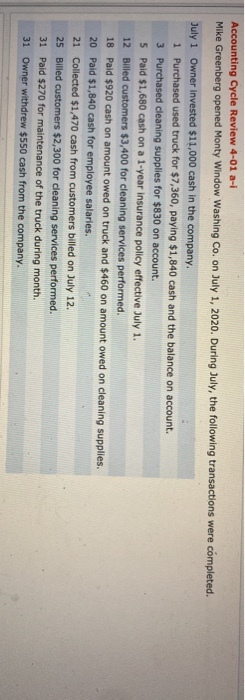

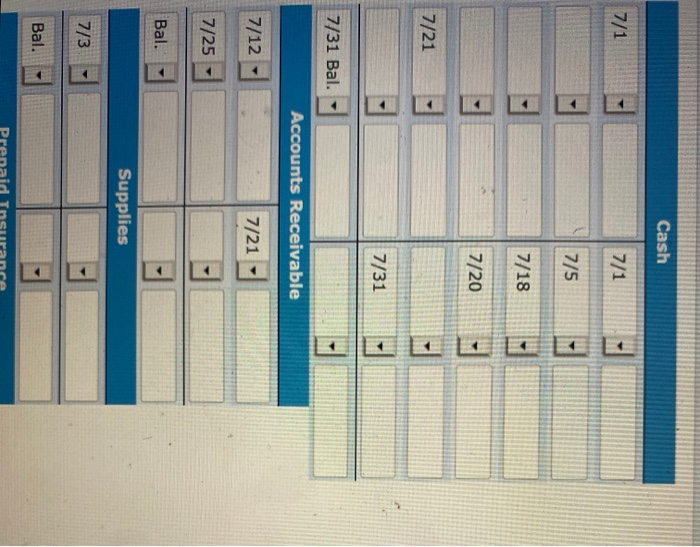

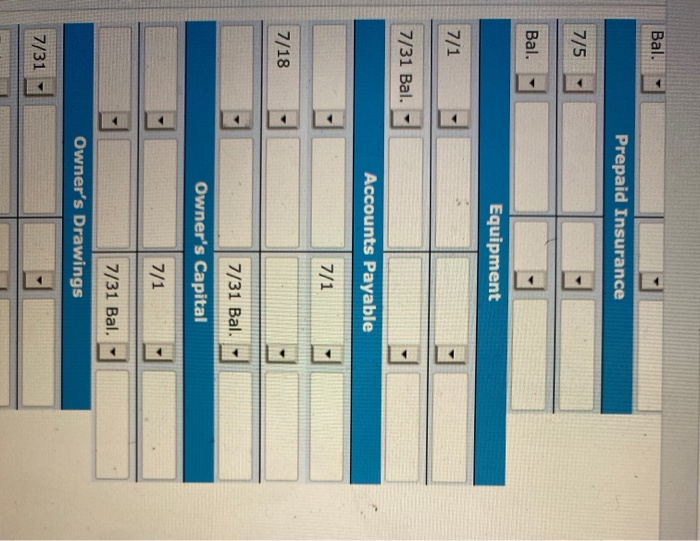

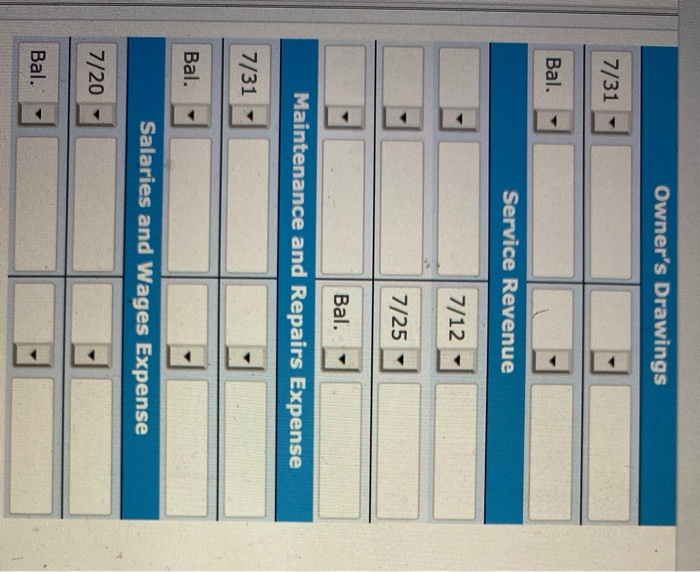

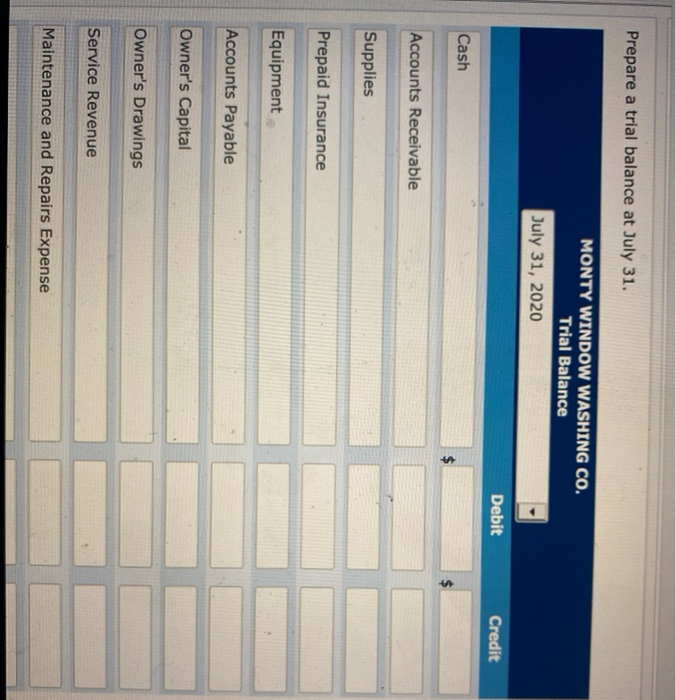

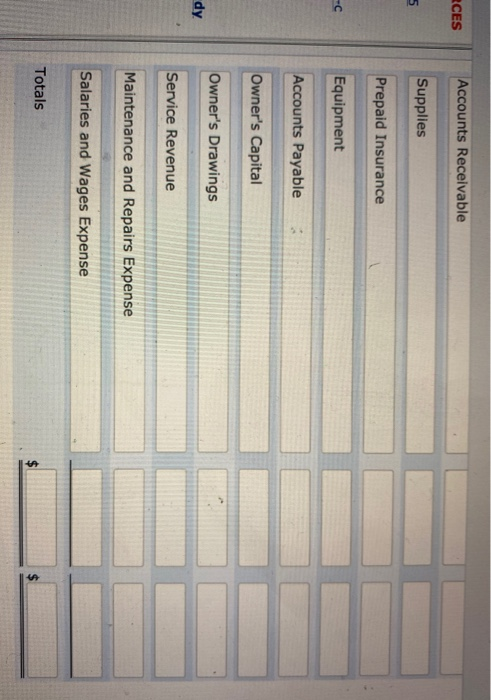

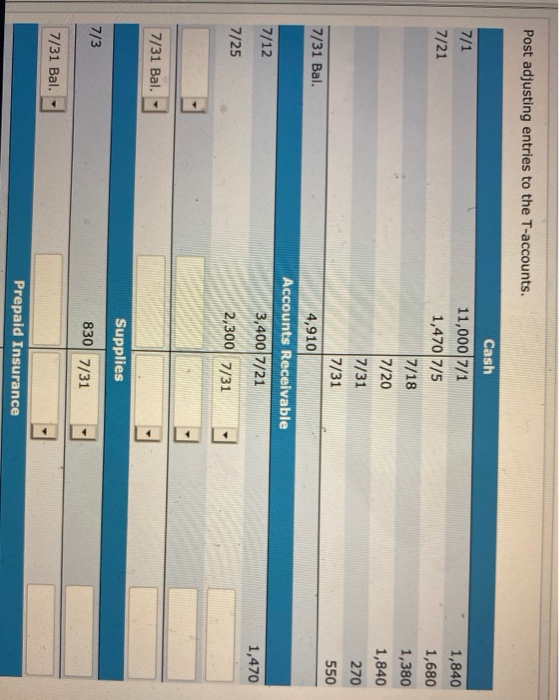

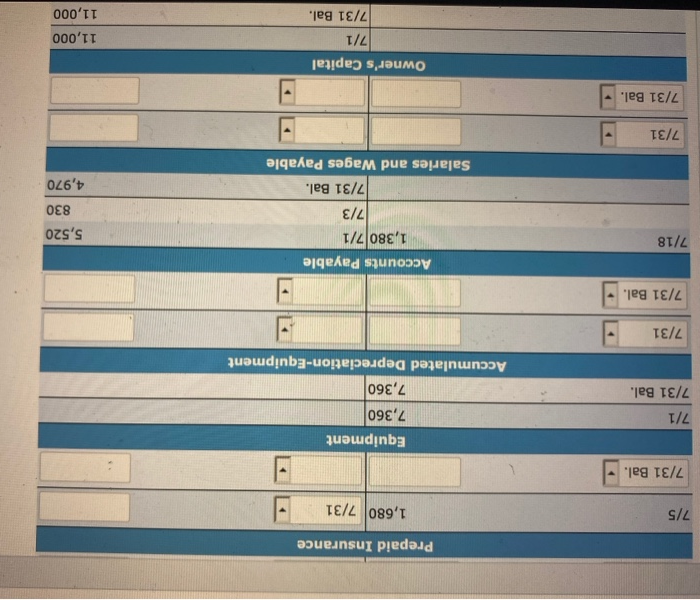

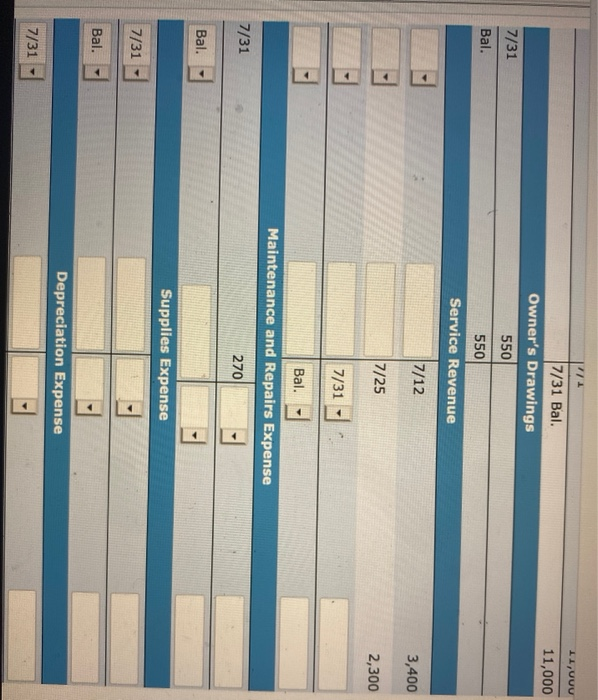

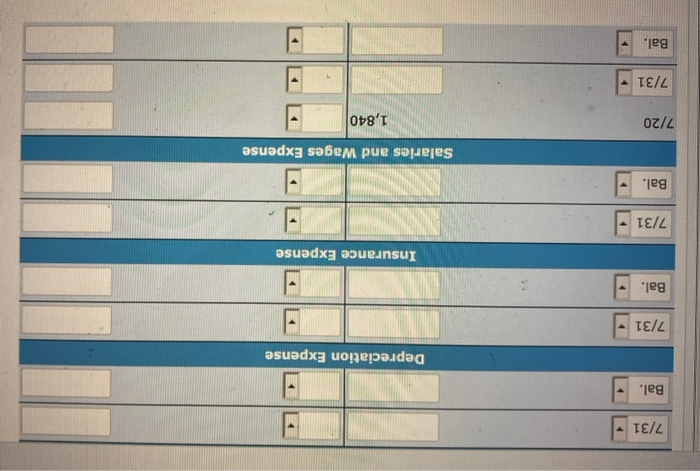

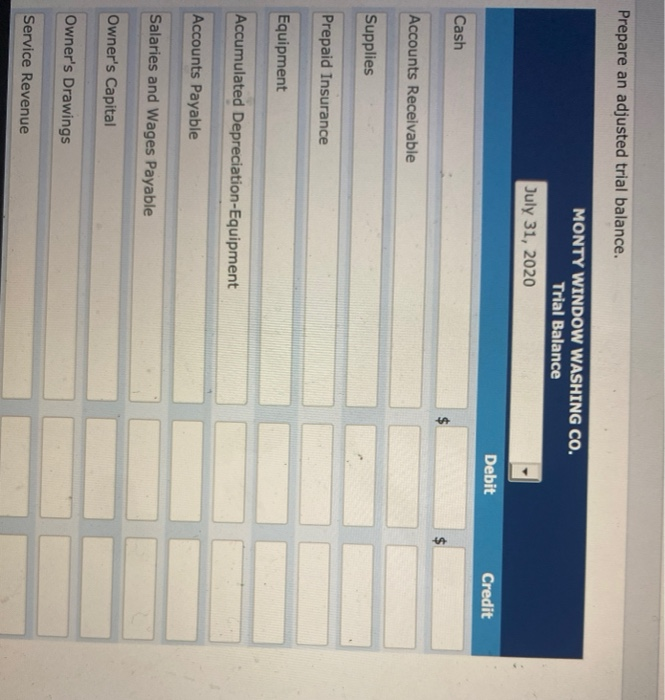

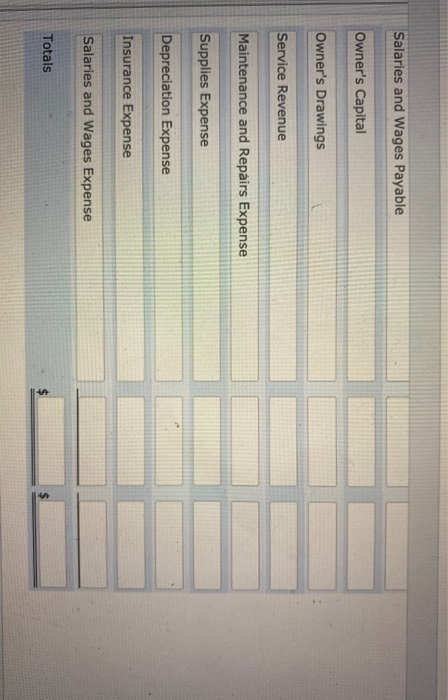

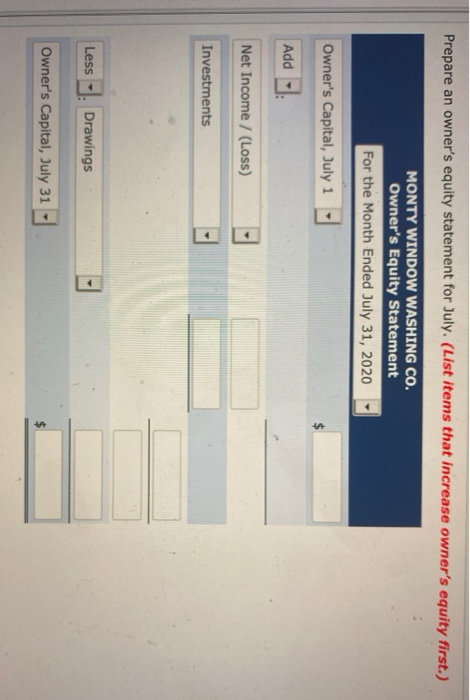

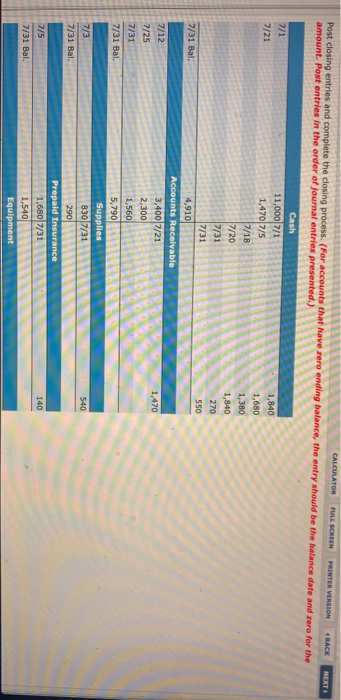

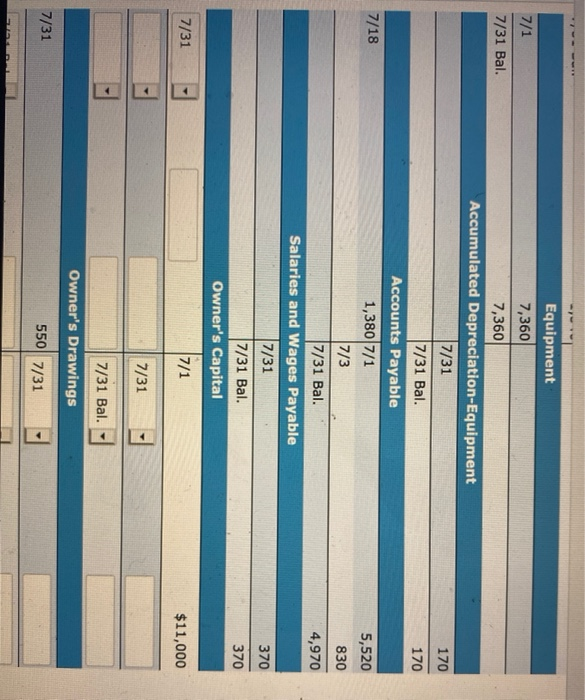

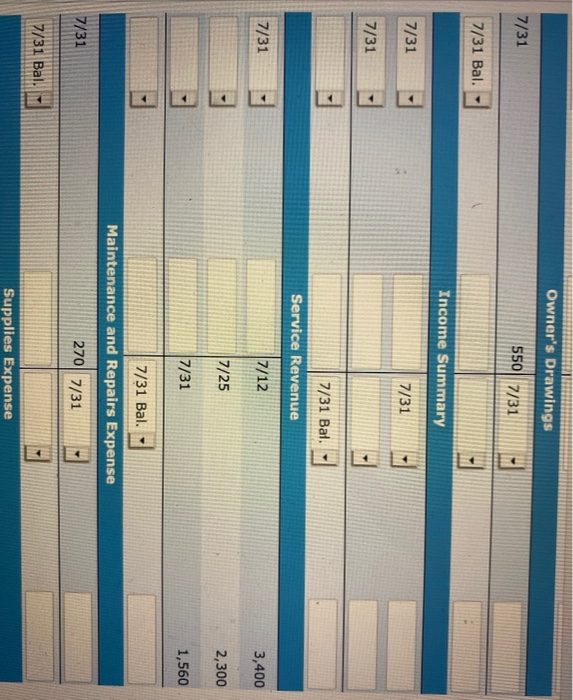

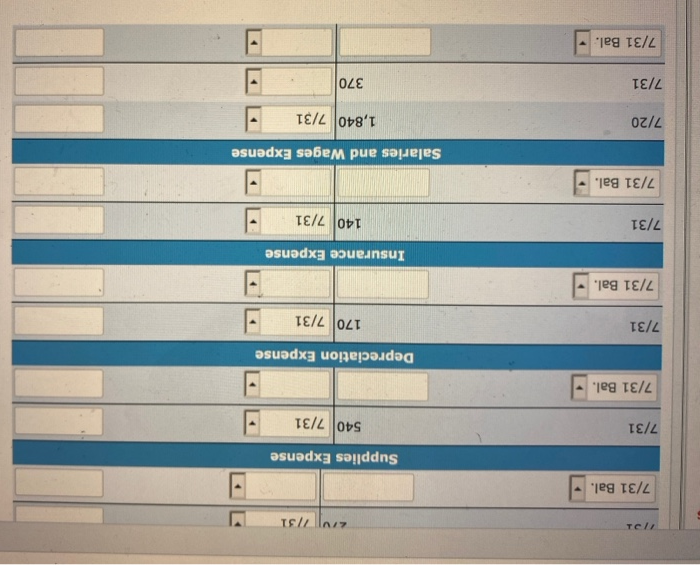

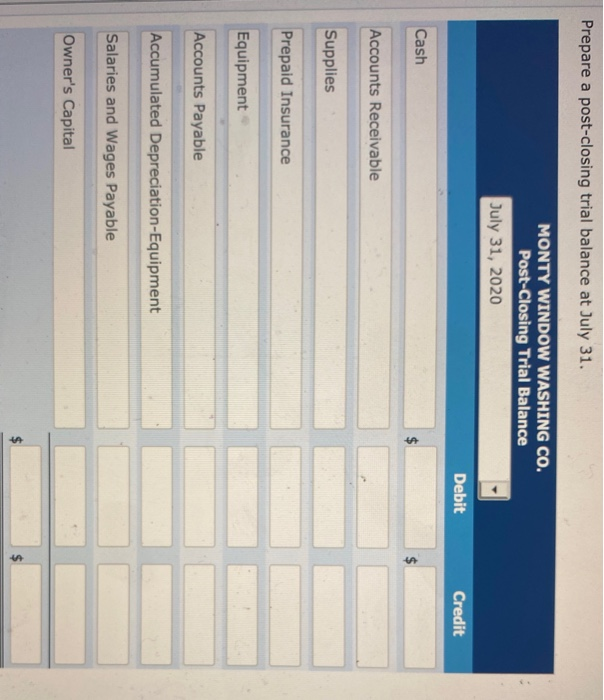

Accounting Cycle Review 4-01 a-l Mike Greenberg opened Monty Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $11,000 cash in the company. 1 Purchased used truck for $7,360, paying $1,840 cash and the balance on account 3 Purchased cleaning supplies for $830 on account. 5 Paid $1,680 cash on a 1-year Insurance policy effective July 1. 12 Billed customers $3,400 for cleaning services performed. 18 Paid $920 cash on amount owed on truck and $460 on amount owed on cleaning supplies. 20 Paid $1,840 cash for employee salaries. 21 Collected $1,470 cash from customers billed on July 12. 25 Billed customers $2,300 for cleaning services performed. 31 Paid $270 for maintenance of the truck during month. 31 Owner withdrew $550 cash from the company. Cash 7/1 7/1 7/5 7/18 7/20 7/21 7/31 7/31 Bal. Accounts Receivable 7/12 7/21 7/25 Bal. Supplies 7/3 Bal. Bal. Prepaid Insurance 7/5 Bal. Equipment 7/1 7/31 Bal. Accounts Payable 7/1 7/18 7/31 Bal. Owner's Capital 7/1 7/31 Bal. Owner's Drawings 7/31 Owner's Drawings 7/31 Bal. Service Revenue 7/12 - 7/25 Bal. Maintenance and Repairs Expense 7/31 Bal. Salaries and Wages Expense 7/20 Bal. Prepare a trial balance at July 31. MONTY WINDOW WASHING CO. Trial Balance July 31, 2020 Debit Credit Cash $ Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Owner's Capital Owner's Drawings Service Revenue Maintenance and Repairs Expense RCES Accounts Receivable 5 Supplies Prepaid Insurance --C Equipment Accounts Payable Owner's Capital Owner's Drawings dy Service Revenue Maintenance and Repairs Expense Salaries and Wages Expense Totals Post adjusting entries to the T-accounts. Cash 7/1 7/21 11,000 7/1 1,470 7/5 7/18 7/20 7/31 7/31 1,840 1,680 1,380 1,840 270 550 7/31 Bal. 4,910 Accounts Receivable 3,400 7/21 7/12 1,470 7/25 2,3007/31 7/31 Bal. - Supplies 7/3 8307/31 7/31 Bal. Prepaid Insurance Prepaid Insurance 7/5 1,6807/31 7/31 Bal. 7/1 7/31 Bal. Equipment 7,360 7,360 Accumulated Depreciation-Equipment 7/31 7/31 Bal. 7/18 Accounts Payable 1,380 7/1 7/3 7/31 Bal. Salaries and Wages Payable 5,520 830 4,970 7/31 7/31 Bal. Owner's Capital 7/1 7/31 Bal. 11,000 11,000 11 11,UVO 11,000 7/31 Bal. Owner's Drawings 550 7/31 Bal. 550 Service Revenue 7/12 3,400 7/25 2,300 7/31 Bal. Maintenance and Repairs Expense 7/31 270 Bal. Supplies Expense 7/31 Bal. Depreciation Expense 7/31 7/31 Bal. Depreciation Expense 7/31 Bal. Insurance Expense 7/31 Bal. Salaries and Wages Expense 7/20 1,840 7/31 Bal. Prepare an adjusted trial balance. MONTY WINDOW WASHING CO. Trial Balance July 31, 2020 Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Salaries and Wages Payable Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Payable Owner's Capital Owner's Drawings Service Revenue Maintenance and Repairs Expense Supplies Expense Depreciation Expense Insurance Expense Salaries and Wages Expense Totals Prepare an owner's equity statement for July. (List items that increase owner's equity first.) MONTY WINDOW WASHING CO. Owner's Equity Statement For the Month Ended July 31, 2020 Owner's Capital, July 1 Add Net Income / (Loss) Investments Less Drawings Owner's Capital, July 31 FULL SCREEN PRINTER VERSION Post closing entries and complete the closing process. (For accounts that have rero ending balance, the entry should be the balance date and zero for the amount. Post entries in the order of journal entries presented.) CALCULATOR 4 4 BLACK NEXT 7/1 7/21 1,840 1,680 1,380 1,840 270 550 7/31 Bal. Cash 11,000 7/1 1,4707/5 7/18 7/20 7/31 7/31 4,910 Accounts Receivable 3,400 7/21 2,300 1,560 5,790 Supplies 8307/31 290 Prepaid Insurance 1,680 7/31 1,540 Equipment 7/12 7/25 7/31 7/31 Bal. 1,470 540 7/3 7/31 Bal. 140 7/5 7/31 Bal. Equipment 7,360 7/1 7/31 Bal. 170 170 7/18 7,360 Accumulated Depreciation-Equipment 7/31 7/31 Bal. Accounts Payable 1,380 7/1 7/3 7/31 Bal. Salaries and Wages Payable 7/31 7/31 Bal. Owner's Capital 5,520 830 4,970 370 370 7/31 7/1 $11,000 7/31 7/31 Bal. Owner's Drawings 7/31 5507/31 Owner's Drawings 7/31 5507/31 7/31 Bal. . Income Summary 7/31 7/31 7/31 7/31 Bal. Service Revenue 7/31 7/12 3,400 7/25 2,300 7/31 1,560 7/31 Bal. Maintenance and Repairs Expense 7/31 2707/31 7/31 Bal. Supplies Expense 11 2147131 7/31 Bal. . Supplies Expense 7/31 5407/31 7/31 Bal. Depreciation Expense 7/31 1707/31 7/31 Bal. Insurance Expense 7/31 1407/31 7/31 Bal. Salaries and Wages Expense 7/20 1,8407/31 7/31 370 7/31 Bal. Prepare a post-closing trial balance at July 31. MONTY WINDOW WASHING CO. Post-Closing Trial Balance July 31, 2020 Debit Credit Cash $ $ Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Accumulated Depreciation-Equipment Salaries and Wages Payable Owner's Capital $