Question

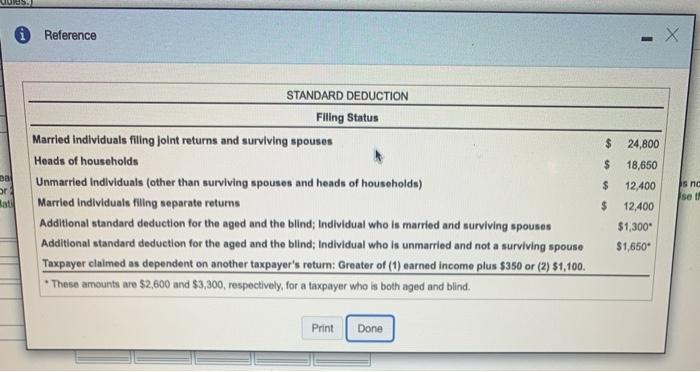

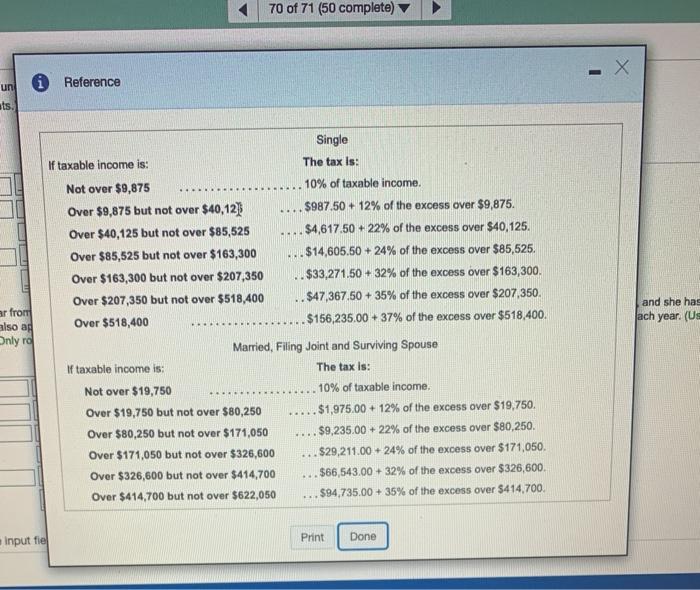

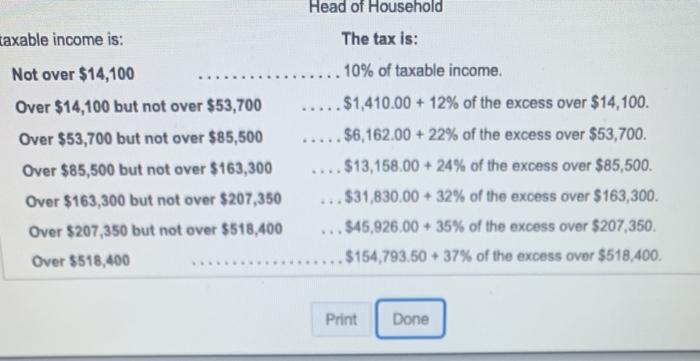

Determine Joy's income tax each year from 2020 through 2024, assuming her only income is her $175,000 annual salary, her itemized deductions are $22,500 annually,

Determine Joy's income tax each year from 2020 through 2024, assuming her only income is her $175,000 annual salary, her itemized deductions are $22,500 annually, and she has not remained. Assume that the tax rate schedules and standard deduction amounts for 2020 also apply in subsequent years. The son was born on April 15, 2007, is Joy's dependent each year, and lives with Joy fro all of each year.

Determine Joy's income tax each year from 2020 through 2024, assuming her only income is her $175,000 annual salary, her itemized deductions are $22,500 annually, and she has not remained. Assume that the tax rate schedules and standard deduction amounts for 2020 also apply in subsequent years. The son was born on April 15, 1996, is Joy's dependent each year, and lives with Joy fro all of each year.

2020 2021 2022 2023 2024 Gross tax Net tax

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of joys income tax for the years 2020202120222023202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started