Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the year ending 30th June 2019, Degas plc entered into a contract to build an office building for a price of 400,000, plus

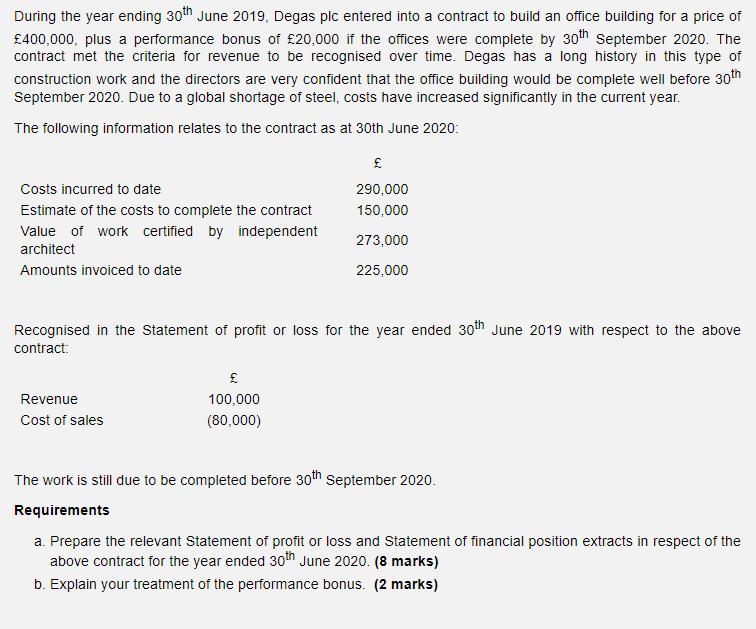

During the year ending 30th June 2019, Degas plc entered into a contract to build an office building for a price of 400,000, plus a performance bonus of 20,000 if the offices were complete by 30th September 2020. The contract met the criteria for revenue to be recognised over time. Degas has a long history in this type of construction work and the directors are very confident that the office building would be complete well before 30th September 2020. Due to a global shortage of steel, costs have increased significantly in the current year. The following information relates to the contract as at 30th June 2020: Costs incurred to date 290,000 Estimate of the costs to complete the contract 150,000 Value of work certified by independent 273,000 architect Amounts invoiced to date 225,000 Recognised in the Statement of profit or loss for the year ended 30th June 2019 with respect to the above contract: Revenue 100,000 Cost of sales (80,000) The work is still due to be completed before 30th september 2020. Requirements a. Prepare the relevant Statement of profit or loss and Statement of financial position extracts in respect of the above contract for the year ended 30th June 2020. (8 marks) b. Explain your treatment of the performance bonus. (2 marks)

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

B Only if the offices are done before September 30 2020 will the performance bonus ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started