Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sarah Brynski is busy running a Starbucks and thinking about inven- tory, making sure the store looks great, ensuring good service, hiring good people,

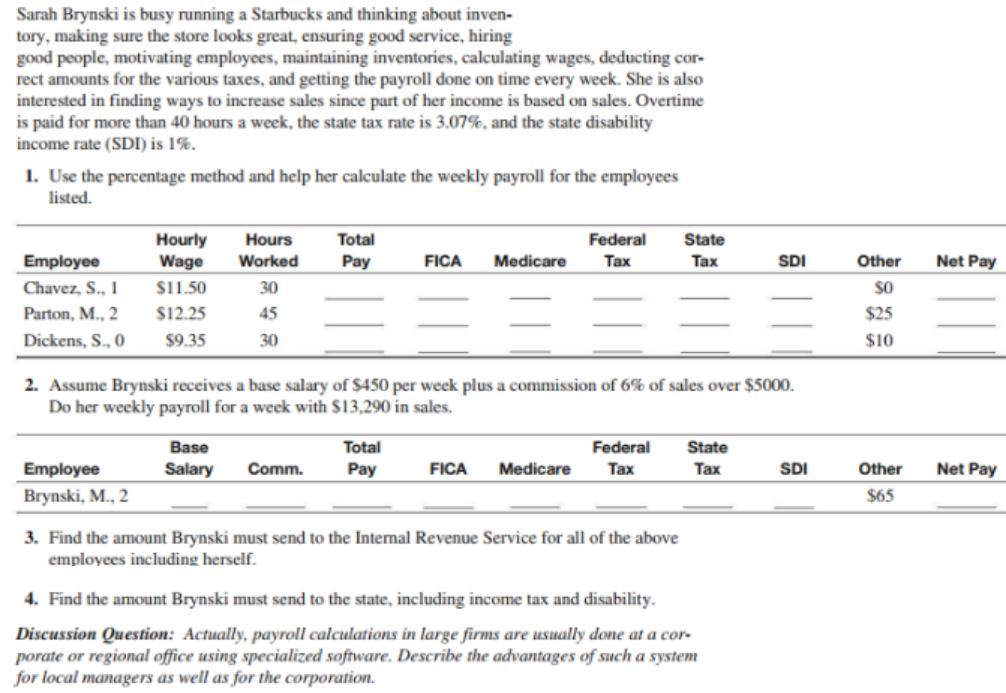

Sarah Brynski is busy running a Starbucks and thinking about inven- tory, making sure the store looks great, ensuring good service, hiring good people, motivating employees, maintaining inventories, calculating wages, deducting cor- rect amounts for the various taxes, and getting the payroll done on time every week. She is also interested in finding ways to increase sales since part of her income is based on sales. Overtime is paid for more than 40 hours a week, the state tax rate is 3.07%, and the state disability income rate (SDI) is 1%. 1. Use the percentage method and help her calculate the weekly payroll for the employees listed. Hours Federal Hourly Wage Total State Employee Worked Pay FICA Medicare SDI Other Net Pay Chavez, S., 1 $11.50 30 sO Parton, M., 2 $12.25 45 $25 Dickens, S., 0 $9.35 30 $10 2. Assume Brynski receives a base salary of $450 per week plus a commission of 6% of sales over $5000. Do her weekly payroll for a week with $13,290 in sales. Base Total Federal State Employee Salary Comm. Pay FICA Medicare SDI Other Net Pay Brynski, M., 2 $65 3. Find the amount Brynski must send to the Intemal Revenue Service for all of the above employees including herself. 4. Find the amount Brynski must send to the state, including income tax and disability. Discussion Question: Actually, payroll calculations in large firms are usually done at a cor- porate or regional office using specialized software. Describe the advantages of such a system for local managers as well as for the corporation.

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

9 7 x 17 10 Stare disability 1 C3 43 5 6 Housily Hours Jotked 1 EMPloyee To lal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started