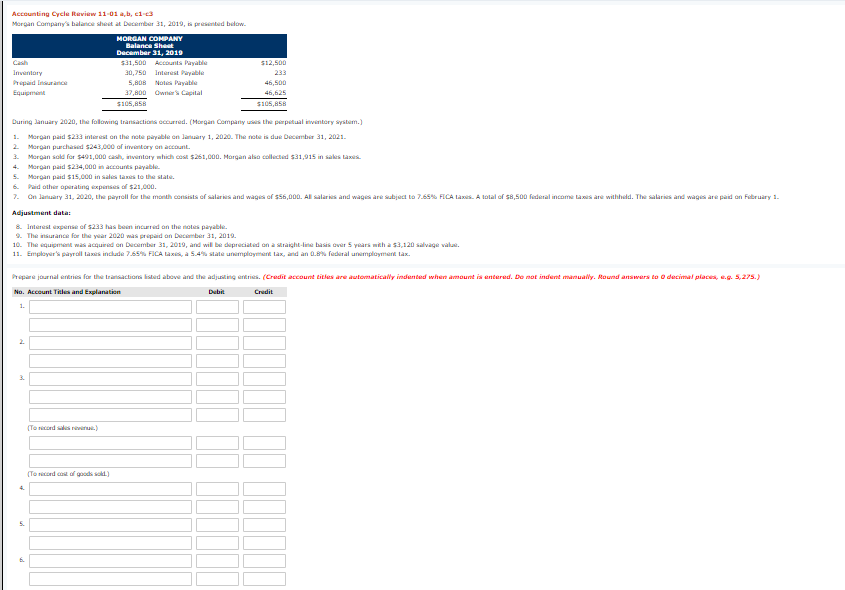

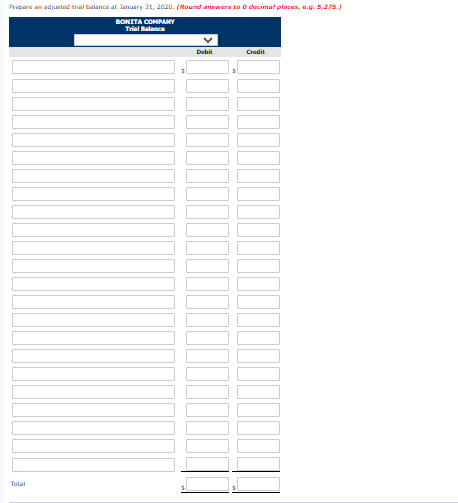

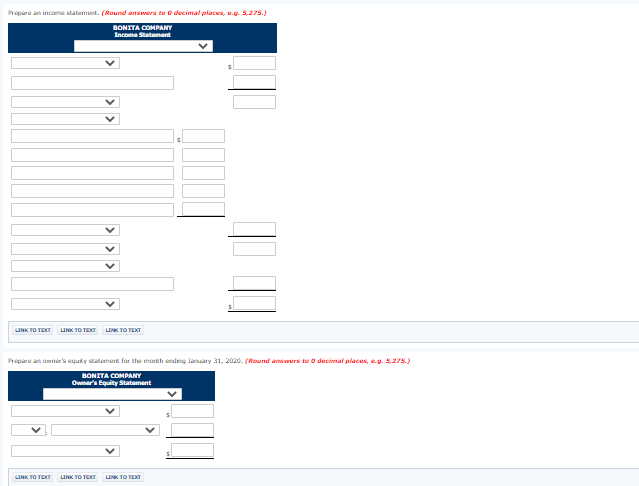

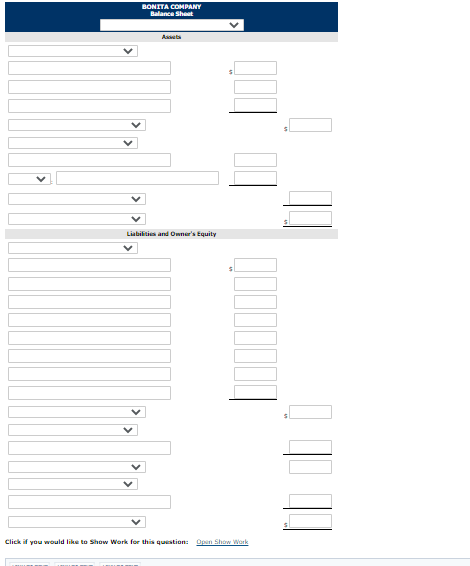

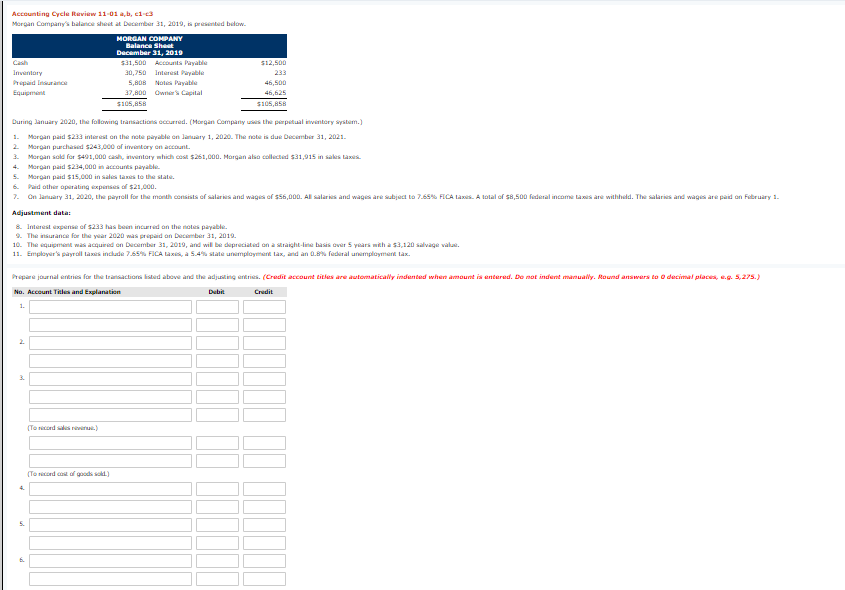

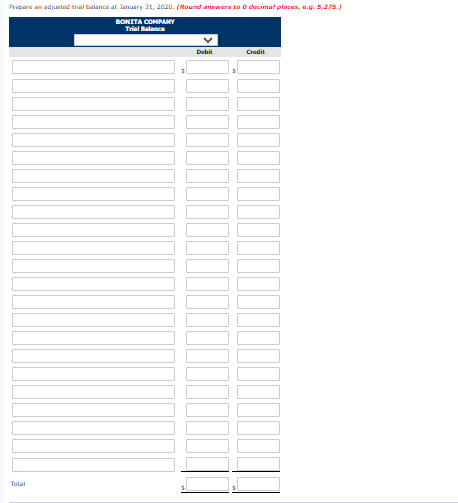

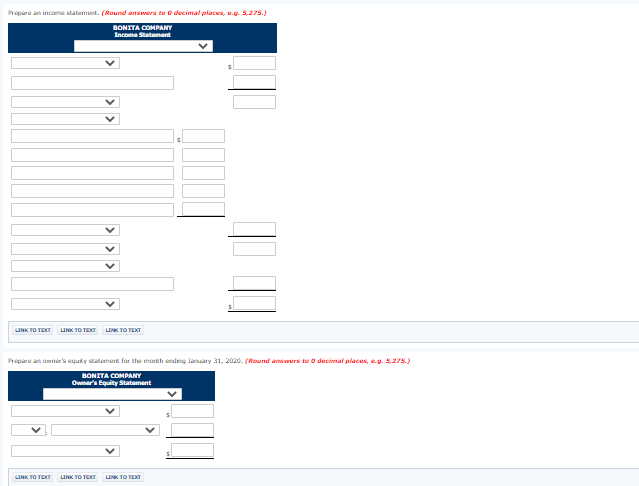

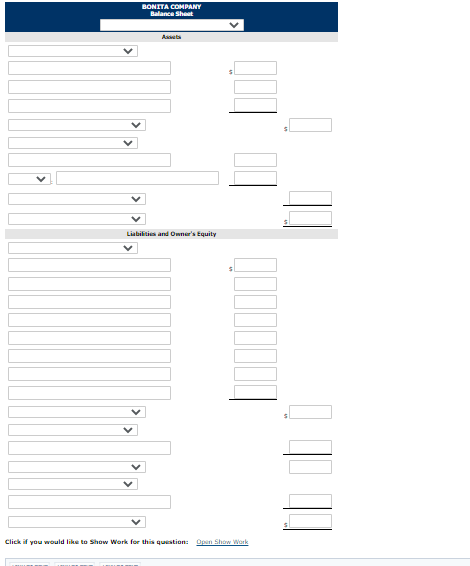

Accounting Cycle Review 11-01 a, b, ci Morgan Company's balance sheet at December 31, 2019, i presented below. MORGAN COMPANY Balance Sheet December 31, 2019 $31,500 Accounts Payable $12,500 Inventory 30,250 Interest Payable 233 Prepaid Care 5,808 Nolas Payable 46,500 Equipment 37,800 Owners Capital 46,625 $105,856 $105,858 During January 2020, the following transactions cccurred. (Morgan Company is the perpetual inventory system.) 1. Morgan paid $223 interest on the not payable on January 1, 2020. The note is due December 31, 2021. 2 Morgan purchased $243,000 of try on account 3. Morgan sold for $493,000 cas, inventory which cost $261,000. Margan also collected $31,915 in sales taxes 4. Morgan paid $234,000 is accounts payable Morgan paid $15,000 in sales taxes to the state. 6. Pred other operating expenses of $21,000. 7. On laruary 31, 2020, the payroll for the month consists of salaries and wage of 556,000. Al salaries and wages are subject to 7.654. FICA laxis. A total of $8,500 federal income taxes are withheld. The salaries and wages are paid on February 1. Adjustment data: & Interest expense of $233 has been incurred on the roles payable 9. The insurance for the year 2020 was prepaid on December 31, 2019. 10. The equipment was acquired on December 31, 2019, and will be depreciated on a straight-line basis over 5 years with a 53,120 Salvage valul 11. Employer's payroll taxes include 7.65% FICA taxes, a 5.4% state unemployment lax, and an 8 federal unemployment lax. Prepare journal and for the transactionalisted above and the adjusting entries. (Credit account cicles are automatically indeed where amourol is red. Do not indera mally. Round answers to decimal places, e.g. 5,275.) No. Account Titles and explanation Debit Credit 1. To records of goods sold . 2. 10. Prepare and adjuriled trial balance at January 31, 2020. (Round answers to decimal places, .-5,275.) BONITA COMPANY Trial Balance Dubi Credit Total Prepare an income statement. (Round answers to decimal places, .g. 5,275.) BONITA COMPANY Income Statement LINK TO TOT LINK TO TEXT LINK TO TEXT Prepare an owner's equity statement for the month ending January 31, 2020. (Round answers to decimal places, c.9. 5,275) BONITA COMPANY Owner's Equity Statement LINK TO TEXT LINK TO TEXT LINK TO TEXT BONITA COMPANY Balance Sheet Liabilities and Owner's Equity Click if you would like to Show Work for this question: Open Show Work