Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-Fill out a journal entry based on the scenario below, and use all the information provided in the accompanying table. Megan Picasso began operations on

-Fill out a journal entry based on the scenario below, and use all the information provided in the accompanying table.

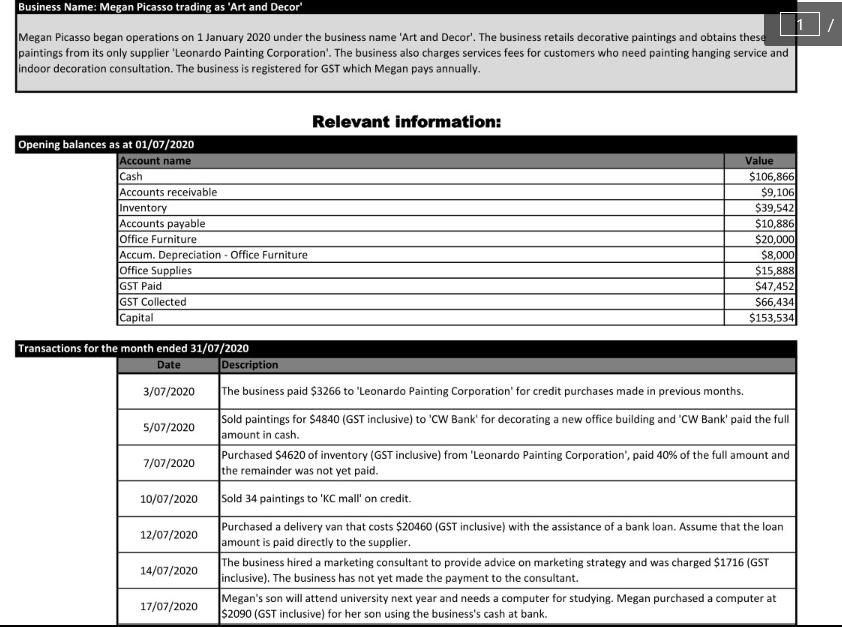

Megan Picasso began operations on 1 January 2020 under the business name 'Art and Decor'. The business retails decorative paintings and obtains these paintings from its only supplier 'Leonardo Painting Corporation'. The business also charges services fees for customers who need painting hanging service and indoor decoration consultation. The business is registered for GST which Megan pays annually.

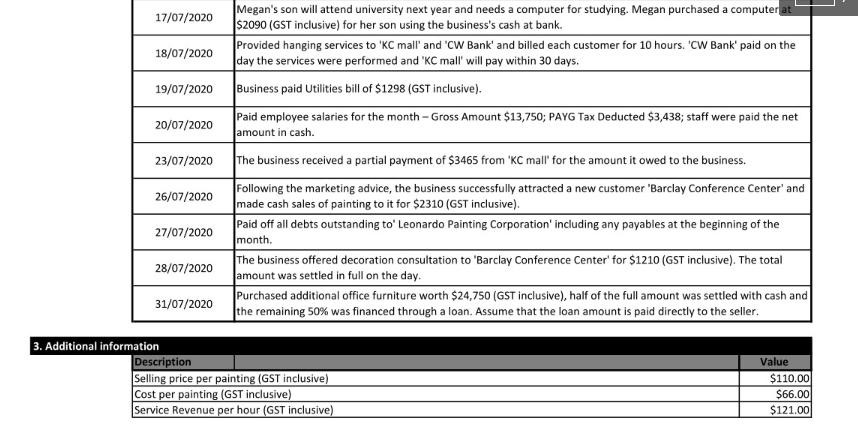

Business Name: Megan Picasso trading as 'Art and Decor Megan Picasso began operations on 1 January 2020 under the business name 'Art and Decor'. The business retails decorative paintings and obtains these paintings from its only supplier 'Leonardo Painting Corporation'. The business also charges services fees for customers who need painting hanging service and indoor decoration consultation. The business is registered for GST which Megan pays annually. Relevant information: Opening balances as at 01/07/2020 Account name Cash Accounts receivable Inventory Accounts payable office Furniture Accum. Depreciation - Office Furniture Office Supplies GST Paid GST Collected Capital Value $106,866 $9,106 $39,542 $10,886 $20,000 $8,000 $15,888 $47,452 $66,434 $153,534 Transactions for the month ended 31/07/2020 Date Description 3/07/2020 The business paid $3266 to 'Leonardo Painting Corporation' for credit purchases made in previous months. Sold paintings for $4840 (GST inclusive) to 'CW Bank' for decorating a new office building and 'CW Bank' paid the full amount in cash. Purchased $4620 of inventory (GST inclusive) from 'Leonardo Painting Corporation', paid 40% of the full amount and the remainder was not yet paid. 5/07/2020 7/07/2020 10/07/2020 Sold 34 paintings to 'KC mall' on credit. Purchased a delivery van that costs $20460 (GST inclusive) with the assistance of a bank loan. Assume that the loan amount is paid directly to the supplier. The business hired a marketing consultant to provide advice on marketing strategy and was charged $1716 (GST inclusive). The business has not yet made the payment to the consultant. Megan's son will attend university next year and needs a computer for studying. Megan purchased a computer at $2090 (GST inclusive) for her son using the business's cash at bank. 12/07/2020 14/07/2020 17/07/2020

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started