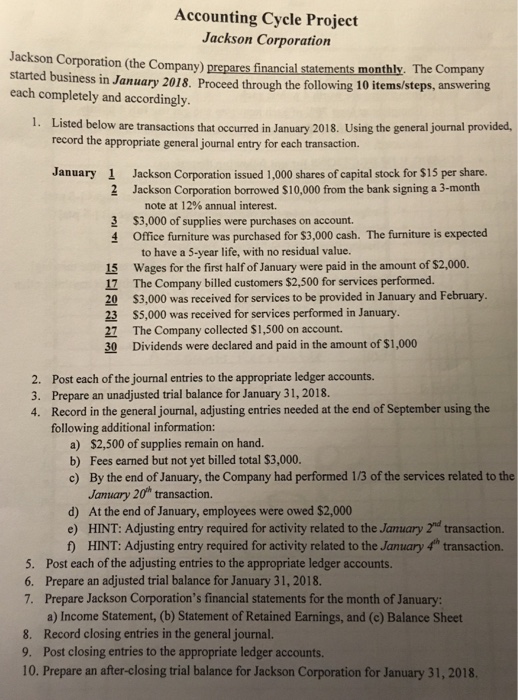

. Accounting Cycle Project Jackson Corporation Jackson Corporation (the Company) prepares financial statements monthly. 1 started business in January 2018. Proceed through the following 10

.

Accounting Cycle Project Jackson Corporation Jackson Corporation (the Company) prepares financial statements monthly. 1 started business in January 2018. Proceed through the following 10 items/steps, answering each completely and accordingly. 1. Listed below are transactions that occurred in January 2018. Using the general journal provided record the appropriate general journal entry for each transaction. January Jackson Corporation issued 1,000 shares of capital stock for $15 per share. 1 2 Jackson Corporation borrowed $10,000 from the bank signing a 3-month note at 12% annual interest. $3,000 of supplies were purchases on account. Office furniture was purchased for $3,000 cash. The furniture is expected to have a 5-year life, with no residual value. 15 Wages for the first half of January were paid in the amount of $2,000 17 The Company billed customers $2,500 for services performed 20 $3,000 was received for services to be provided in January and February 23 $5,000 was received for services performed in January 27 The Company collected $1,500 on account. 30 Dividends were declared and paid in the amount of $1,000 2. 3. 4. Post each of the journal entries to the appropriate ledger accounts. Prepare an unadjusted trial balance for January 31, 2018. Record in the general journal, adjusting entries needed at the end of September using the following additional information: a) $2,500 of supplies remain on hand. b) Fees earned but not yet billed total $3,000. e) By the end of January, the Company had performed 1/3 of the services related to the January 20h transaction. d) At the end of January, employees were owed $2,000 e) HINT: Adjusting entry required for activity related to the January 2nd transaction. f) HINT: Adjusting entry required for activity related to the January 4 transaction. 5. Post each of the adjusting entries to the appropriate ledger accounts. 6. Prepare an adjusted trial balance for January 31, 2018 7. Prepare Jackson Corporation's financial statements for the month of January: a) Income Statement, (b) Statement of Retained Earnings, and (e) Balance Sheet 8. Record closing entries in the general journal. 9. Post closing entries to the appropriate ledger accounts. 10. Prepare an after-closing trial balance for Jackson Corporation for January 31, 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started