Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Events: The business you are doing the accounting for is Milu Inc. (Milu). Milu is a restaurant located in Regina. Analyze the following events

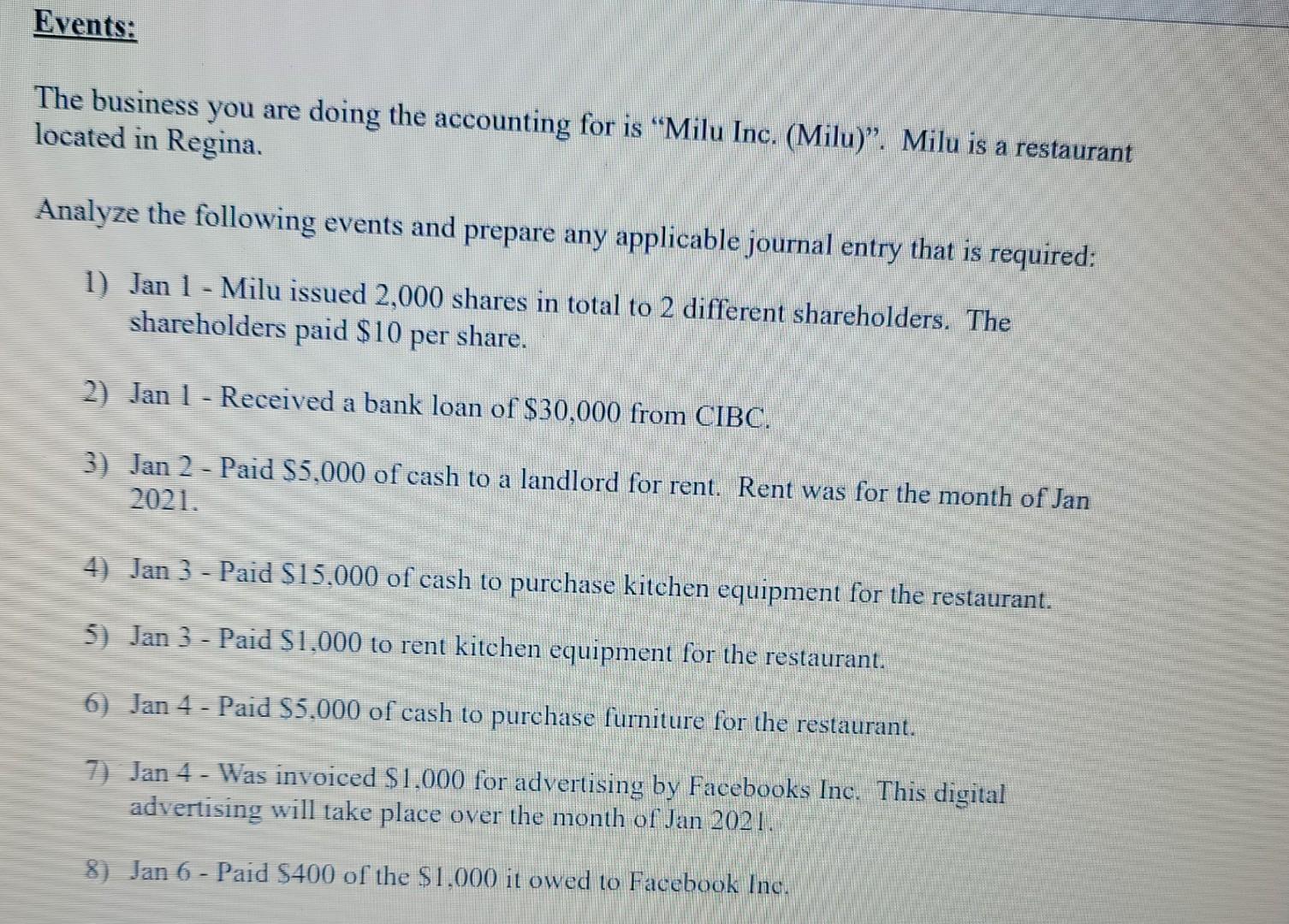

Events: The business you are doing the accounting for is "Milu Inc. (Milu)". Milu is a restaurant located in Regina. Analyze the following events and prepare any applicable journal entry that is required: 1) Jan 1 - Milu issued 2,000 shares in total to 2 different shareholders. The shareholders paid $10 per share. 2) Jan 1- Received a bank loan of $30,000 from CIBC. 3) Jan 2 - Paid $5,000 of cash to a landlord for rent. Rent was for the month of Jan 2021. 4) Jan 3 - Paid $15,000 of cash to purchase kitchen equipment for the restaurant. 5) Jan 3 - Paid $1,000 to rent kitchen equipment for the restaurant. 6) Jan 4 - Paid $5,000 of cash to purchase furniture for the restaurant. 7) Jan 4 - Was invoiced $1,000 for advertising by Facebooks Inc. This digital advertising will take place over the month of Jan 2021. 8) Jan 6 - Paid $400 of the $1,000 it owed to Facebook Inc. 10) Jan 8 to 28 - Over the month Milu sold the following food and drink. All cash related to these sales was received. Type Food - Sides Food - Meat Bottled Drinks Total Feb 2021 Apr 2021 May 2021 Jun 2021 Jul 2021 Aug 2021 Sep 2021 Oct 2021 Nov 2021 Dec 2021 Jan 2022 Total Units Sold (Units / Bottles) Cost 500 500 500 500 500 500 500 500 Selling Prices 11) Jan 29 - Paid $16,000 of cash to the vendor(s) they owed money too. 12) Jan 29 - Paid $8,000 in cash for wages to its employees. 13) Jan 29 - Paid $5,000 of cash to its shareholders via dividends. 14) Feb 1- Milu wanted to get insurance for its operations. On Feb 1 they paid $6,000 for insurance that covers the following months: 500 500 500 5.000 1,500 1,000 1,000 Selling Price ($) 14 3 31 Total ($) 21,000 14,000 3,000 38,000 15) Feb 1- Milu sold $1.000 of giftcards to customer. These giftcards can be used to purchase food from Milu. Events: The business you are doing the accounting for is "Milu Inc. (Milu)". Milu is a restaurant located in Regina. Analyze the following events and prepare any applicable journal entry that is required: 1) Jan 1 - Milu issued 2,000 shares in total to 2 different shareholders. The shareholders paid $10 per share. 2) Jan 1- Received a bank loan of $30,000 from CIBC. 3) Jan 2 - Paid $5,000 of cash to a landlord for rent. Rent was for the month of Jan 2021. 4) Jan 3 - Paid $15,000 of cash to purchase kitchen equipment for the restaurant. 5) Jan 3 - Paid $1,000 to rent kitchen equipment for the restaurant. 6) Jan 4 - Paid $5,000 of cash to purchase furniture for the restaurant. 7) Jan 4 - Was invoiced $1,000 for advertising by Facebooks Inc. This digital advertising will take place over the month of Jan 2021. 8) Jan 6 - Paid $400 of the $1,000 it owed to Facebook Inc. 10) Jan 8 to 28 - Over the month Milu sold the following food and drink. All cash related to these sales was received. Type Food - Sides Food - Meat Bottled Drinks Total Feb 2021 Apr 2021 May 2021 Jun 2021 Jul 2021 Aug 2021 Sep 2021 Oct 2021 Nov 2021 Dec 2021 Jan 2022 Total Units Sold (Units / Bottles) Cost 500 500 500 500 500 500 500 500 Selling Prices 11) Jan 29 - Paid $16,000 of cash to the vendor(s) they owed money too. 12) Jan 29 - Paid $8,000 in cash for wages to its employees. 13) Jan 29 - Paid $5,000 of cash to its shareholders via dividends. 14) Feb 1- Milu wanted to get insurance for its operations. On Feb 1 they paid $6,000 for insurance that covers the following months: 500 500 500 5.000 1,500 1,000 1,000 Selling Price ($) 14 3 31 Total ($) 21,000 14,000 3,000 38,000 15) Feb 1- Milu sold $1.000 of giftcards to customer. These giftcards can be used to purchase food from Milu. Events: The business you are doing the accounting for is "Milu Inc. (Milu)". Milu is a restaurant located in Regina. Analyze the following events and prepare any applicable journal entry that is required: 1) Jan 1 - Milu issued 2,000 shares in total to 2 different shareholders. The shareholders paid $10 per share. 2) Jan 1- Received a bank loan of $30,000 from CIBC. 3) Jan 2 - Paid $5,000 of cash to a landlord for rent. Rent was for the month of Jan 2021. 4) Jan 3 - Paid $15,000 of cash to purchase kitchen equipment for the restaurant. 5) Jan 3 - Paid $1,000 to rent kitchen equipment for the restaurant. 6) Jan 4 - Paid $5,000 of cash to purchase furniture for the restaurant. 7) Jan 4 - Was invoiced $1,000 for advertising by Facebooks Inc. This digital advertising will take place over the month of Jan 2021. 8) Jan 6 - Paid $400 of the $1,000 it owed to Facebook Inc. 10) Jan 8 to 28 - Over the month Milu sold the following food and drink. All cash related to these sales was received. Type Food - Sides Food - Meat Bottled Drinks Total Feb 2021 Apr 2021 May 2021 Jun 2021 Jul 2021 Aug 2021 Sep 2021 Oct 2021 Nov 2021 Dec 2021 Jan 2022 Total Units Sold (Units / Bottles) Cost 500 500 500 500 500 500 500 500 Selling Prices 11) Jan 29 - Paid $16,000 of cash to the vendor(s) they owed money too. 12) Jan 29 - Paid $8,000 in cash for wages to its employees. 13) Jan 29 - Paid $5,000 of cash to its shareholders via dividends. 14) Feb 1- Milu wanted to get insurance for its operations. On Feb 1 they paid $6,000 for insurance that covers the following months: 500 500 500 5.000 1,500 1,000 1,000 Selling Price ($) 14 3 31 Total ($) 21,000 14,000 3,000 38,000 15) Feb 1- Milu sold $1.000 of giftcards to customer. These giftcards can be used to purchase food from Milu. Events: The business you are doing the accounting for is "Milu Inc. (Milu)". Milu is a restaurant located in Regina. Analyze the following events and prepare any applicable journal entry that is required: 1) Jan 1 - Milu issued 2,000 shares in total to 2 different shareholders. The shareholders paid $10 per share. 2) Jan 1- Received a bank loan of $30,000 from CIBC. 3) Jan 2 - Paid $5,000 of cash to a landlord for rent. Rent was for the month of Jan 2021. 4) Jan 3 - Paid $15,000 of cash to purchase kitchen equipment for the restaurant. 5) Jan 3 - Paid $1,000 to rent kitchen equipment for the restaurant. 6) Jan 4 - Paid $5,000 of cash to purchase furniture for the restaurant. 7) Jan 4 - Was invoiced $1,000 for advertising by Facebooks Inc. This digital advertising will take place over the month of Jan 2021. 8) Jan 6 - Paid $400 of the $1,000 it owed to Facebook Inc. 10) Jan 8 to 28 - Over the month Milu sold the following food and drink. All cash related to these sales was received. Type Food - Sides Food - Meat Bottled Drinks Total Feb 2021 Apr 2021 May 2021 Jun 2021 Jul 2021 Aug 2021 Sep 2021 Oct 2021 Nov 2021 Dec 2021 Jan 2022 Total Units Sold (Units / Bottles) Cost 500 500 500 500 500 500 500 500 Selling Prices 11) Jan 29 - Paid $16,000 of cash to the vendor(s) they owed money too. 12) Jan 29 - Paid $8,000 in cash for wages to its employees. 13) Jan 29 - Paid $5,000 of cash to its shareholders via dividends. 14) Feb 1- Milu wanted to get insurance for its operations. On Feb 1 they paid $6,000 for insurance that covers the following months: 500 500 500 5.000 1,500 1,000 1,000 Selling Price ($) 14 3 31 Total ($) 21,000 14,000 3,000 38,000 15) Feb 1- Milu sold $1.000 of giftcards to customer. These giftcards can be used to purchase food from Milu.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 2 3 4 16 17 18 5 6 7 8 9 Date 10 11 21 22 A Date Particulars Jan01 Cash Account 12 13 14 Date Part...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started