Answered step by step

Verified Expert Solution

Question

1 Approved Answer

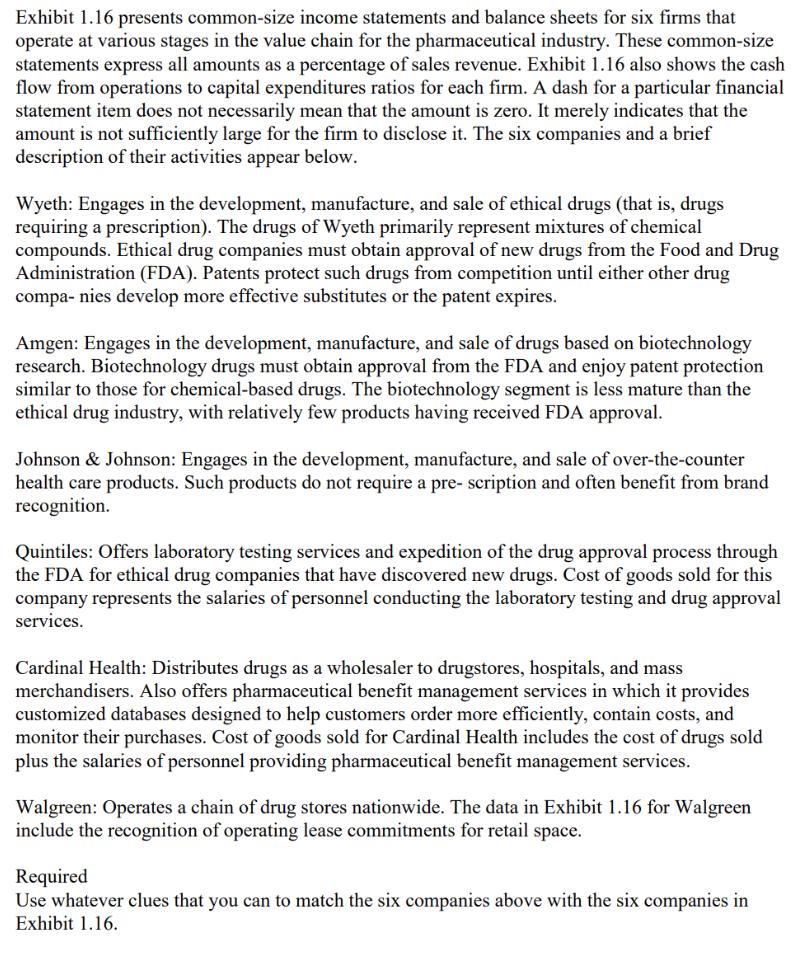

Please explain 1 reason why each company was chosen. Income Statement Sales Cost of Goods Sold Selling and Administrative Research and Development Interest Income Taxes

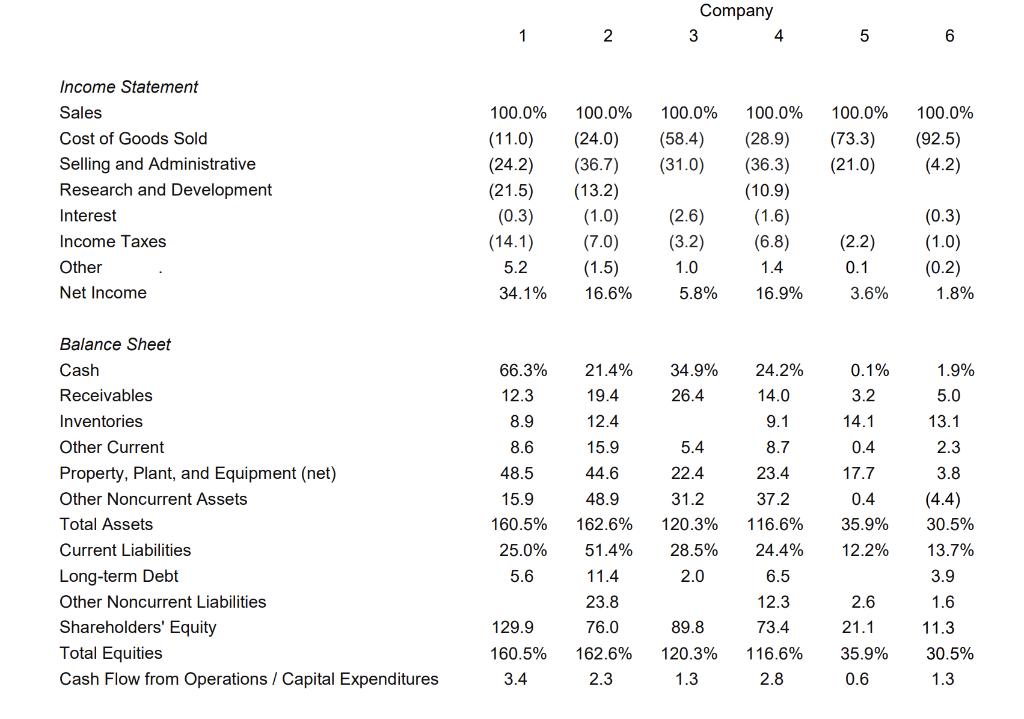

Income Statement Sales Cost of Goods Sold Selling and Administrative Research and Development Interest Income Taxes Other Net Income Balance Sheet Cash Receivables Inventories Other Current Property, Plant, and Equipment (net) Other Noncurrent Assets Total Assets Current Liabilities Long-term Debt Other Noncurrent Liabilities Shareholders' Equity Total Equities Cash Flow from Operations / Capital Expenditures 1 - (21.5) (0.3) (14.1) 5.2 34.1% 2 66.3% 12.3 8.9 8.6 48.5 15.9 160.5% 25.0% 5.6 100.0% 100.0% (11.0) (24.0) (24.2) (36.7) (31.0) (13.2) (1.0) (7.0) (1.5) 16.6% 21.4% 19.4 12.4 15.9 44.6 48.9 162.6% 51.4% 11.4 23.8 76.0 Company 129.9 160.5% 162.6% 3.4 2.3 3 4 100.0% 100.0% 100.0% 100.0% (58.4) (28.9) (73.3) (92.5) (36.3) (21.0) (4.2) (10.9) (2.6) (1.6) (3.2) (6.8) 1.0 1.4 5.8% 16.9% 34.9% 24.2% 26.4 14.0 9.1 5.4 8.7 22.4 23.4 31.2 37.2 120.3% 116.6% 28.5% 24.4% 2.0 6.5 12.3 73.4 116.6% 2.8 89.8 120.3% 1.3 5 (2.2) 0.1 3.6% 0.1% 3.2 14.1 0.4 17.7 0.4 35.9% 12.2% 6 2.6 21.1 35.9% 0.6 (0.3) (1.0) (0.2) 1.8% 1.9% 5.0 13.1 2.3 3.8 (4.4) 30.5% 13.7% 3.9 1.6 11.3 30.5% 1.3

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started