Answered step by step

Verified Expert Solution

Question

1 Approved Answer

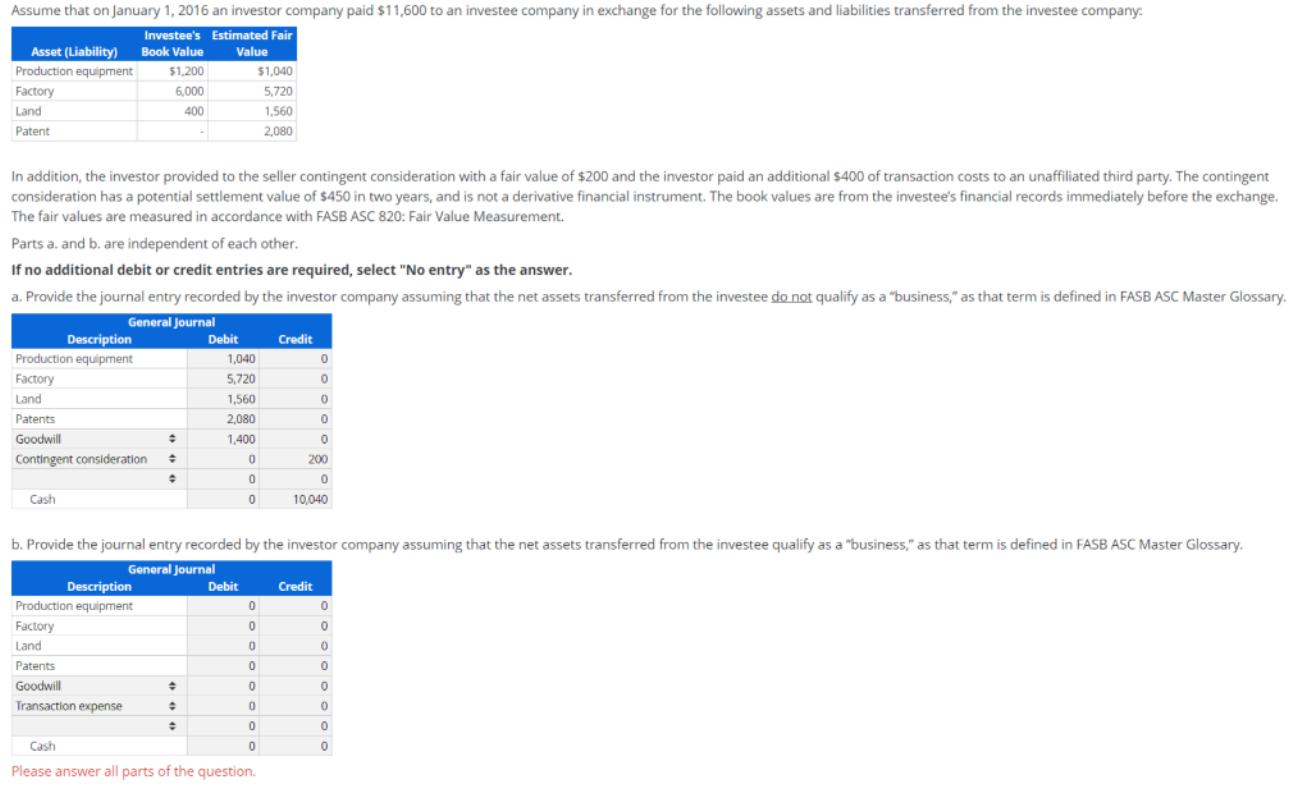

Assume that on January 1, 2016 an investor company paid $11,600 to an investee company in exchange for the following assets and liabilities transferred

Assume that on January 1, 2016 an investor company paid $11,600 to an investee company in exchange for the following assets and liabilities transferred from the investee company: Investee's Estimated Fair Asset (Liability) Book Value Production equipment Value $1,200 $1,040 Factory 6,000 5,720 Land 400 1,560 Patent 2,080 In addition, the investor provided to the seller contingent consideration with a fair value of $200 and the investor paid an additional $400 of transaction costs to an unaffiliated third party. The contingent consideration has a potential settlement value of $450 in two years, and is not a derivative financial instrument. The book values are from the investee's financial records immediately before the exchange. The fair values are measured in accordance with FASB ASC 820: Fair Value Measurement. Parts a. and b. are independent of each other. If no additional debit or credit entries are required, select "No entry" as the answer. a. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee do not qualify as a "business," as that term is defined in FASB ASC Master Glossary. General Journal Description Production equipment Debit Credit 1,040 Factory 5,720 Land 1,560 Patents 2,080 Goodwill 1,400 Contingent consideration + 200 Cash 10,040 b. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee qualify as a "business," as that term is defined in FASB ASC Master Glossary. General Journal Description Production equipment Debit Credit Factory Land Patents Goodwill Transaction expense Cash Please answer all parts of the question.

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started