Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To raise operating funds, National Distribution Center soid its office building to an insurance company on January 1, 2021, for $950,000 and immediately leased

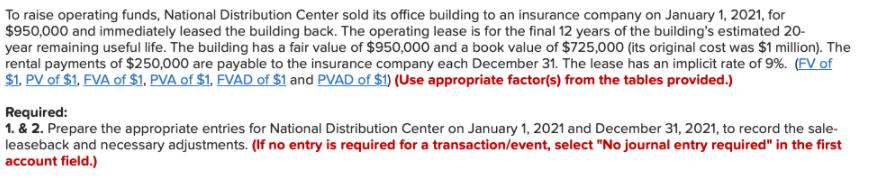

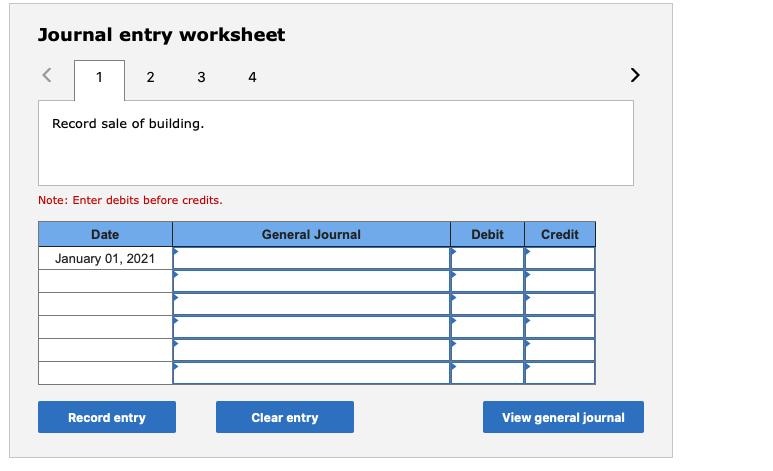

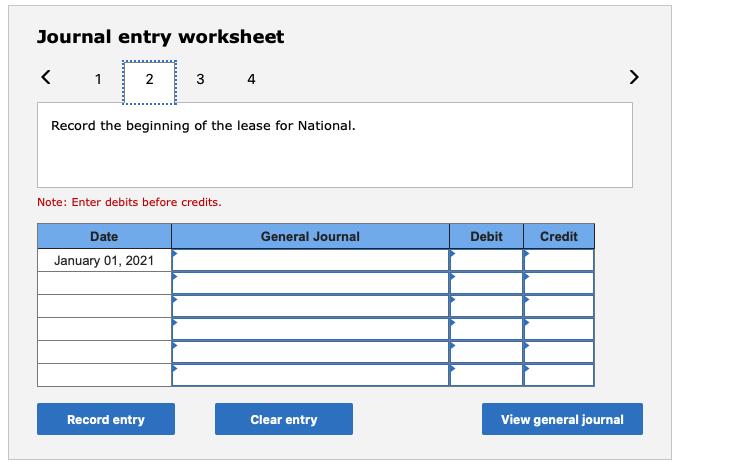

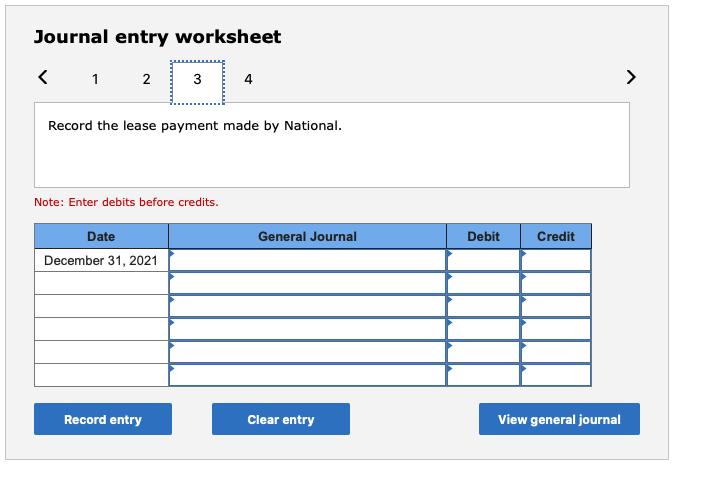

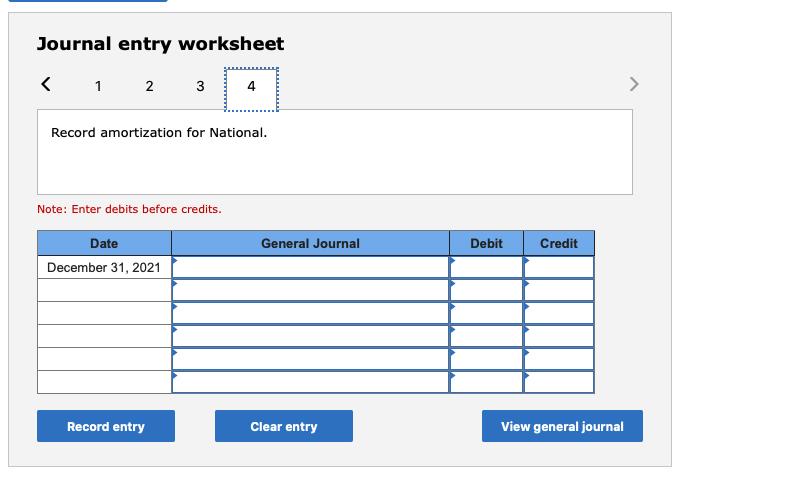

To raise operating funds, National Distribution Center soid its office building to an insurance company on January 1, 2021, for $950,000 and immediately leased the building back. The operating lease is for the final 12 years of the building's estimated 20- year remaining useful life. The building has a fair value of $950,000 and a book value of $725,000 (its original cost was $1 million). The rental payments of $250,000 are payable to the insurance company each December 31. The lease has an implicit rate of 9%. (FV of $1. PV of $1, EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. & 2. Prepare the appropriate entries for National Distribution Center on January 1, 2021 and December 31, 2021, to record the sale- leaseback and necessary adjustments. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 2 3 4 Record sale of building. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2021 Record entry Clear entry View general journal Journal entry worksheet 1 3 4 > Record the beginning of the lease for National. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2021 Record entry Clear entry View general journal Journal entry worksheet 2 4 > Record the lease payment made by National. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general journal Journal entry worksheet 1 2 3 Record amortization for National. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general journal 4.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Date General Journal Debit Credit January 012021 Cash 950000 Accumulated Depreciation Buildi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started