Question: DIRECTIONS. Using the information provided, COMPLETE the fillable W-2 form provided and the tax tables provided in the back of your textbook. SUBMIT YOUR

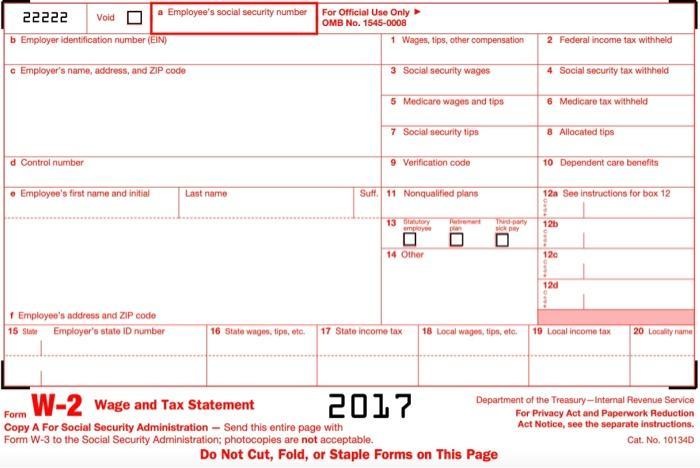

DIRECTIONS. Using the information provided, COMPLETE the fillable W-2 form provided and the tax tables provided in the back of your textbook. SUBMIT YOUR COMPLETED W-2 FORM BELOW Carmen Garcia 4900 Gladwynne Terrace Harlingen, TX 78550 Married, 3 allowances $820 per week SS# 111-22-5771 Union Dues withheld: $102 Social Security Withheld Medicare tax withheld $2643.68 $618.28 $1308.84 $1654.64 $25.48 ** State Income tax withheld Local Income tax withheld TX State Unemployment tax withheld ** Label state unemployment as TX SUI FILLABLE W-2 FORM 22222 b Employer identification number (EIN) e Employer's name, address, and ZIP code d Control number Void a Employee's social security number e Employee's first name and initial f Employee's address and ZIP code 15 State Employer's state ID number Last name 16 State wages, tips, etc. For Official Use Only OMB No. 1545-0008 1 Wages, tips, other compensation 3 Social security wages 5 Medicare wages and tips 7 Social security tips W-2 Wage and Tax Statement Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable. 9 Verification code Suff. 11 Nonqualified plans 13 Statutory Petromar employee 14 Other 17 State income tax 2017 plan U Third-party sick pay O 18 Local wages, tips, etc. 2 Federal income tax withheld Do Not Cut, Fold, or Staple Forms on This Page 4 Social security tax withheld 6 Medicare tax withheld 8 Allocated tips 10 Dependent care benefits 12a See instructions for box 12 12b 120 12d 19 Local income tax 20 Locality name Department of the Treasury-Internal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 10134D

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Hello Student I hope you find this answer helpful Wishing you the best o... View full answer

Get step-by-step solutions from verified subject matter experts