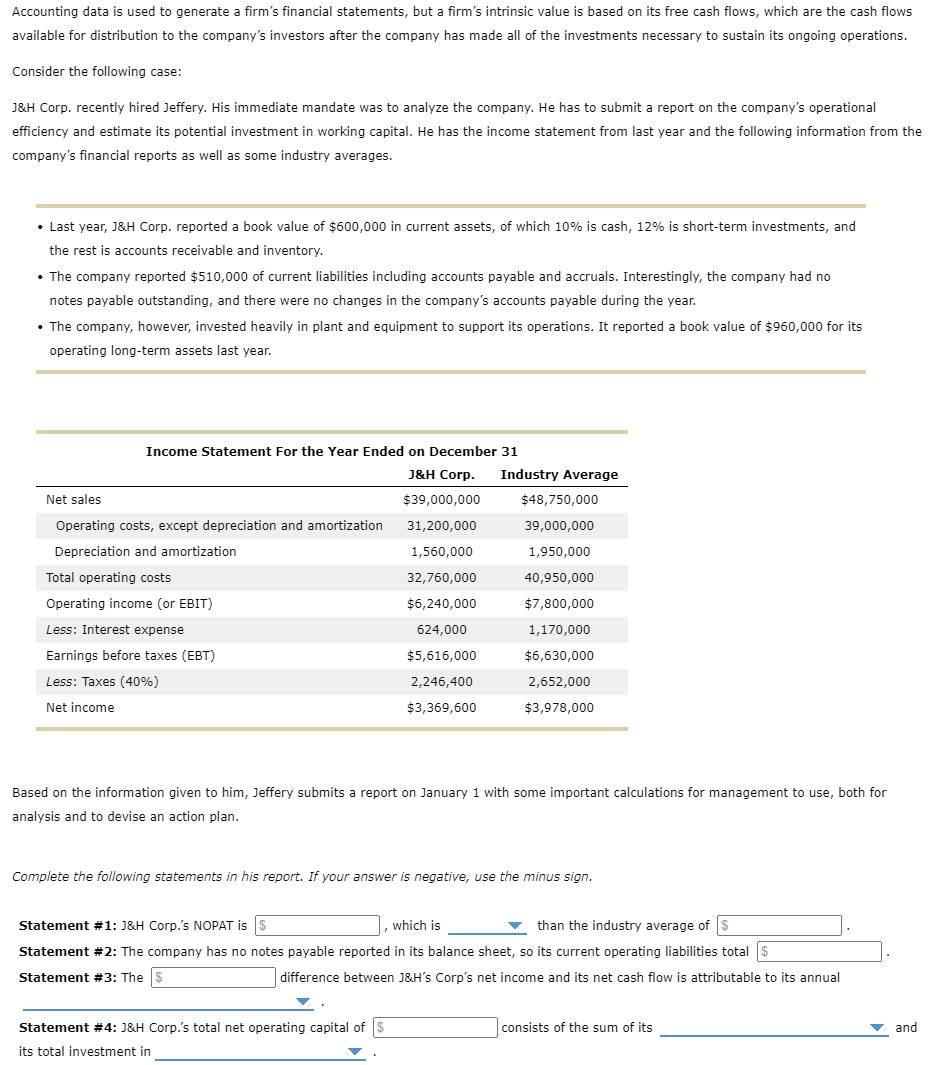

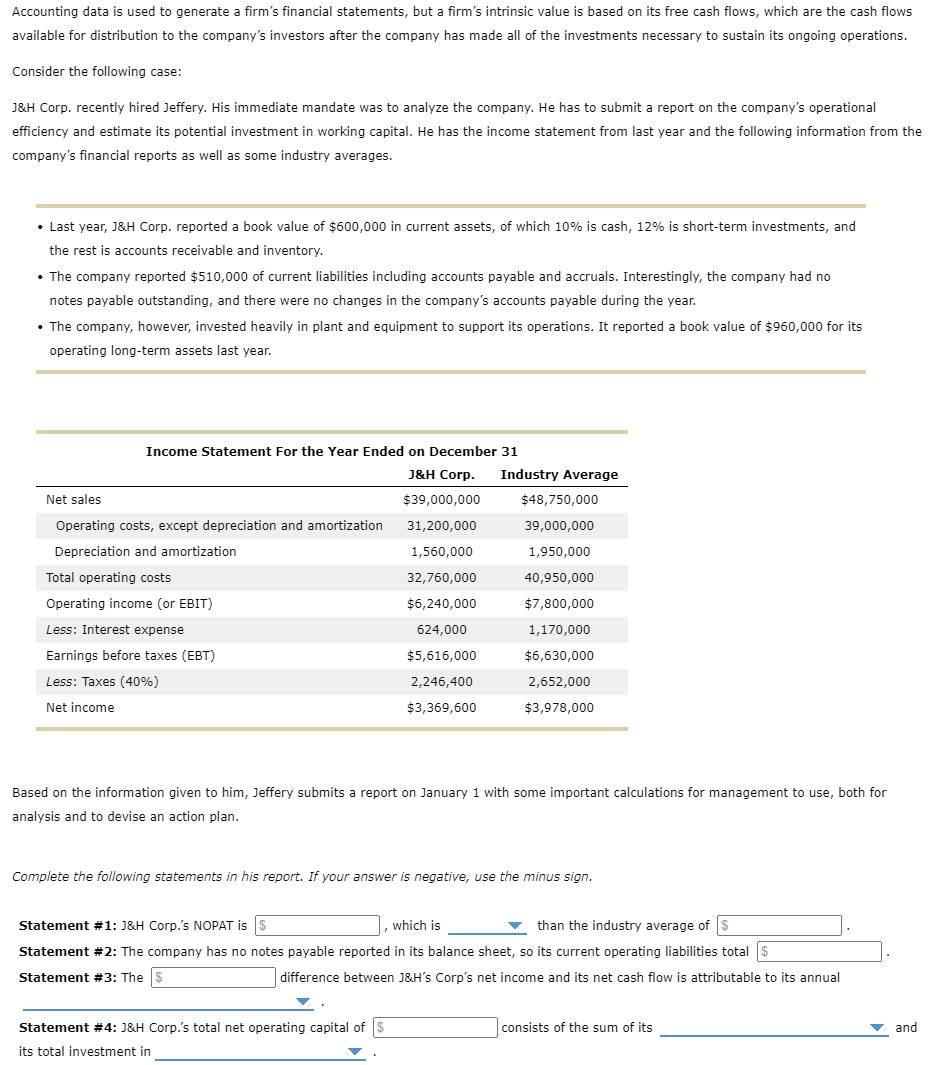

Accounting data is used to generate a firm's financial statements, but a firm's intrinsic value is based on its free cash flows, which are the cash flows available for distribution to the company's investors after the company has made all of the investments necessary to sustain its ongoing operations. Consider the following case: J\&H Corp. recently hired Jeffery. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efficiency and estimate its potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages. - Last year, J\&H Corp. reported a book value of $600,000 in current assets, of which 10% is cash, 12% is short-term investments, and the rest is accounts receivable and inventory. - The company reported $510,000 of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable outstanding, and there were no changes in the company's accounts payable during the year. - The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $960,000 for its operating long-term assets last year. Based on the information given to him, Jeffery submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Complete the following statements in his report. If your answer is negative, use the minus sign. Statement #1: J\&H Corp.'s NOPAT is Statement #2: The company has no notes payable reported in its balance sheet, so its current operating liabilities total Statement #3: The Statement #4: J\&H Corp.'s total net operating capital of its total investment in Accounting data is used to generate a firm's financial statements, but a firm's intrinsic value is based on its free cash flows, which are the cash flows available for distribution to the company's investors after the company has made all of the investments necessary to sustain its ongoing operations. Consider the following case: J\&H Corp. recently hired Jeffery. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efficiency and estimate its potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages. - Last year, J\&H Corp. reported a book value of $600,000 in current assets, of which 10% is cash, 12% is short-term investments, and the rest is accounts receivable and inventory. - The company reported $510,000 of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable outstanding, and there were no changes in the company's accounts payable during the year. - The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $960,000 for its operating long-term assets last year. Based on the information given to him, Jeffery submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Complete the following statements in his report. If your answer is negative, use the minus sign. Statement #1: J\&H Corp.'s NOPAT is Statement #2: The company has no notes payable reported in its balance sheet, so its current operating liabilities total Statement #3: The Statement #4: J\&H Corp.'s total net operating capital of its total investment in