Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnson Mining Company purchased land containing mineral ore on February 1, 20Y1, at a cost of $1,250,000. It estimated that a total of 60,000

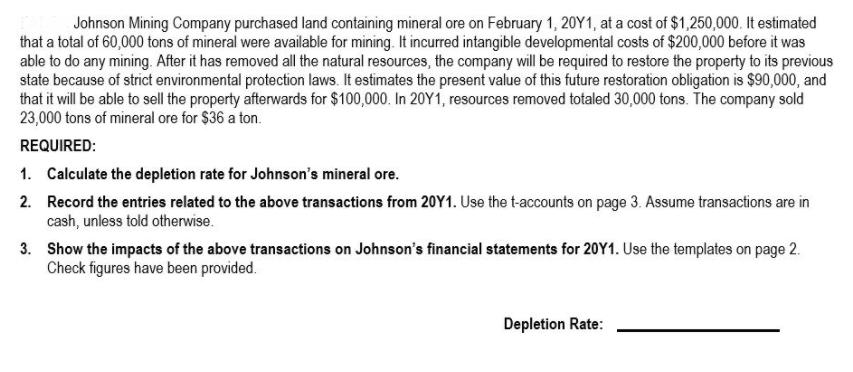

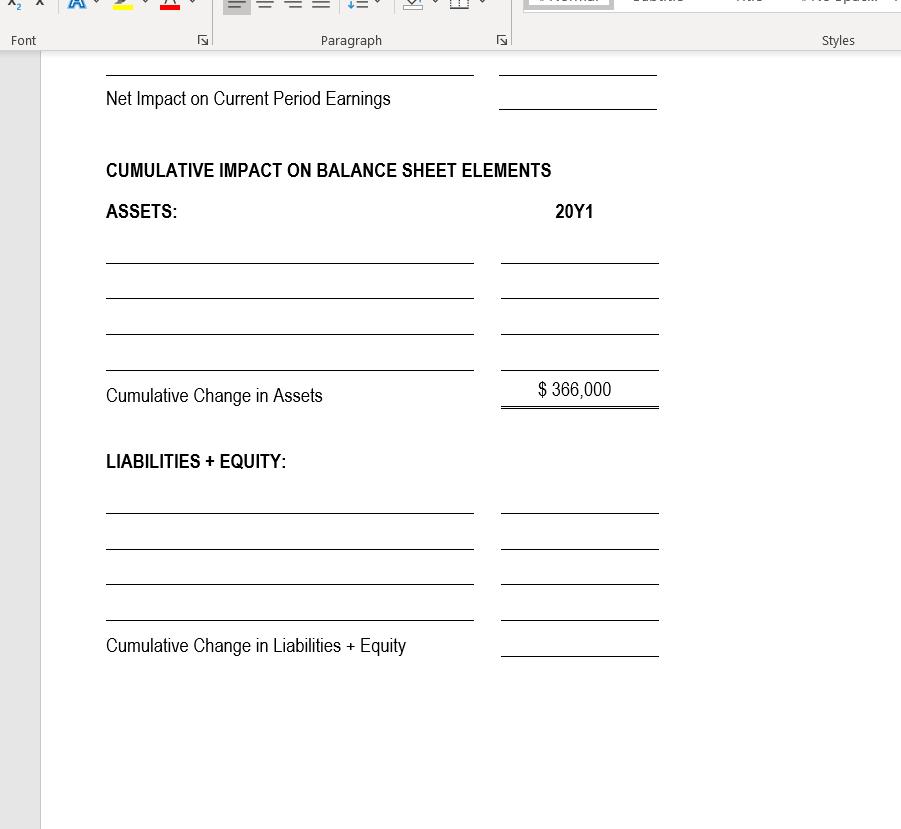

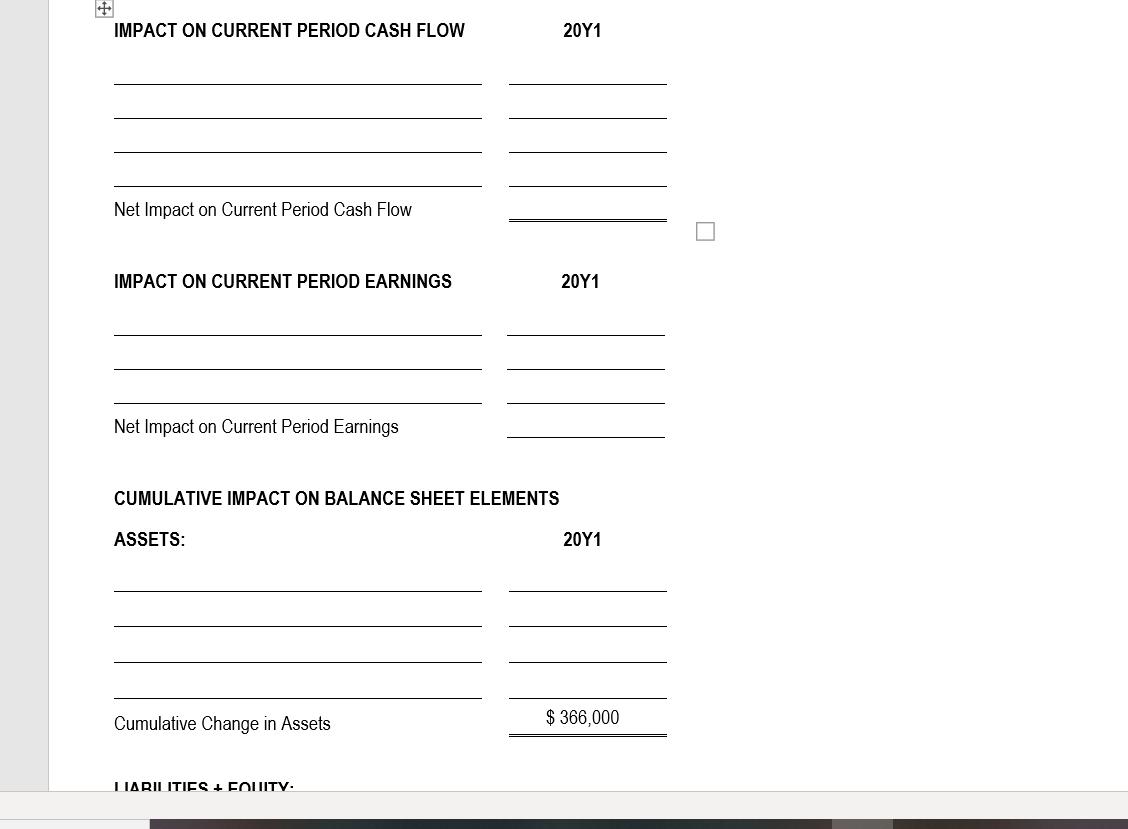

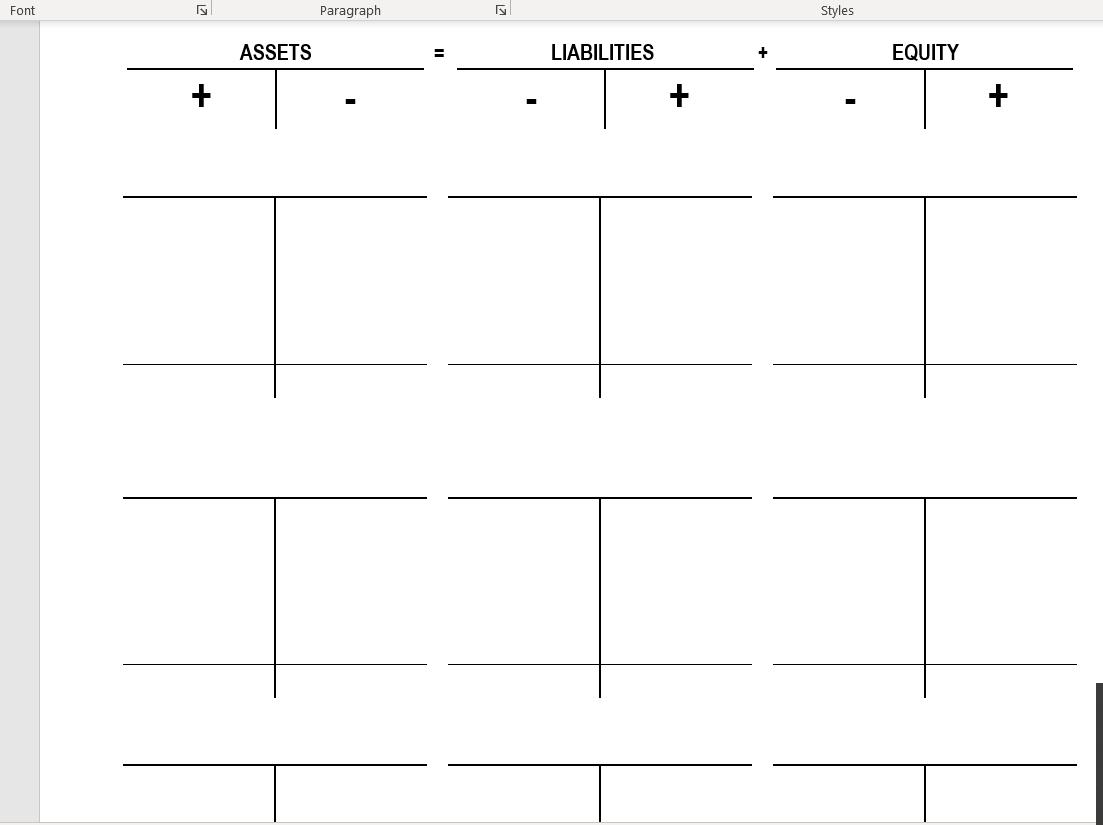

Johnson Mining Company purchased land containing mineral ore on February 1, 20Y1, at a cost of $1,250,000. It estimated that a total of 60,000 tons of mineral were available for mining. It incurred intangible developmental costs of $200,000 before it was able to do any mining. After it has removed all the natural resources, the company will be required to restore the property to its previous state because of strict environmental protection laws. It estimates the present value of this future restoration obligation is $90,000, and that it will be able to sell the property afterwards for $100,000. In 20Y1, resources removed totaled 30,000 tons. The company sold 23,000 tons of mineral ore for $36 a ton. REQUIRED: 1. Calculate the depletion rate for Johnson's mineral ore. 2. Record the entries related to the above transactions from 20Y1. Use the t-accounts on page 3. Assume transactions are in cash, unless told otherwise. 3. Show the impacts of the above transactions on Johnson's financial statements for 20Y1. Use the templates on page 2. Check figures have been provided. Depletion Rate: Font Paragraph Styles Net Impact on Current Period Earnings CUMULATIVE IMPACT ON BALANCE SHEET ELEMENTS ASSETS: 201 Cumulative Change in Assets $ 366,000 LIABILITIES + EQUITY: Cumulative Change in Liabilities + Equity IMPACT ON CURRENT PERIOD CASH FLOW 201 Net Impact on Current Period Cash Flow IMPACT ON CURRENT PERIOD EARNINGS 201 Net Impact on Current Period Earnings CUMULATIVE IMPACT ON BALANCE SHEET ELEMENTS ASSETS: 201 Cumulative Change in Assets $ 366,000 LIARILITIS + FOUITV. Font Paragraph Styles ASSETS LIABILITIES EQUITY

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 2 1 Purchase Price 2 1250000 Development Cost Future Restoration Obligation 200000 4 90000 Total C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started