Answered step by step

Verified Expert Solution

Question

1 Approved Answer

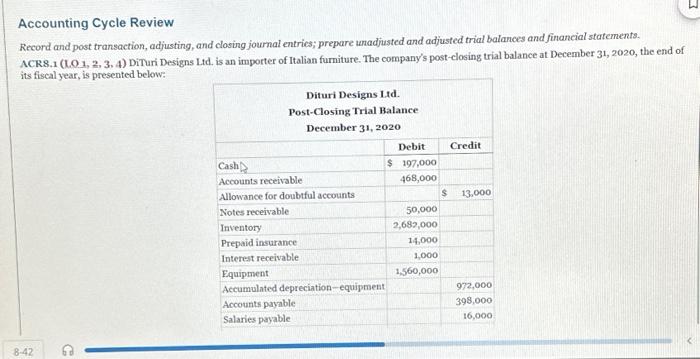

Accounting Cycle Review Record and post transaction, adjusting, and closing journal entries; prepare unadjusted and adjusted trial balances and financial statements. ACR8.1 (LO.1, 2.

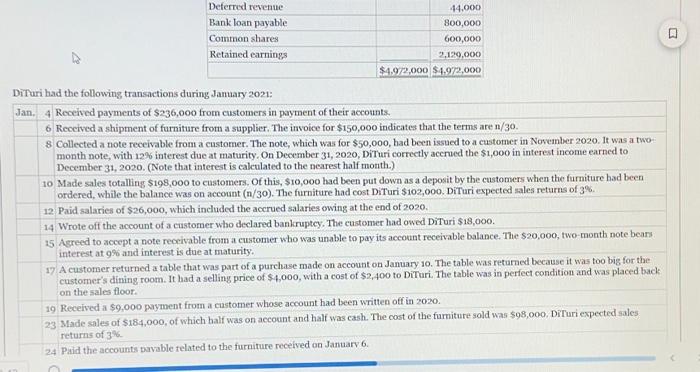

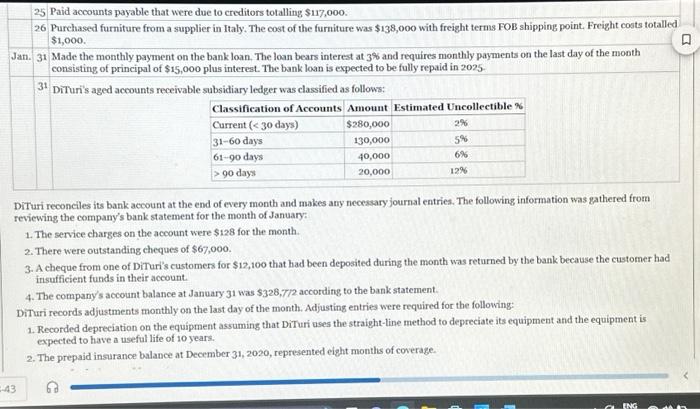

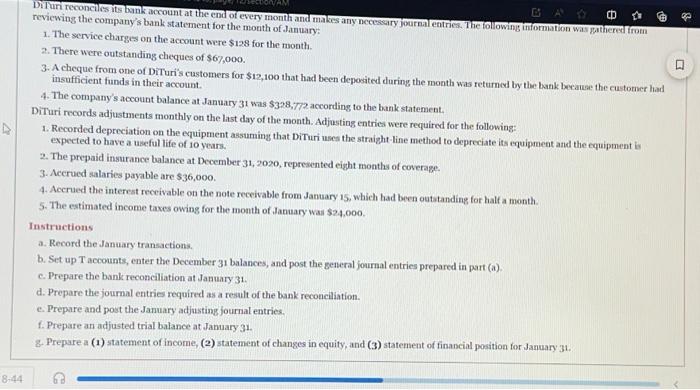

Accounting Cycle Review Record and post transaction, adjusting, and closing journal entries; prepare unadjusted and adjusted trial balances and financial statements. ACR8.1 (LO.1, 2. 3. 4) DiTuri Designs Ltd. is an importer of Italian furniture. The company's post-closing trial balance at December 31, 2020, the end of its fiscal year, is presented below: Dituri Designs Ltd. 8-42 Post-Closing Trial Balance December 31, 2020 Cash Accounts receivable Allowance for doubtful accounts Notes receivable Inventory Prepaid insurance, Interest receivable Equipment Accumulated depreciation-equipment Accounts payable Salaries payable Debit Credit $ 197,000 468,000 $ 13,000 50,000 2,682,000 14,000 1,000 1,560,000 972,000 398,000 16,000 Deferred revenue Bank loan payable Common shares Retained earnings DiTuri had the following transactions during January 2021: 44.000 800,000 600,000 2,120,000 $4.972,000 $4,972,000 Jan. 4 Received payments of $236,000 from customers in payment of their accounts. 6 Received a shipment of furniture from a supplier. The invoice for $150,000 indicates that the terms are n/30. 8 Collected a note receivable from a customer. The note, which was for $50,000, had been issued to a customer in November 2020. It was a two- month note, with 12% interest due at maturity. On December 31, 2020, DiTuri correctly accrued the $1,000 in interest income earned to December 31, 2020. (Note that interest is calculated to the nearest half month.) 10 Made sales totalling $198,000 to customers. Of this, $10,000 had been put down as a deposit by the customers when the furniture had been ordered, while the balance was on account (n/30). The furniture had cost DiTuri $102,000. DiTuri expected sales returns of 3%. 12 Paid salaries of $26,000, which included the accrued salaries owing at the end of 2020. 14 Wrote off the account of a customer who declared bankruptcy. The customer had owed DiTuri $18,000. 15 Agreed to accept a note receivable from a customer who was unable to pay its account receivable balance. The $20,000, two-month note bears interest at 9% and interest is due at maturity. 17 A customer returned a table that was part of a purchase made on account on January 10. The table was returned because it was too big for the customer's dining room. It had a selling price of $4,000, with a cost of $2,400 to DiTuri. The table was in perfect condition and was placed back on the sales floor. 19 Received a $9,000 payment from a customer whose account had been written off in 2020. 23 Made sales of $184,000, of which half was on account and half was cash. The cost of the furniture sold was $98,000. DiTuri expected sales returns of 3%. 24 Paid the accounts payable related to the furniture received on January 6. 25 Paid accounts payable that were due to creditors totalling $117,000. 26 Purchased furniture from a supplier in Italy. The cost of the furniture was $138,000 with freight terms FOB shipping point. Freight costs totalled $1,000. Jan. 31 Made the monthly payment on the bank loan. The loan bears interest at 3% and requires monthly payments on the last day of the month consisting of principal of $15,000 plus interest. The bank loan is expected to be fully repaid in 2025 31 DiTuri's aged accounts receivable subsidiary ledger was classified as follows: Classification of Accounts Amount Estimated Uncollectible % Current ( 90 days $280,000 2% 130,000 5% 40,000 20,000 6% 12% DiTuri reconciles its bank account at the end of every month and makes any necessary journal entries. The following information was gathered from reviewing the company's bank statement for the month of January: 1. The service charges on the account were $128 for the month. 2. There were outstanding cheques of $67,000. 3. A cheque from one of DiTuri's customers for $12,100 that had been deposited during the month was returned by the bank because the customer had insufficient funds in their account. 4. The company's account balance at January 31 was $328,772 according to the bank statement. DiTuri records adjustments monthly on the last day of the month. Adjusting entries were required for the following: 1. Recorded depreciation on the equipment assuming that DiTuri uses the straight-line method to depreciate its equipment and the equipment is expected to have a useful life of 10 years. 2. The prepaid insurance balance at December 31, 2020, represented eight months of coverage. -43 ENG & CD DiTuri reconciles its bank account at the end of every month and makes any necessary journal entries. The following information was gathered from reviewing the company's bank statement for the month of January: 1. The service charges on the account were $128 for the month. 2. There were outstanding cheques of $67,000. 3. A cheque from one of DiTuri's customers for $12,100 that had been deposited during the month was returned by the bank because the customer had insufficient funds in their account. 4. The company's account balance at January 31 was $328,772 according to the bank statement. DiTuri records adjustments monthly on the last day of the month. Adjusting entries were required for the following: 1. Recorded depreciation on the equipment assuming that DiTuri uses the straight-line method to depreciate its equipment and the equipment is expected to have a useful life of 10 years. 2. The prepaid insurance balance at December 31, 2020, represented eight months of coverage. 3. Accrued salaries payable are $36,000. 4. Accrued the interest receivable on the note receivable from January 15, which had been outstanding for half a month. 5. The estimated income taxes owing for the month of January was $24,000. Instructions a. Record the January transactions. b. Set up T accounts, enter the December 31 balances, and post the general journal entries prepared in part (a). c. Prepare the bank reconciliation at January 31. d. Prepare the journal entries required as a result of the bank reconciliation. e. Prepare and post the January adjusting journal entries. f. Prepare an adjusted trial balance at January 31. g. Prepare a (1) statement of income, (2) statement of changes in equity, and (3) statement of financial position for January 31. 8-44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started