Answered step by step

Verified Expert Solution

Question

1 Approved Answer

determine ms. dalvi's minimum taxable income for the 2020 taxation year 5. In addition to the $175 in charitable contributions withheld by Eleanor's employer, Eleanor

determine ms. dalvi's minimum taxable income for the 2020 taxation year

determine ms. dalvi's minimum taxable income for the 2020 taxation year

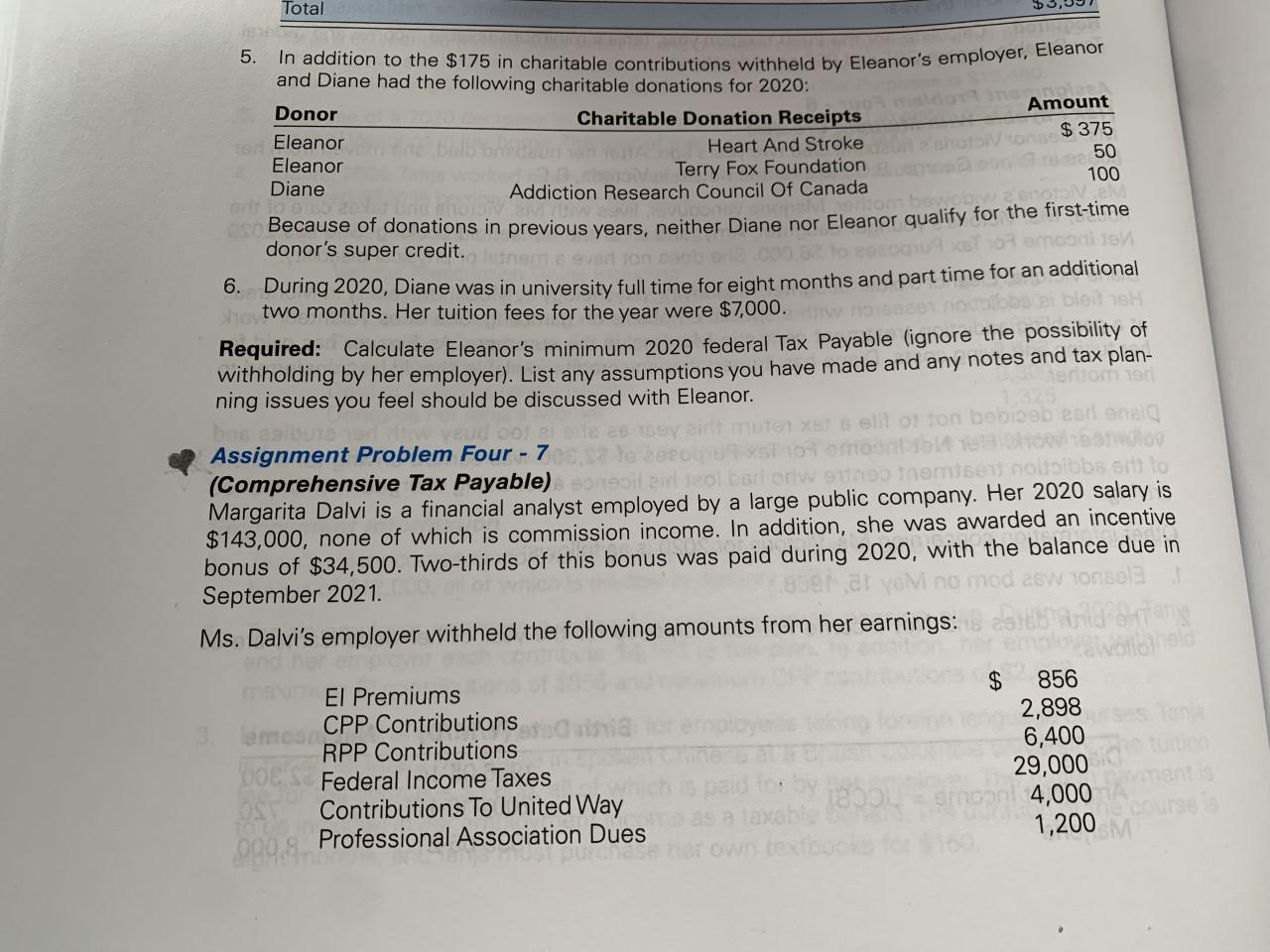

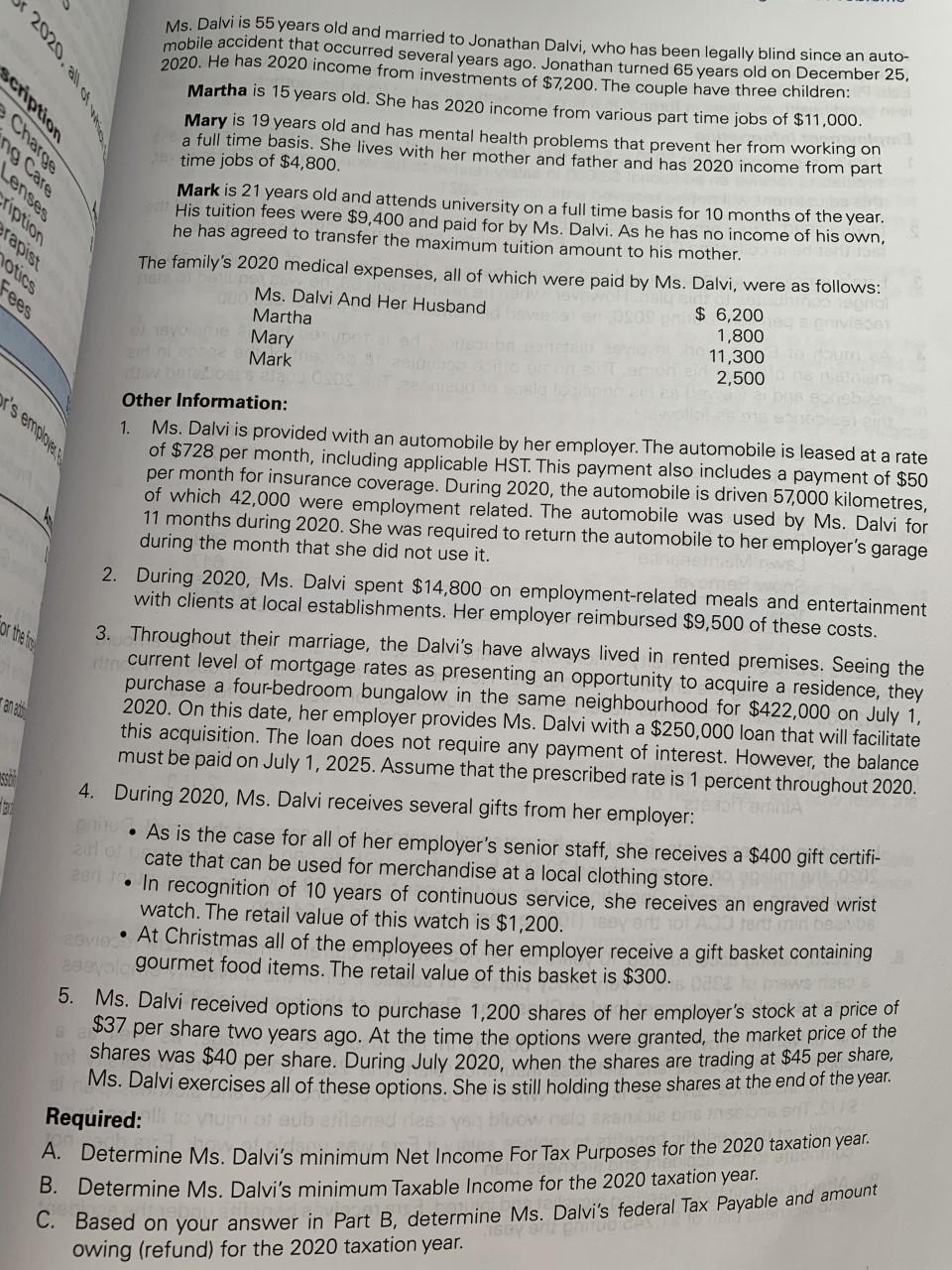

5. In addition to the $175 in charitable contributions withheld by Eleanor's employer, Eleanor and Diane had the following charitable donations for 2020: Total Donor en Eleanor Eleanor Diane brit to 150 20 om bewobiy a' enotoiveM eso Because of donations in previous years, neither Diane nor Eleanor qualify for the first-time donor's super credit. letnem e ever son coeb eria ,000.82 to 2pcoque mon ei bleit 16H 6. During 2020, Diane was in university full time for eight months and part time for an additional hoytwo months. Her tuition fees for the year were $7,000.dliw nasazen no Required: Calculate Eleanor's minimum 2020 federal Tax Payable (ignore the possibility of withholding by her employer). List any assumptions you have made and any notes and tax plan- ning issues you feel should be discussed with Eleanor. 30 teritom nari bas esibura uten xer s elit or ton bebiseb ear ensi veud oot ei ole es 169y Assignment Problem Four - 7 107 omtoont fblow e3fmov (Comprehensive Tax Payable) eoneoil air teol bari oriw entrep themtsent noitoibbs ortt to Margarita Dalvi is a financial analyst employed by a large public company. Her 2020 salary is $143,000, none of which is commission income. In addition, she was awarded an incentive bonus of $34,500. Two-thirds of this bonus was paid during 2020, with the balance due in mod asw September 2021. 80er, ar Ms. Dalvi's employer withheld the following amounts from her earnings: moon 008'S TO L Charitable Donation Receipts Heart And Stroke Terry Fox Foundation Addiction Research Council Of Canada 000 El Premiums CPP Contributions RPP Contributions Federal Income Taxes Contributions To United Way Professional Association Dues urchase Amount $375 50 100 paid as a taxable own textbooks $ 856 2,898 6,400 29,000 noon 4,000 1,200 Tany vollotheld

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Part A Ms Dalvis minimum Net Employment Income wou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started