Answered step by step

Verified Expert Solution

Question

1 Approved Answer

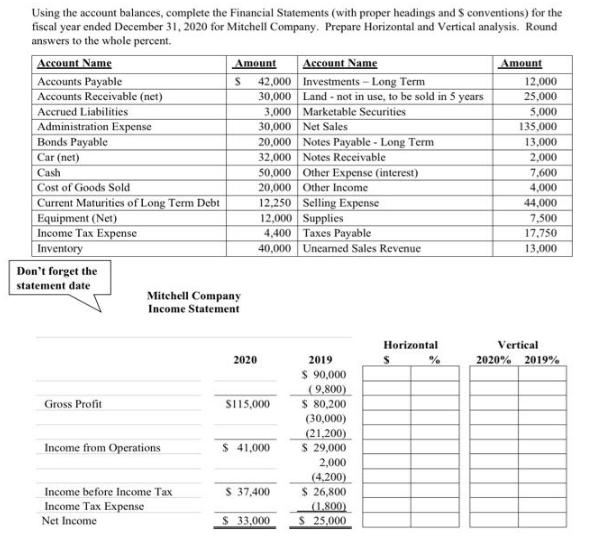

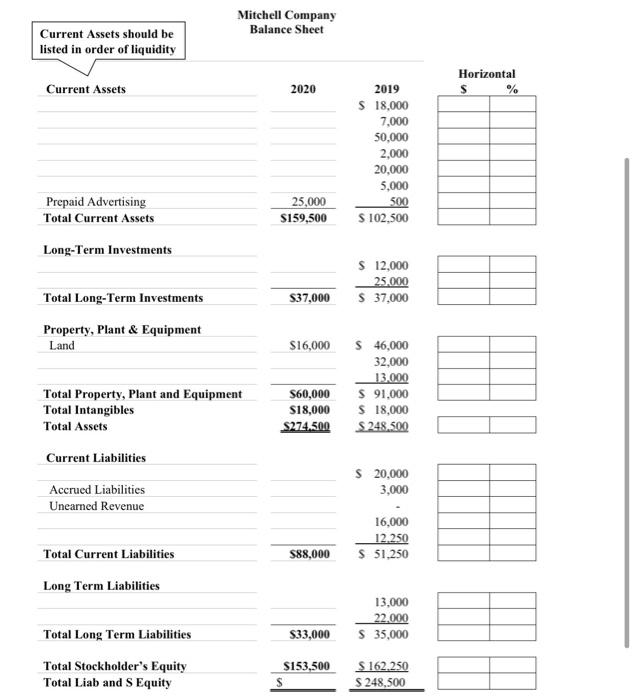

Using the account balances, complete the Financial Statements (with proper headings and 5 conventions) for the fiscal year ended December 31, 2020 for Mitchell

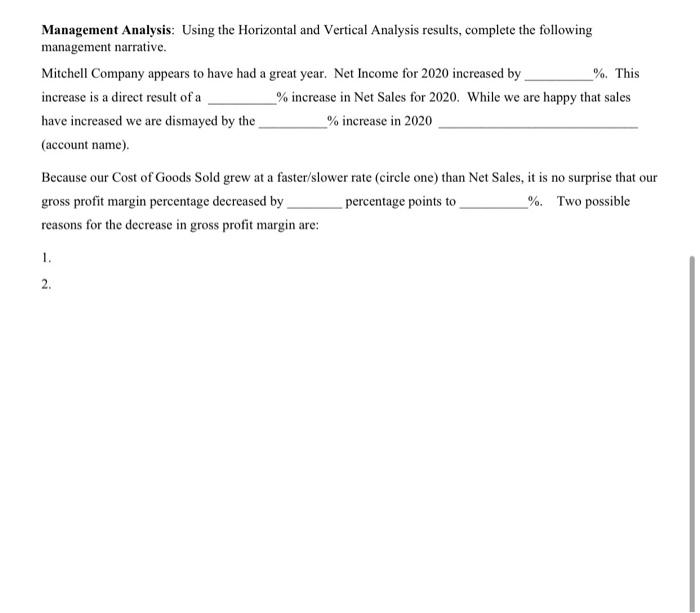

Using the account balances, complete the Financial Statements (with proper headings and 5 conventions) for the fiscal year ended December 31, 2020 for Mitchell Company. Prepare Horizontal and Vertical analysis. Round answers to the whole percent. Account Name Accounts Payable Accounts Receivable (net) Accrued Liabilities Administration Expense Bonds Payable Car (net) Cash Cost of Goods Sold Current Maturities of Long Term Debt Equipment (Net) Income Tax Expense Inventory Don't forget the statement date Gross Profit Income from Operations Amount Mitchell Company Income Statement Income before Income Tax Income Tax Expense Net Income S 2020 42,000 30,000 3,000 Marketable Securities 30,000 Net Sales 20,000 Notes Payable - Long Term 32,000 Notes Receivable 50,000 Other Expense (interest) 20,000 Other Income 12,250 Selling Expense 12,000 Supplies 4,400 Taxes Payable 40,000 Uneamed Sales Revenue $115,000 $ 41,000 Account Name Investments - Long Term Land - not in use, to be sold in 5 years $ 37,400 $ 33,000 2019 $ 90,000 (9,800) $ 80,200 (30,000) (21,200) $ 29,000 2,000 (4,200) $ 26,800 (1.800) $ 25,000 Horizontal % Amount 12,000 25,000 5,000 135,000 13,000 2,000 7,600 4,000 44,000 7,500 17,750 13,000 Vertical 2020% 2019% Current Assets should be listed in order of liquidity Current Assets Prepaid Advertising Total Current Assets Long-Term Investments Total Long-Term Investments Property, Plant & Equipment Land Total Property, Plant and Equipment Total Intangibles Total Assets Current Liabilities Accrued Liabilities Unearned Revenue Total Current Liabilities Long Term Liabilities Mitchell Company Balance Sheet Total Long Term Liabilities Total Stockholder's Equity Total Liab and S Equity 2020 25,000 $159,500 $37,000 S $16,000 $60,000 $18,000 $274.500 $33,000 $153,500 2019 $ 18,000 7,000 50,000 2,000 20,000 5,000 500 $ 102,500 $ 12,000 25.000 $ 37,000 $ 46,000 32,000 13.000 $ 91,000 $ 18,000 $248.500 16,000 12.250 $88,000 $ 51,250 $ 20,000 3,000 13,000 22,000 $ 35,000 $ 162.250 $248,500 Horizontal S % Management Analysis: Using the Horizontal and Vertical Analysis results, complete the following management narrative. Mitchell Company appears to have had a great year. Net Income for 2020 increased by increase is a direct result of a have increased we are dismayed by the (account name). %. This % increase in Net Sales for 2020. While we are happy that sales % increase in 2020 Because our Cost of Goods Sold grew at a faster/slower rate (circle one) than Net Sales, it is no surprise that our gross profit margin percentage decreased by %. Two possible percentage points to reasons for the decrease in gross profit margin are: 1. 2.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Assembling Units 28080 units 22400 Processing Orders 12408 orders 9920 Support...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started