Question: In 2020, Simon, age 12, has interest income of $5,460 on funds he inherited from his grandmother, and no earned income. He has no

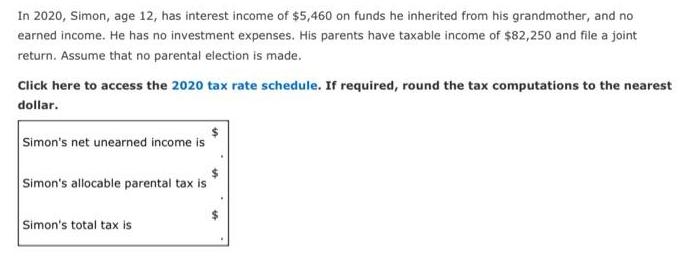

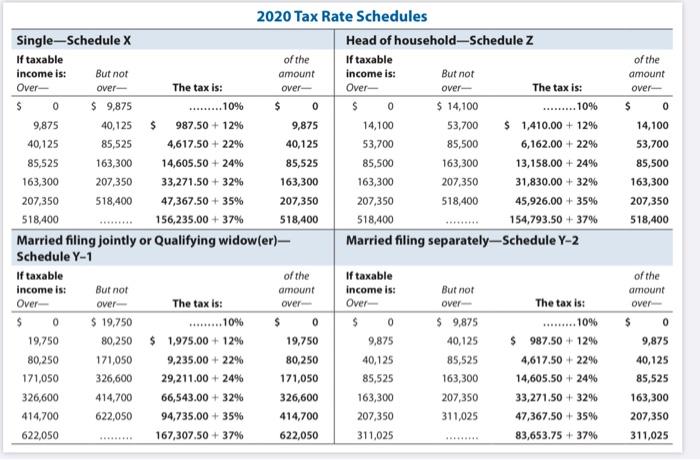

In 2020, Simon, age 12, has interest income of $5,460 on funds he inherited from his grandmother, and no earned income. He has no investment expenses. His parents have taxable income of $82,250 and file a joint return. Assume that no parental election is made. Click here to access the 2020 tax rate schedule. If required, round the tax computations to the nearest dollar. Simon's net unearned income is Simon's allocable parental tax is Simon's total tax is %24 2020 Tax Rate Schedules Single-Schedule x Head of household-Schedule Z If taxable of the If taxable of the income is: But not amount income is: But not unt Over- over- The tax is: over- Over- over- The tax is: over- $ 9,875 .....10% $ 0 $ 14,100 ....10% 9,875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 $ 1,410.00 + 12% 14,100 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 53,700 85,525 163,300 14,605.50 + 24% 85,525 85,500 163,300 13,158.00 + 24% 85,500 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830.00 + 32% 163,300 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 207,350 518,400 156,235.00 + 37% 518,400 518,400 154,793.50 + 37% 518,400 ........ ....... Married filing jointly or Qualifying widow(er)- Schedule Y-1 Married filing separately-Schedule Y-2 If taxable of the If taxable of the income is: Over- income is: But not amount But not amount The tax is: Over- over- over- over- The tax is: over- $ 19,750 . 10% $ 9,875 .......10% 19,750 80,250 $ 1,975.00 + 12% 19,750 9,875 40,125 $ 987.50 + 12% 9,875 80,250 171,050 9,235.00 + 22% 80,250 40,125 85,525 4,617.50 + 22% 40,125 171,050 326,600 29,211.00 + 24% 171,050 85,525 163,300 14,605.50 + 24% 85,525 66,543.00 + 32% 94,735.00 + 35% 326,600 414,700 326,600 163,300 207,350 33,271.50 + 32% 163,300 414,700 622,050 414,700 207,350 311,025 47,367.50 + 35% 207,350 622,050 167,307.50 + 379% 622,050 311,025 83,653.75 + 37% 311,025 ........

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Interest income unearned 5460 standard deduction 1100 G... View full answer

Get step-by-step solutions from verified subject matter experts