Answered step by step

Verified Expert Solution

Question

1 Approved Answer

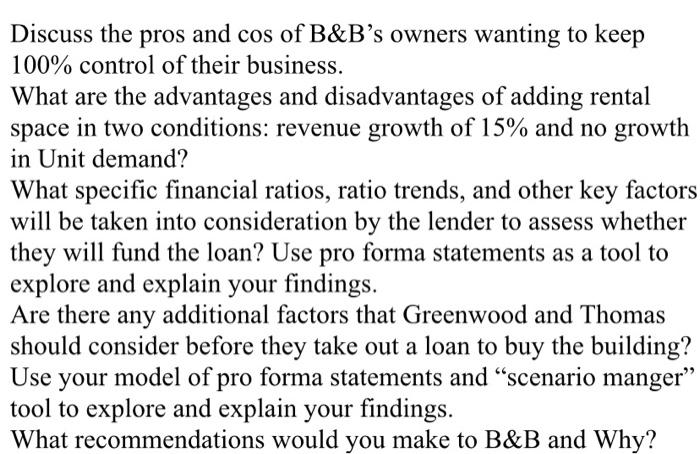

Discuss the pros and cos of B&B's owners wanting to keep 100% control of their business. What are the advantages and disadvantages of adding

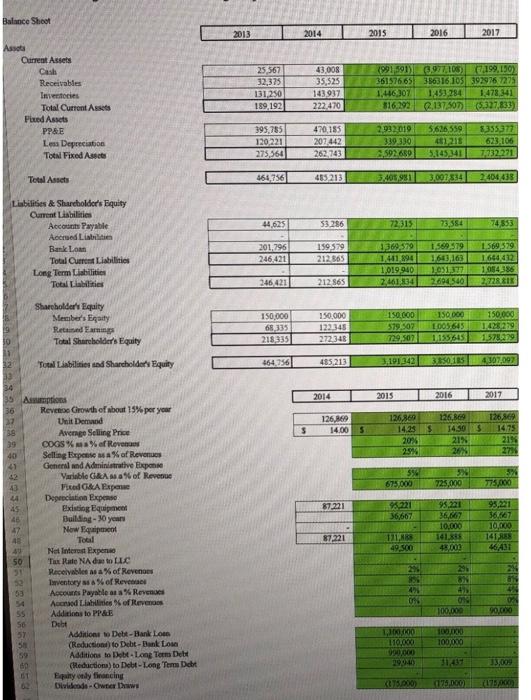

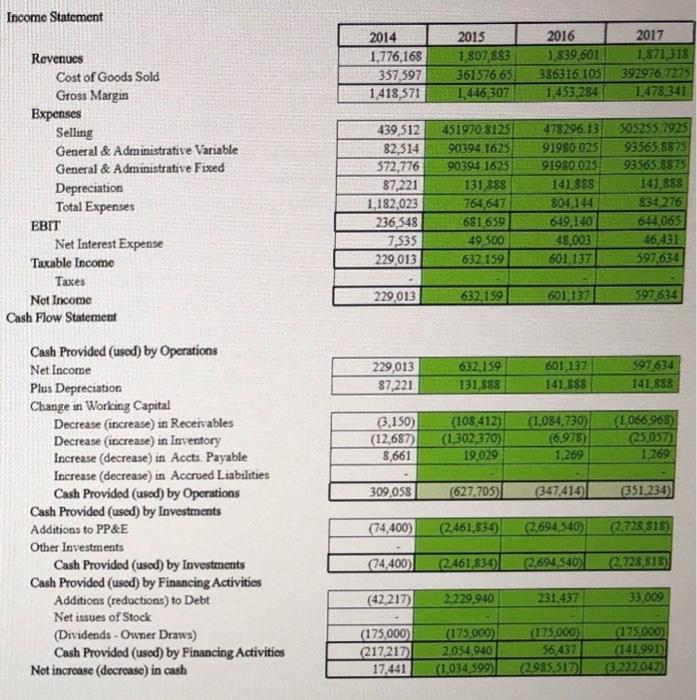

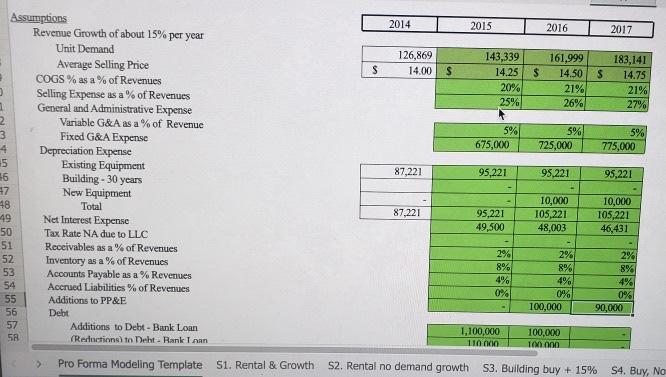

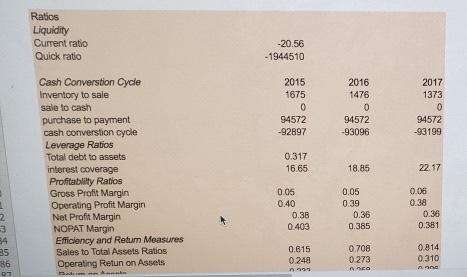

Discuss the pros and cos of B&B's owners wanting to keep 100% control of their business. What are the advantages and disadvantages of adding rental space in two conditions: revenue growth of 15% and no growth in Unit demand? What specific financial ratios, ratio trends, and other key factors will be taken into consideration by the lender to assess whether they will fund the loan? Use pro forma statements as a tool to explore and explain your findings. Are there any additional factors that Greenwood and Thomas should consider before they take out a loan to buy the building? Use your model of pro forma statements and "scenario manger" tool to explore and explain your findings. What recommendations would you make to B&B and Why? Balance Shoot 2013 2014 2015 2016 2017 Assota Current Assets Cash Receivables (991591) 361576.65 C199,150) 43,008 35,525 143937 222,470 6,977106) 386316105 392976 7275 1453 284 816.292 Q137507) 25,567 32,375 Inventories 131,250 1.446307 1,478 341 Total CurrontAssets 189 192 (5,327,833) Fixed Assets 5.626 559 441218 5.45341 2,932019 8355377 623.106 PPAE 395,785 470, 185 120221 275,564 Lesa Depreciation 207,442 339.330 Total Fixed Assets 262.743 .592689 7.732.271 Total Assets 464,756 485213 3007834 2404 435 Lisbilities & Shareholders Equity Curent Liabilities Accounts Payable 44,625 53.286 72.315 73,584 74,853 Accrued Liabilitien 201,796 246,421 1369,579 1,441,894 1,019940 2.461834 1569,579 1644,432 1,054386 2728.8IX 159.579 212.865 1,569.579 Bank Loan Total Current Liabilities Long Term Lisbilities 1643,163 1051377 2694540 Total Liabilities 246 421 212 865 Sharcholder's Equity Member's Eqaity Retained EarmingP Total Sharebolder's Equity 150,000 150.000 68,335 218335 150,000 1005645 1,155645 150,000 150.000 579.507 79,507 1428279 1.578.279 122345 272,348 32 Total Liabilities snd Sharcholders Equity 464.756 485,213 3,191342 3850185 4307.097 34 35 Assmptions 2014 2015 2016 2017 Revense Crowth of about 15% per your Unit Demand Avernge Seling Price COGS % % ef Revenaes Selling Expense MA% of Revenues General and Administrative Exponse Variable GAas a of Revenue Fited GA Expeae Depreciation Expense Exiating Equipment Building - 30 yean Now Equipment Total 36 27 126869 126,869 126,869 126, 14.00 14.25 1430 1475 20% 21% 21% 39 40 41 25% 26 276 42 675,000 725,000 775,000 43 44 245 95.221 36,667 10,000 141.85 48,003 95,221 36.667 10.000 95221 36,667 87.221 141 88 46AS 87.221 49,500 Net Interest Expene Tax Rate NA da to LLC Receivables as a % of Revenoes 29% Inventory as a% of Revenac Accounts Payable asa% Revenues Accnsed Liahilities % of Revenas Additions to PP&E Debt 53 0% 100,000 90,000 55 56 100,000 100,000 Additions Dete-Bank Losn (Reduction) to Debt-Bank Losn Additions to Dobt- Long Term Dett (Redactions) to Debt - Long Tem Dcbt Equity only fieoncing Dividende - Owner Daws L100,000 110,000 000000 29940 57 59 60 31439 33,009 175.000) (475A00) 375000) Income Statement 2017 1,871318 392976 7275 1,478 341 2015 2016 1,839,601 386316.105 1453,284 2014 1,776,168 357,597 1418,571 1,807,883 361576.65 1,446,307 Revenues Cost of Goods Sold Gross Margin Bxpenses Selling General & Administrative Variable 505255.7925 93565.8875 451970 8125 439,512 82,514 572,776 87,221 1,182,023 236,548 7,535 229,013 478296. 13 91980 025 91980.025 141 888 804,144 649,140 48,003 601 137 90394 1625 93565.8875 141,888 834 276 644,065 46,431 597,634 General & Administrative Fixed 90394 1625 131,888 Depreciation Total Expenses 764,647 681 659 49 300 EBIT Net Interest Expense Taxable Income 632.159 Taxes 229,013 632,159 601 137 597,634 Net Income Cash Flow Staterment Cash Provided (used) by Operations 229,013 87,221 597,634 141,888 632,159 601,137 141,888 Net Income 131,888 Plus Depreciation Change in Working Capital Decrease (increase) in Receivables Decrease (increase) in Inventory Increase (decrease) in Accts. Payable Increase (decrease) in Accrued Liabilities Cash Provided (used) by Operations Cash Provided (used) by Investments (3,150) (12,687) 8,661 (108412) (1,302,370) 19,029 (1,084,730) (6,975) 1,269 (1,066 968) 25.057) 1,269 309,058 (627,705) 347,414) 351,234) Additions to PP&E (74,400) (2461,834) (2.694 540) (2.728 818) Other Investments (74,400) (2.461,834)| (2694,540) 2.728 818) Cash Provided (used) by Investments Cash Provided (used) by Financing Activities Additions (reductions) to Debt (42,217) 2229,940 231,437 33,009 Net issues of Stock (Dividends - Owner Draws) Cash Provided (used) by Financing Activitios Net increase (decrease) in cash (175,000) (217,217) 17,441 (175,000) 2,054,940 (1,034,599) (175.000) 56,437 (2985 517) (175,000) (141,991) (3,222,042) Assumptions Revenue Growth of about 15% per year 2014 2015 2016 2017 Unit Demand 126,869 143,339 161,999 183,141 Average Selling Price COGS % as a % of Revenues Selling Expense as a % of Revenues General and Administrative Expense 14.00 14.25 14.50 14.75 20% 25% 21% 26% 21% 27% Variable G&A as a % of Revenue 5% 5% 725,000 5% Fixed G&A Expense Depreciation Expense Existing Equipment Building - 30 years New Equipment 675,000 775,000 15 87,221 95,221 95,221 95,221 48 49 10,000 105,221 10,000 105,221 46,431 Total 87,221 95,221 Net Interest Expense 50 49,500 48,003 Tax Rate NA due to LLC Receivables as a % of Revenues 51 2% 8% 4% 0% 100,000 2% 2% 8% 4% 0% 90,000 52 Inventory as a % of Revenues Accounts Payable as a % Revenues Accrued Liabilities % of Revenues 8% 4% 0% 53 54 55 Additions to PP&E 56 Debt 57 Additions to Debt - Bank Loan 1,100,000 110 000 100,000 100 000 58 (Reductions) to Deht - Rank Inan Pro Forma Modeling Template S1. Rental & Growth S2. Rental no demand growth S3. Building buy + 15% S4. Buy, No Ratios Liquidity Current ratio -20.56 Quick ratio -1944510 Cash Converstion Cycle Inventory to sale sale to cash 2015 2016 1476 2017 1675 1373 94572 purchase to payment cash converstion cycle Leverage Ratios Total debt to assets 94572 94572 -92897 -93096 -93199 0.317 interest coverage 16.65 18.85 22.17 Profitablity Ratios Gross Profit Margin Operating Profit Margin Net Profit Margin NOPAT Margin Efficiency and Retun Measures Sales to Total Assets Ratios Operating Retun on Assets 0.06 0.38 0.36 0.05 0.05 0.40 0.39 0.38 0.36 0.403 0.385 0.381 0.615 0.708 0.814 35 86 0.248 0 273 0.310

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Advantages of Small Business Ownership Being a business owner can be extremely rewarding Having the courage to take a risk and start a venture is part of the American dream Success brings with it many ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started