Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Cycle Project Part 1 Regular Transactions The following transaction occurred for Zeta Video Game Supplies during The fallowing transaction occurred for Omega Car

Accounting Cycle Project Part 1 – Regular Transactions The following transaction occurred for Zeta Video Game Supplies during

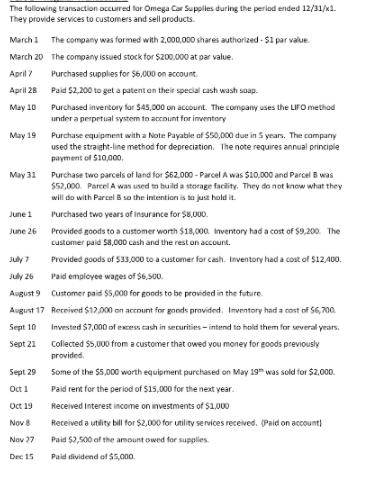

The fallowing transaction occurred for Omega Car Supplies during the period ended 12/31/x1. They provide services to customers and sell products. March 1 The company was formed with 2,000,000 shares authorized - $1 par value. March 20 The company issued stock for $200.000 at par value. April 7 Purchased supplies for $6,000 on account. April 28 Paid $2,200 to get a patent on their special cash wash soap. May 10 Purchased inventory for 545,000 on account. The company uses the LIFO method under a perpetual system to account for imventory May 19 Purchase equipment with a Note Payable of $50,000 due in S years. The company used the straight-line method for depreciation. The note requires annual principle payment of $10,00, Purchase two parcels of land for $62.000 - Parcel A was $10,000 and Parcel B was $52,000. Parcel A was used to huild a storage faciity. They do not know what they will do with Parcel B sa the intention is to just hold it. May 31 Purchased two years of insurance for $8,000. June 1 Provided goods to a customer worth $18,000. Inventory had a cost of $9,200. The customer paid S8,000 cash and the rest on account. July 7 Provided goods of 533,000 to a customer for cash. Inventory had a cost of $12,400. July 26 Paid employee wages of $6,500. August 9 Customer paid $5,000 for goods to be provided in the future. August 17 Received $12.000 on account for gonds provided. Imventory had a cost of 56,700. Sept 10 Invested $7,000 of ecess cash in securities - intend to hold them for several years. Sept 21 Collected $5,000 from a customer that owed you money for goods previously provided. Sept 29 Some of the $5,000 worth equipment purchased on May 19" was sold for $2.000. Oct 1 Paid rent for the period of $15,000 for the next year. Oct 19 Received interest income on investments of $1,000 Nov 8 Received a utlity bill for $2,000 for utility services received. (Paid on account) Nov 27 Paid $2,500 of the amount owed for supplies. Dec 15 aid dividend of $5,00.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A CD E Journal entries of Zeta Video Game supplies for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started