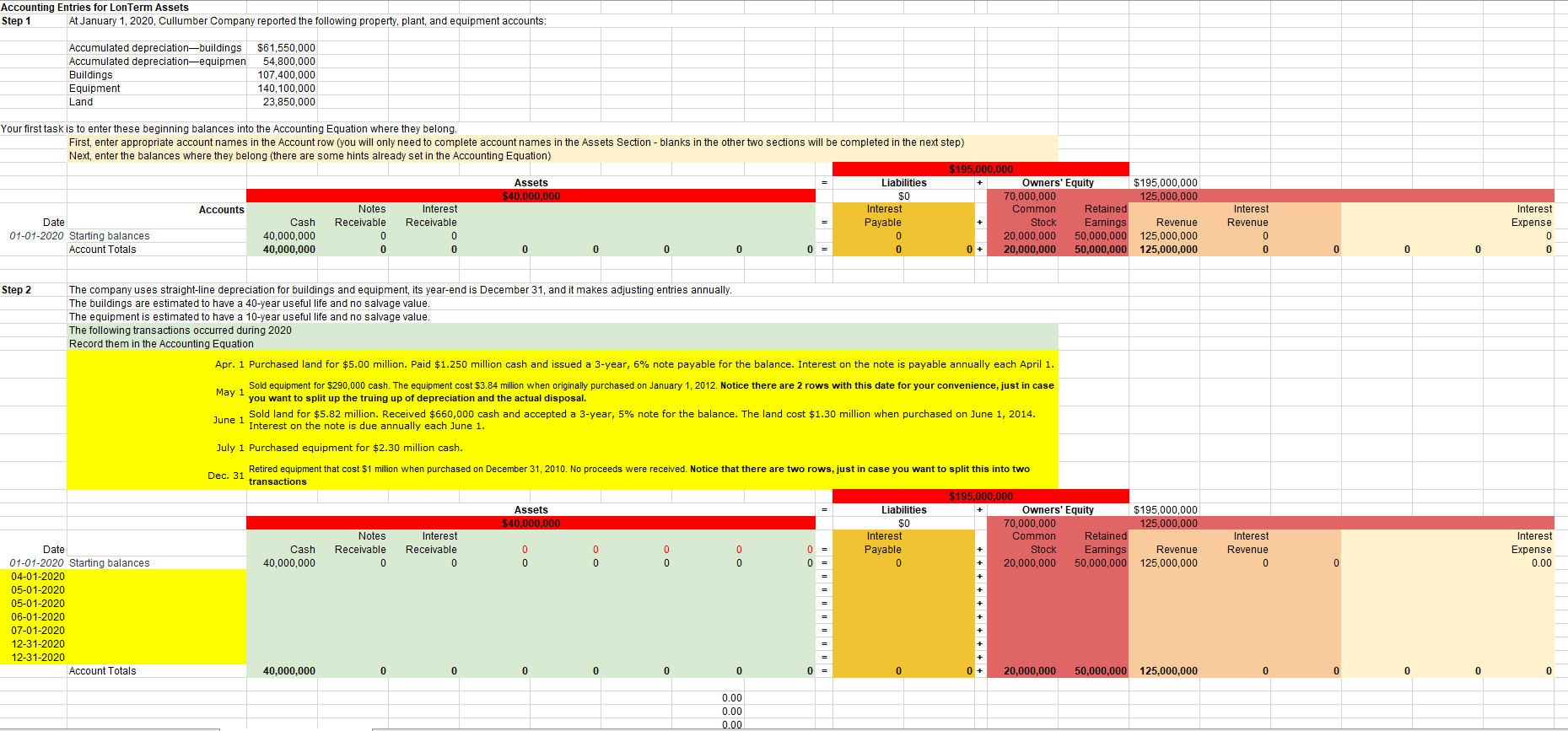

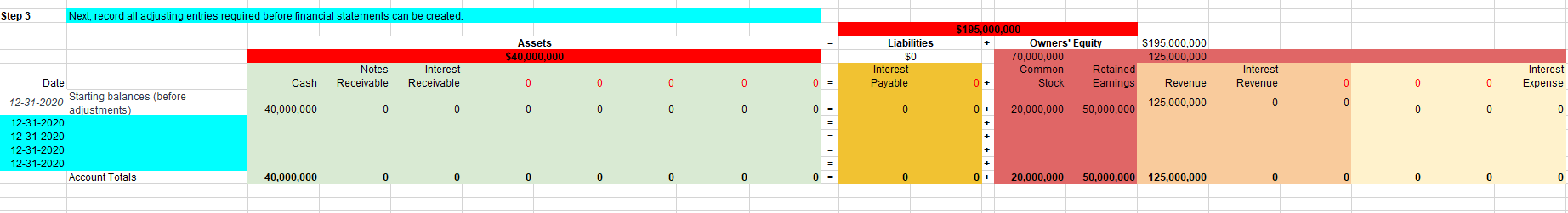

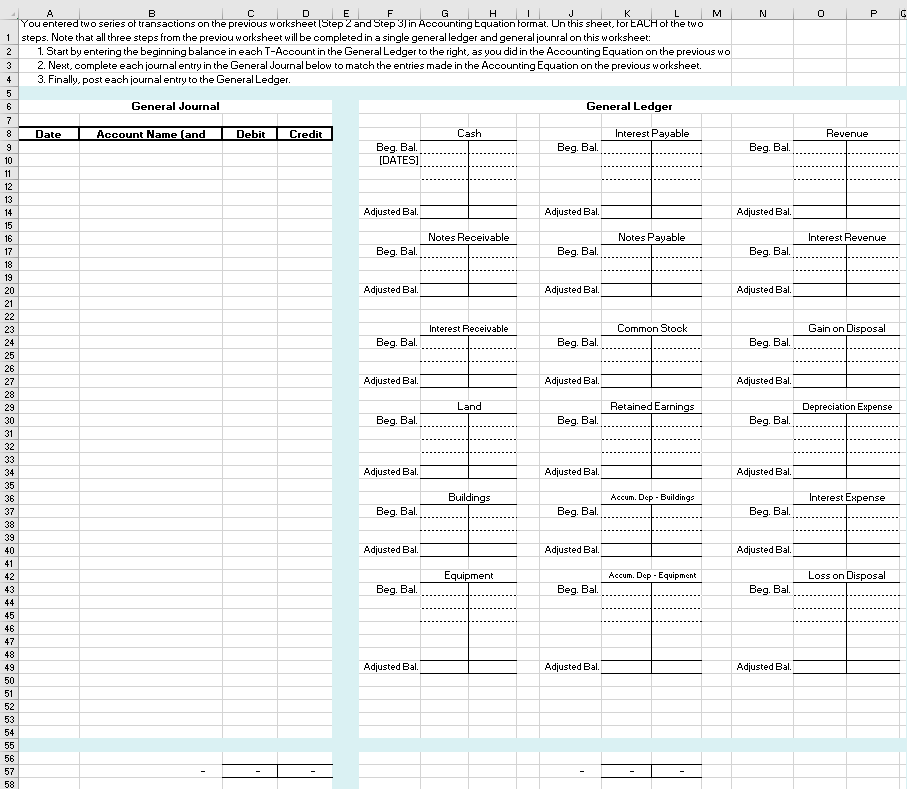

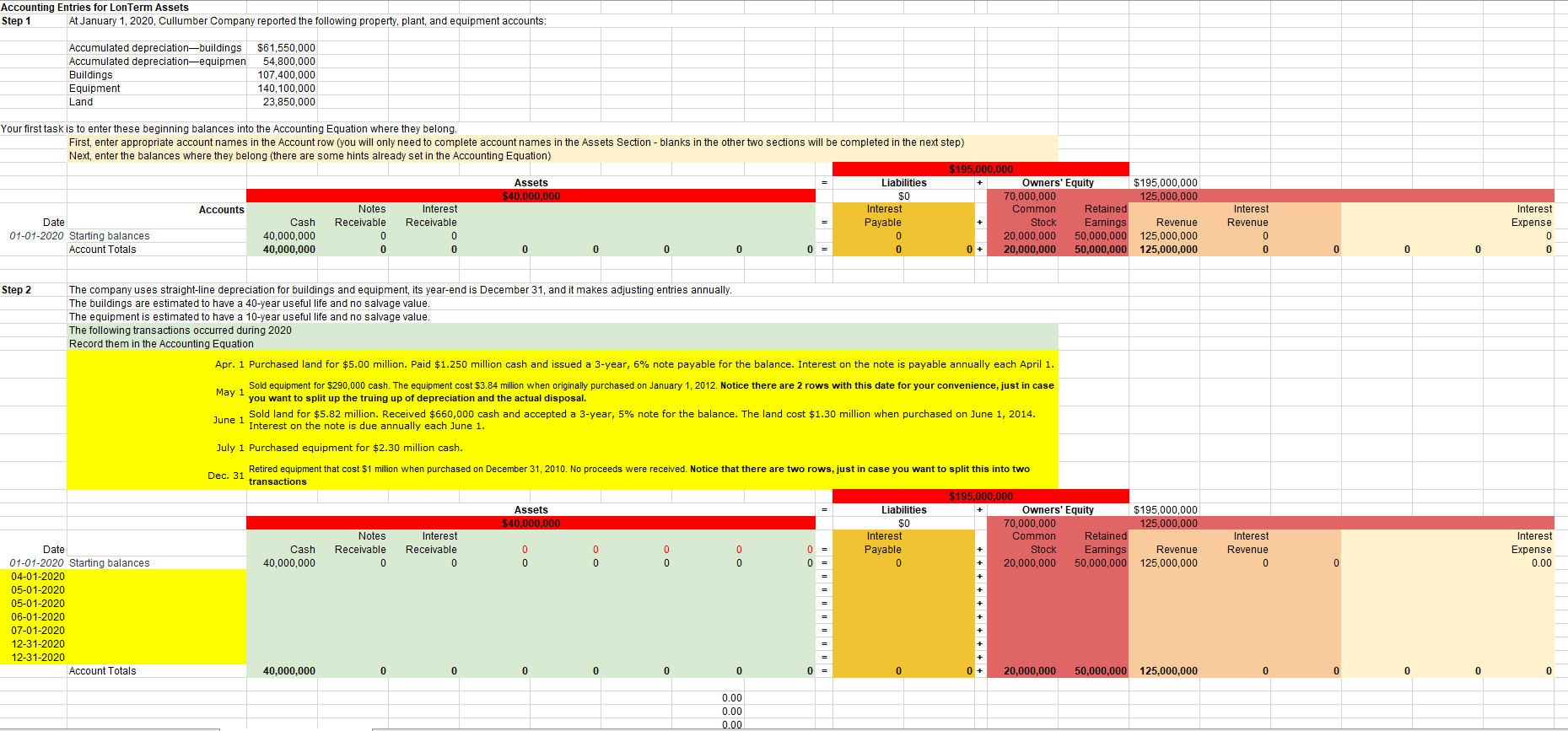

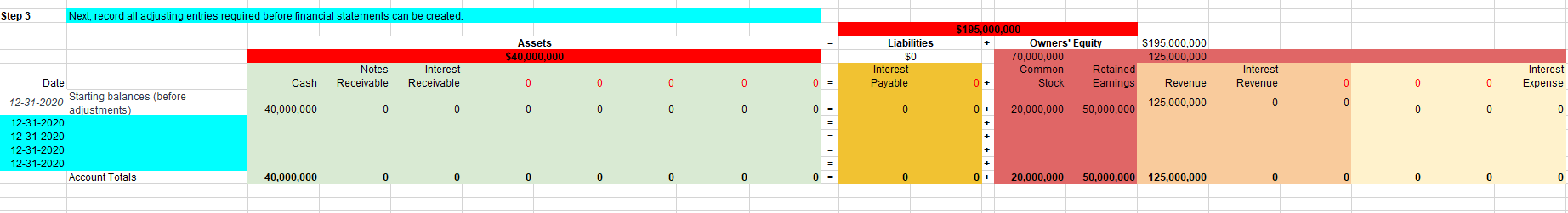

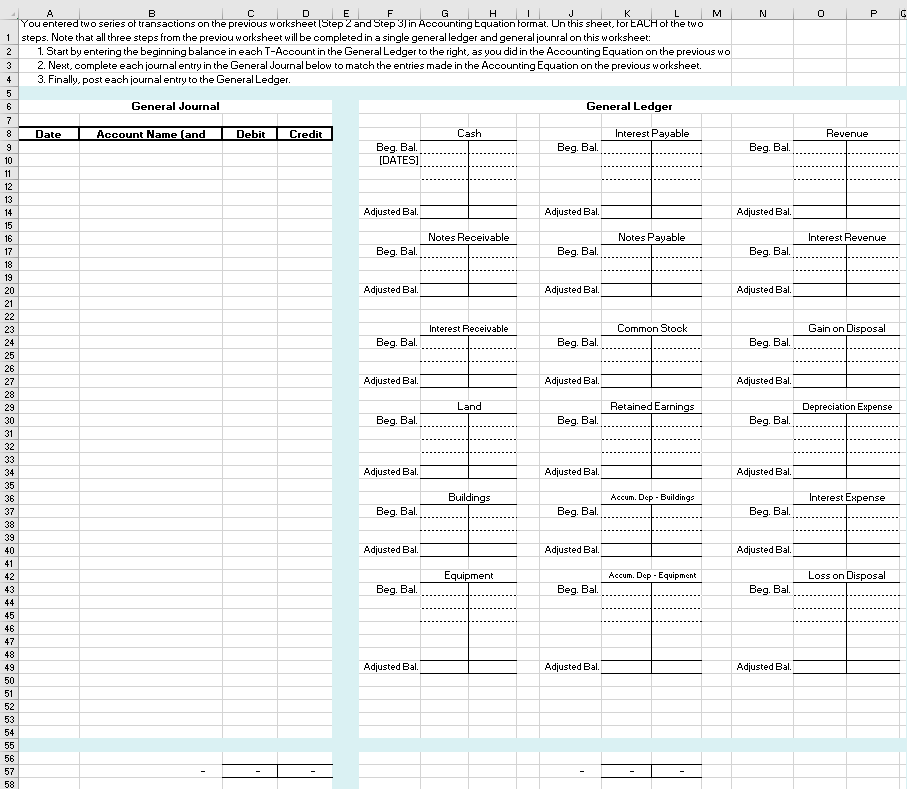

Accounting Entries for LonTerm Assets Step 1 At January 1, 2020, Cullumber Company reported the following property, plant, and equipment accounts: Accumulated depreciation-buildings $61,550,000 Accumulated depreciation-equipmen 54,800,000 Buildings 107,400,000 Equipment 140,100,000 Land 23,850,000 Your first task is to enter these beginning balances into the Accounting Equation where they belong. First, enter appropriate account names in the Account row (you will only need to complete account names in the Assets Section - blanks in the other two sections will be completed in the next step) Next, enter the balances where they belong (there are some hints already set in the Accounting Equation) $195,000,000 Assets Liabilities Owners' Equity $195,000,000 $40,000,000 $0 70,000,000 125,000,000 Accounts Notes Interest Interest Common Retained Date Cash Receivable Receivable Stock Earnings Revenue 01-01-2020 Starting balances 40,000,000 0 0 20,000,000 50,000,000 125,000,000 Account Totals 40,000,000 0 0 0 0 0 0 = 0 0 + 20,000,000 50,000,000 125,000,000 Payable Interest Revenue 0 0 Interest Expense 0 0 0 0 0 Step 2 The company uses straight-line depreciation for buildings and equipment, its year-end is December 31, and it makes adjusting entries annually. The buildings are estimated to have a 40-year useful life and no salvage value. The equipment is estimated to have a 10-year useful life and no salvage value. The following transactions occurred during 2020 Record them in the Accounting Equation Apr. 1 Purchased land for $5.00 million. Paid $1.250 million cash and issued a 3-year, 6% note payable for the balance. Interest on the note is payable annually each April 1. May 1 Sold equipment for $290,000 cash. The equipment cost $3.84 million when originally purchased on January 1, 2012. Notice there are 2 rows with this date for your convenience, just in case you want to split up the truing up of depreciation and the actual disposal. June 1 Sold land for $5.82 million. Received $660,000 cash and accepted a 3-year, 5% note for the balance. The land cost $1.30 million when purchased on June 1, 2014. Interest on the note is due annually each June 1. July 1 Purchased equipment for $2.30 million cash. Retired equipment that cost $1 million when purchased on December 31, 2010. No proceeds were received. Notice that there are two rows, just in case you want to split this into two Dec. 31 transactions $195,000,000 Assets Liabilities Owners' Equity $195,000,000 $40,000,000 $0 70,000,000 125,000,000 Notes Interest Interest Common Retained Date Cash Receivable Receivable 0 0 0 0 Payable Earnings Revenue 01-01-2020 Starting balances 40,000,000 0 0 0 0 0 0 0 20.000.000 50,000,000 125,000,000 04-01-2020 05-01-2020 05-01-2020 Interest Stock Revenue 0 Interest Expense 0.00 0 06-01-2020 07-01-2020 12-31-2020 12-31-2020 Account Totals 40,000,000 0 0 0 0 0 0 0 20,000,000 50,000,000 125,000,000 0 0 0 0 0.00 0.00 0.00 Step 3 Next, record all adjusting entries required before financial statements can be created. + Assets $40,000,000 $195,000,000 Owners' Equity 70,000,000 Common Retained 0 + Stock Earnings $195,000,000 125,000,000 Notes Receivable Liabilities $0 Interest Payable Interest Receivable Cash Interest Revenue 0 Interest Expense 0 0 0 = 0 Revenue 0 0 0 0 125,000,000 0 0 40,000,000 0 0 0 0 0 0 0 0 20,000,000 0 + + 50,000,000 0 0 0 Date 12-31-2020 Starting balances (before adjustments) 12-31-2020 12-31-2020 12-31-2020 12-31-2020 Account Totals + + 40,000,000 0 0 0 0 0 0 0 0 0 + 20,000,000 50,000,000 125,000,000 0 0 0 0 0 A B G J L M N O P C E F H You entered two series of transactions on the previous worksheet Step 2 and Step 3) in Accounting Equation format. Un this sheet, for EACH of the two 1 steps. Note that all three steps from the previou worksheet will be completed in a single general ledger and general jounral on this worksheet: 2 1. Start by entering the beginning balance in each T-Account in the General Ledger to the right, as you did in the Accounting Equation on the previous wo 2. Next, complete each journal entry in the General Journal below to match the entries made in the Accounting Equation on the previous worksheet. 3. Finally, post each journal entry to the General Ledger. 3 4 5 6 7 8 General Journal General Ledger Date Account Name (and Debit Credit Cash Interest Payable Revenue Beg. Bal. [DATES) Beg. Bal Beg. Bal Adjusted Bal Adjusted Bal. Adjusted Bal. Notes Receivable Notes Payable Interest Revenue Beg. Bal Beg. Bal Beg. Bal Adjusted Bal. Adjusted Bal. Adjusted Bal. 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Interest Receivable Common Stock Gain on Disposal Beg. Bal. Beg. Bal Beg. Bal. Adjusted Bal. Adjusted Bal. Adjusted Bal Land Retained Earnings Depreciation Expense Beg. Bal. Beg. Bal. Beg. Bal. Adjusted Bal. Adjusted Bal. Adjusted Bal. Buildings Accum. Dep. Buildings Interest Expense Beg. Bal. Beg. Bal. Beg. Bal Adjusted Bal. Adjusted Bal Adjusted Bal. Equipment Accum. Dep - Equipment Loss on Disposal Beg. Bal Beg. Bal. Beg. Bal. 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Adjusted Bal. Adjusted Bal. Adjusted Bal. Accounting Entries for LonTerm Assets Step 1 At January 1, 2020, Cullumber Company reported the following property, plant, and equipment accounts: Accumulated depreciation-buildings $61,550,000 Accumulated depreciation-equipmen 54,800,000 Buildings 107,400,000 Equipment 140,100,000 Land 23,850,000 Your first task is to enter these beginning balances into the Accounting Equation where they belong. First, enter appropriate account names in the Account row (you will only need to complete account names in the Assets Section - blanks in the other two sections will be completed in the next step) Next, enter the balances where they belong (there are some hints already set in the Accounting Equation) $195,000,000 Assets Liabilities Owners' Equity $195,000,000 $40,000,000 $0 70,000,000 125,000,000 Accounts Notes Interest Interest Common Retained Date Cash Receivable Receivable Stock Earnings Revenue 01-01-2020 Starting balances 40,000,000 0 0 20,000,000 50,000,000 125,000,000 Account Totals 40,000,000 0 0 0 0 0 0 = 0 0 + 20,000,000 50,000,000 125,000,000 Payable Interest Revenue 0 0 Interest Expense 0 0 0 0 0 Step 2 The company uses straight-line depreciation for buildings and equipment, its year-end is December 31, and it makes adjusting entries annually. The buildings are estimated to have a 40-year useful life and no salvage value. The equipment is estimated to have a 10-year useful life and no salvage value. The following transactions occurred during 2020 Record them in the Accounting Equation Apr. 1 Purchased land for $5.00 million. Paid $1.250 million cash and issued a 3-year, 6% note payable for the balance. Interest on the note is payable annually each April 1. May 1 Sold equipment for $290,000 cash. The equipment cost $3.84 million when originally purchased on January 1, 2012. Notice there are 2 rows with this date for your convenience, just in case you want to split up the truing up of depreciation and the actual disposal. June 1 Sold land for $5.82 million. Received $660,000 cash and accepted a 3-year, 5% note for the balance. The land cost $1.30 million when purchased on June 1, 2014. Interest on the note is due annually each June 1. July 1 Purchased equipment for $2.30 million cash. Retired equipment that cost $1 million when purchased on December 31, 2010. No proceeds were received. Notice that there are two rows, just in case you want to split this into two Dec. 31 transactions $195,000,000 Assets Liabilities Owners' Equity $195,000,000 $40,000,000 $0 70,000,000 125,000,000 Notes Interest Interest Common Retained Date Cash Receivable Receivable 0 0 0 0 Payable Earnings Revenue 01-01-2020 Starting balances 40,000,000 0 0 0 0 0 0 0 20.000.000 50,000,000 125,000,000 04-01-2020 05-01-2020 05-01-2020 Interest Stock Revenue 0 Interest Expense 0.00 0 06-01-2020 07-01-2020 12-31-2020 12-31-2020 Account Totals 40,000,000 0 0 0 0 0 0 0 20,000,000 50,000,000 125,000,000 0 0 0 0 0.00 0.00 0.00 Step 3 Next, record all adjusting entries required before financial statements can be created. + Assets $40,000,000 $195,000,000 Owners' Equity 70,000,000 Common Retained 0 + Stock Earnings $195,000,000 125,000,000 Notes Receivable Liabilities $0 Interest Payable Interest Receivable Cash Interest Revenue 0 Interest Expense 0 0 0 = 0 Revenue 0 0 0 0 125,000,000 0 0 40,000,000 0 0 0 0 0 0 0 0 20,000,000 0 + + 50,000,000 0 0 0 Date 12-31-2020 Starting balances (before adjustments) 12-31-2020 12-31-2020 12-31-2020 12-31-2020 Account Totals + + 40,000,000 0 0 0 0 0 0 0 0 0 + 20,000,000 50,000,000 125,000,000 0 0 0 0 0 A B G J L M N O P C E F H You entered two series of transactions on the previous worksheet Step 2 and Step 3) in Accounting Equation format. Un this sheet, for EACH of the two 1 steps. Note that all three steps from the previou worksheet will be completed in a single general ledger and general jounral on this worksheet: 2 1. Start by entering the beginning balance in each T-Account in the General Ledger to the right, as you did in the Accounting Equation on the previous wo 2. Next, complete each journal entry in the General Journal below to match the entries made in the Accounting Equation on the previous worksheet. 3. Finally, post each journal entry to the General Ledger. 3 4 5 6 7 8 General Journal General Ledger Date Account Name (and Debit Credit Cash Interest Payable Revenue Beg. Bal. [DATES) Beg. Bal Beg. Bal Adjusted Bal Adjusted Bal. Adjusted Bal. Notes Receivable Notes Payable Interest Revenue Beg. Bal Beg. Bal Beg. Bal Adjusted Bal. Adjusted Bal. Adjusted Bal. 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Interest Receivable Common Stock Gain on Disposal Beg. Bal. Beg. Bal Beg. Bal. Adjusted Bal. Adjusted Bal. Adjusted Bal Land Retained Earnings Depreciation Expense Beg. Bal. Beg. Bal. Beg. Bal. Adjusted Bal. Adjusted Bal. Adjusted Bal. Buildings Accum. Dep. Buildings Interest Expense Beg. Bal. Beg. Bal. Beg. Bal Adjusted Bal. Adjusted Bal Adjusted Bal. Equipment Accum. Dep - Equipment Loss on Disposal Beg. Bal Beg. Bal. Beg. Bal. 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Adjusted Bal. Adjusted Bal. Adjusted Bal