Question

Accounting for business combinations Tasks a. Present a calculation of goodwill at the date of acquisition for Acorn Assets Ltd and the non-controlling interest. b.

Accounting for business combinations

Tasks

a. Present a calculation of goodwill at the date of acquisition for Acorn Assets Ltd and the non-controlling interest.

b. Prepare consolidation journal entries to record all of the intragroup adjustments and eliminations. Do not show any of your workings for this part of the question.

c. Calculate the value of the non-controlling interest and prepare consolidation journal entries to recognise the non-controlling interest in the groups consolidated financial statements.

d. Prepare a consolidation worksheet for the year ending 31 March 2022.

e. Explain the final balance reported in the consolidation worksheet for the following items:

i. Interest payable

ii. Revaluation surplus

iii. Dividends payable

f. Explain and describe the purpose of the adjustments made to:

i. Sales

ii. The investment in Beech Branches Ltd

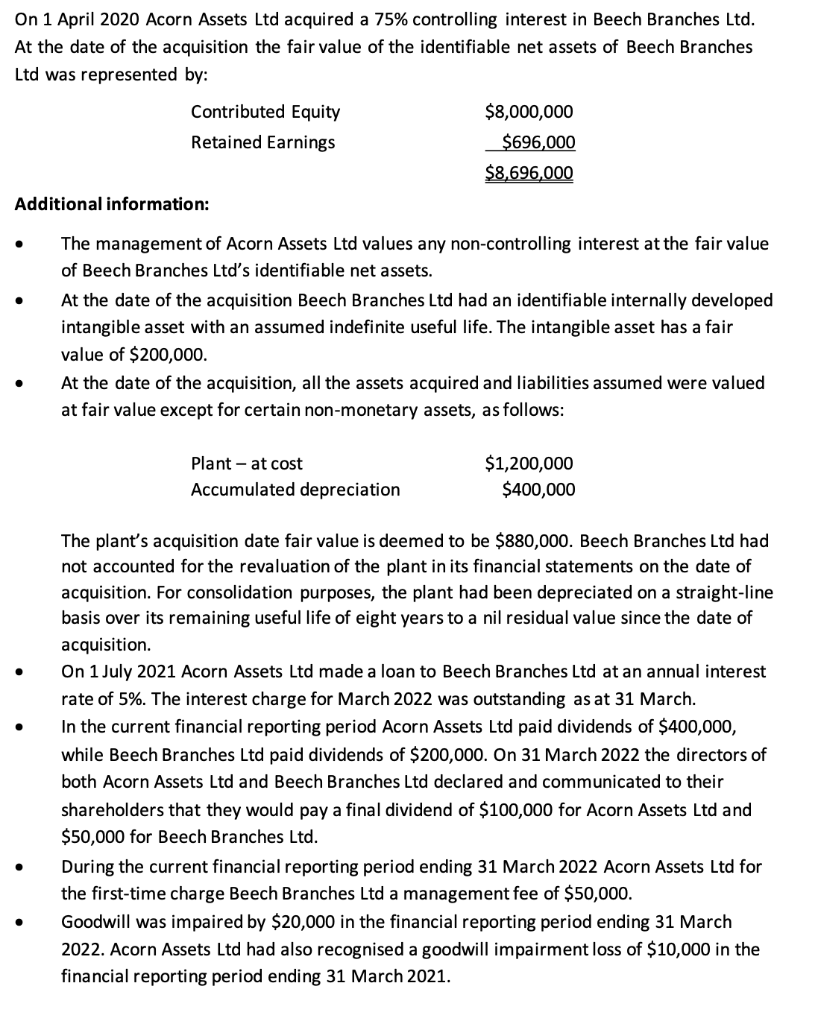

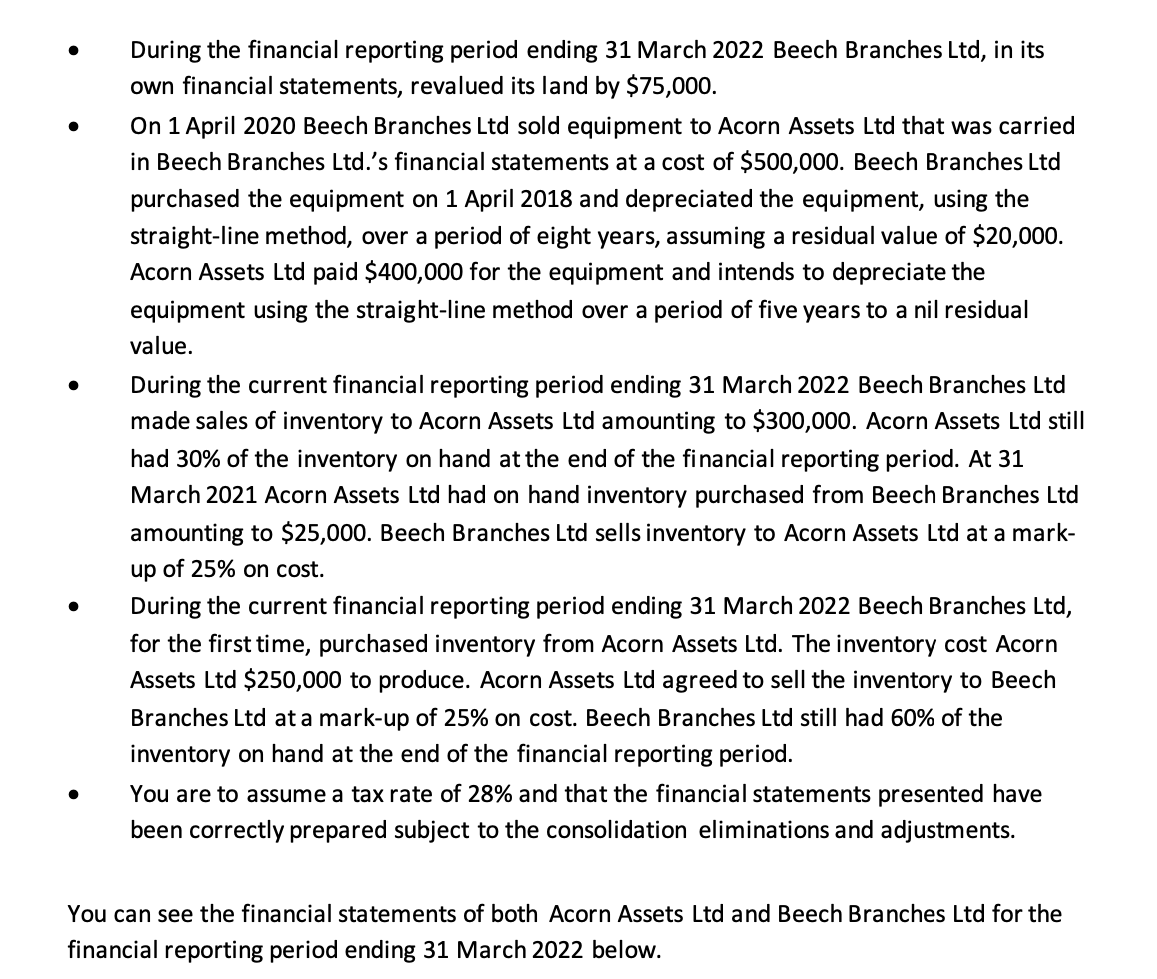

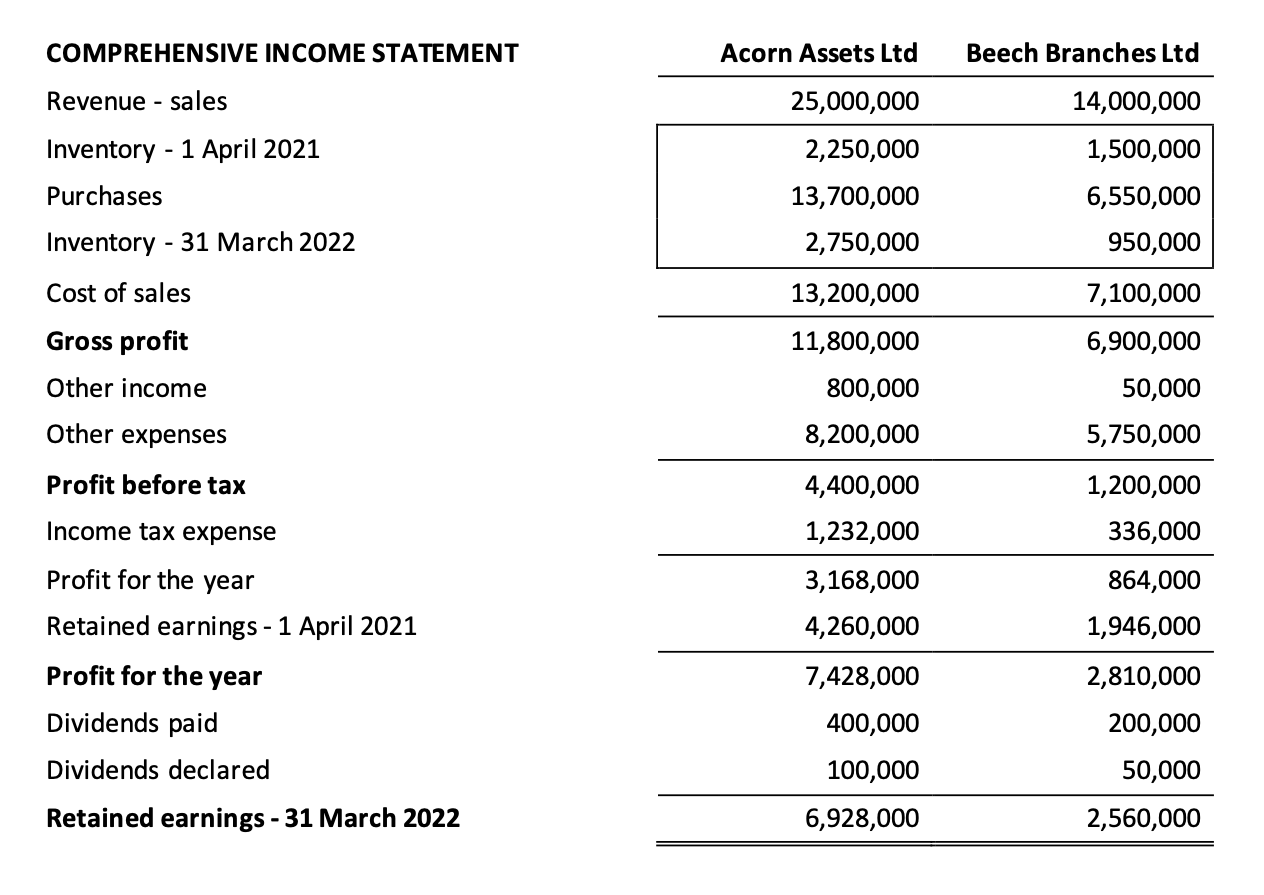

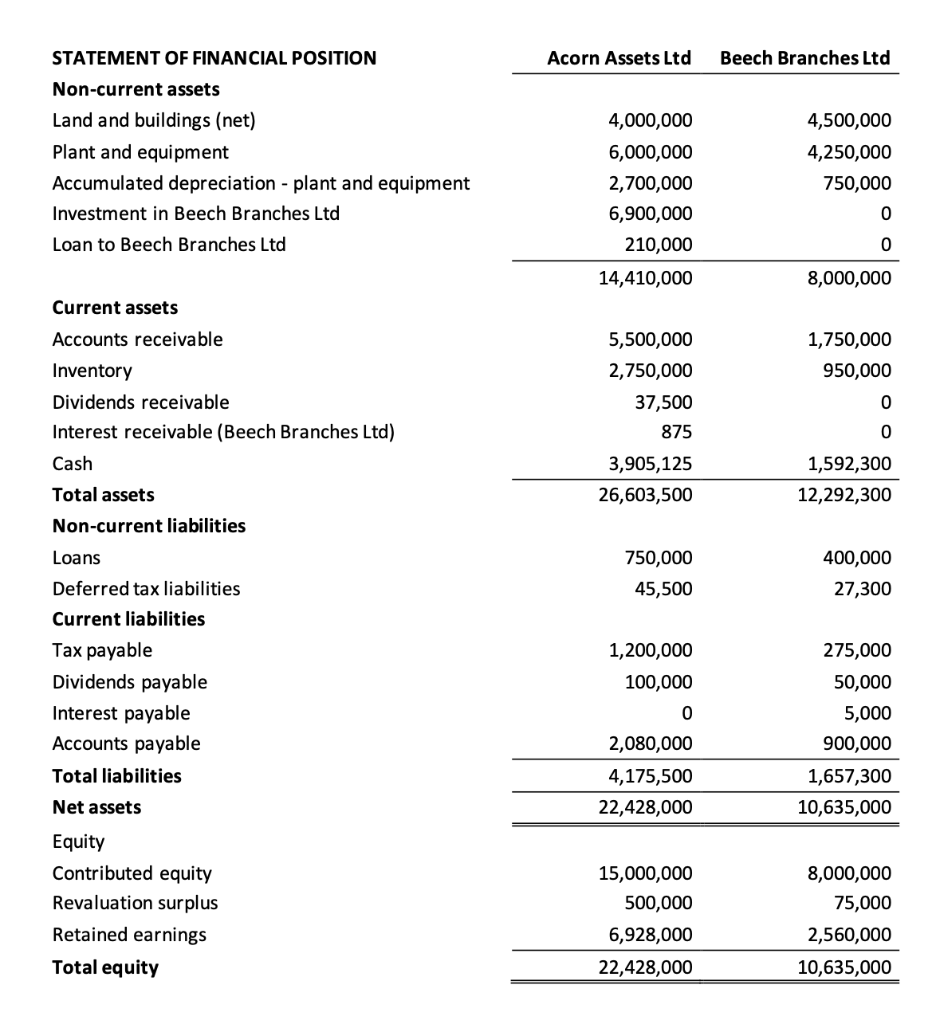

On 1 April 2020 Acorn Assets Ltd acquired a 75% controlling interest in Beech Branches Ltd. At the date of the acquisition the fair value of the identifiable net assets of Beech Branches Ltd was represented by: Additional information: - The management of Acorn Assets Ltd values any non-controlling interest at the fair value of Beech Branches Ltd's identifiable net assets. - At the date of the acquisition Beech Branches Ltd had an identifiable internally developed intangible asset with an assumed indefinite useful life. The intangible asset has a fair value of $200,000. - At the date of the acquisition, all the assets acquired and liabilities assumed were valued at fair value except for certain non-monetary assets, as follows: The plant's acquisition date fair value is deemed to be $880,000. Beech Branches Ltd had not accounted for the revaluation of the plant in its financial statements on the date of acquisition. For consolidation purposes, the plant had been depreciated on a straight-line basis over its remaining useful life of eight years to a nil residual value since the date of acquisition. - On 1 July 2021 Acorn Assets Ltd made a loan to Beech Branches Ltd at an annual interest rate of 5%. The interest charge for March 2022 was outstanding as at 31March. - In the current financial reporting period Acorn Assets Ltd paid dividends of $400,000, while Beech Branches Ltd paid dividends of \$200,000. On 31 March 2022 the directors of both Acorn Assets Ltd and Beech Branches Ltd declared and communicated to their shareholders that they would pay a final dividend of $100,000 for Acorn Assets Ltd and $50,000 for Beech Branches Ltd. - During the current financial reporting period ending 31 March 2022 Acorn Assets Ltd for the first-time charge Beech Branches Ltd a management fee of $50,000. - Goodwill was impaired by $20,000 in the financial reporting period ending 31March 2022. Acorn Assets Ltd had also recognised a goodwill impairment loss of $10,000 in the financial reporting period ending 31 March 2021. - During the financial reporting period ending 31 March 2022 Beech Branches Ltd, in its own financial statements, revalued its land by $75,000. On 1 April 2020 Beech Branches Ltd sold equipment to Acorn Assets Ltd that was carried in Beech Branches Ltd.'s financial statements at a cost of $500,000. Beech Branches Ltd purchased the equipment on 1 April 2018 and depreciated the equipment, using the straight-line method, over a period of eight years, assuming a residual value of $20,000. Acorn Assets Ltd paid \$400,000 for the equipment and intends to depreciate the equipment using the straight-line method over a period of five years to a nil residual value. During the current financial reporting period ending 31 March 2022 Beech Branches Ltd made sales of inventory to Acorn Assets Ltd amounting to $300,000. Acorn Assets Ltd still had 30% of the inventory on hand at the end of the financial reporting period. At 31 March 2021 Acorn Assets Ltd had on hand inventory purchased from Beech Branches Ltd amounting to $25,000. Beech Branches Ltd sells inventory to Acorn Assets Ltd at a markup of 25% on cost. During the current financial reporting period ending 31 March 2022 Beech Branches Ltd, for the first time, purchased inventory from Acorn Assets Ltd. The inventory cost Acorn Assets Ltd $250,000 to produce. Acorn Assets Ltd agreed to sell the inventory to Beech Branches Ltd at a mark-up of 25% on cost. Beech Branches Ltd still had 60% of the inventory on hand at the end of the financial reporting period. You are to assume a tax rate of 28% and that the financial statements presented have been correctly prepared subject to the consolidation eliminations and adjustments. You can see the financial statements of both Acorn Assets Ltd and Beech Branches Ltd for the financial reporting period ending 31 March 2022 below. \begin{tabular}{lrr} COMPREHENSIVE INCOME STATEMENT & Acorn Assets Ltd & Beech Branches Ltd \\ \cline { 2 - 3 } Revenue - sales & 25,000,000 & 14,000,000 \\ Inventory - 1 April 2021 & 2,250,000 & 1,500,000 \\ Purchases & 13,700,000 & 6,550,000 \\ Inventory - 31 March 2022 & 2,750,000 & 950,000 \\ Cost of sales & 13,200,000 & 7,100,000 \\ Gross profit & 11,800,000 & 6,900,000 \\ Other income & 800,000 & 50,000 \\ Other expenses & 8,200,000 & 5,750,000 \\ \hline Profit before tax & 4,400,000 & 1,200,000 \\ Income tax expense & 1,232,000 & 336,000 \\ \hline Profit for the year & 3,168,000 & 864,000 \\ Retained earnings - 1 April 2021 & 4,260,000 & 1,946,000 \\ \hline Profit for the year & 7,428,000 & 2,810,000 \\ Dividends paid & 400,000 & 200,000 \\ Dividends declared & 100,000 & 50,000 \\ \hline Retained earnings - 31 March 2022 & 6,928,000 & 2,560,000 \\ \hline \end{tabular} On 1 April 2020 Acorn Assets Ltd acquired a 75% controlling interest in Beech Branches Ltd. At the date of the acquisition the fair value of the identifiable net assets of Beech Branches Ltd was represented by: Additional information: - The management of Acorn Assets Ltd values any non-controlling interest at the fair value of Beech Branches Ltd's identifiable net assets. - At the date of the acquisition Beech Branches Ltd had an identifiable internally developed intangible asset with an assumed indefinite useful life. The intangible asset has a fair value of $200,000. - At the date of the acquisition, all the assets acquired and liabilities assumed were valued at fair value except for certain non-monetary assets, as follows: The plant's acquisition date fair value is deemed to be $880,000. Beech Branches Ltd had not accounted for the revaluation of the plant in its financial statements on the date of acquisition. For consolidation purposes, the plant had been depreciated on a straight-line basis over its remaining useful life of eight years to a nil residual value since the date of acquisition. - On 1 July 2021 Acorn Assets Ltd made a loan to Beech Branches Ltd at an annual interest rate of 5%. The interest charge for March 2022 was outstanding as at 31March. - In the current financial reporting period Acorn Assets Ltd paid dividends of $400,000, while Beech Branches Ltd paid dividends of \$200,000. On 31 March 2022 the directors of both Acorn Assets Ltd and Beech Branches Ltd declared and communicated to their shareholders that they would pay a final dividend of $100,000 for Acorn Assets Ltd and $50,000 for Beech Branches Ltd. - During the current financial reporting period ending 31 March 2022 Acorn Assets Ltd for the first-time charge Beech Branches Ltd a management fee of $50,000. - Goodwill was impaired by $20,000 in the financial reporting period ending 31March 2022. Acorn Assets Ltd had also recognised a goodwill impairment loss of $10,000 in the financial reporting period ending 31 March 2021. - During the financial reporting period ending 31 March 2022 Beech Branches Ltd, in its own financial statements, revalued its land by $75,000. On 1 April 2020 Beech Branches Ltd sold equipment to Acorn Assets Ltd that was carried in Beech Branches Ltd.'s financial statements at a cost of $500,000. Beech Branches Ltd purchased the equipment on 1 April 2018 and depreciated the equipment, using the straight-line method, over a period of eight years, assuming a residual value of $20,000. Acorn Assets Ltd paid \$400,000 for the equipment and intends to depreciate the equipment using the straight-line method over a period of five years to a nil residual value. During the current financial reporting period ending 31 March 2022 Beech Branches Ltd made sales of inventory to Acorn Assets Ltd amounting to $300,000. Acorn Assets Ltd still had 30% of the inventory on hand at the end of the financial reporting period. At 31 March 2021 Acorn Assets Ltd had on hand inventory purchased from Beech Branches Ltd amounting to $25,000. Beech Branches Ltd sells inventory to Acorn Assets Ltd at a markup of 25% on cost. During the current financial reporting period ending 31 March 2022 Beech Branches Ltd, for the first time, purchased inventory from Acorn Assets Ltd. The inventory cost Acorn Assets Ltd $250,000 to produce. Acorn Assets Ltd agreed to sell the inventory to Beech Branches Ltd at a mark-up of 25% on cost. Beech Branches Ltd still had 60% of the inventory on hand at the end of the financial reporting period. You are to assume a tax rate of 28% and that the financial statements presented have been correctly prepared subject to the consolidation eliminations and adjustments. You can see the financial statements of both Acorn Assets Ltd and Beech Branches Ltd for the financial reporting period ending 31 March 2022 below. \begin{tabular}{lrr} COMPREHENSIVE INCOME STATEMENT & Acorn Assets Ltd & Beech Branches Ltd \\ \cline { 2 - 3 } Revenue - sales & 25,000,000 & 14,000,000 \\ Inventory - 1 April 2021 & 2,250,000 & 1,500,000 \\ Purchases & 13,700,000 & 6,550,000 \\ Inventory - 31 March 2022 & 2,750,000 & 950,000 \\ Cost of sales & 13,200,000 & 7,100,000 \\ Gross profit & 11,800,000 & 6,900,000 \\ Other income & 800,000 & 50,000 \\ Other expenses & 8,200,000 & 5,750,000 \\ \hline Profit before tax & 4,400,000 & 1,200,000 \\ Income tax expense & 1,232,000 & 336,000 \\ \hline Profit for the year & 3,168,000 & 864,000 \\ Retained earnings - 1 April 2021 & 4,260,000 & 1,946,000 \\ \hline Profit for the year & 7,428,000 & 2,810,000 \\ Dividends paid & 400,000 & 200,000 \\ Dividends declared & 100,000 & 50,000 \\ \hline Retained earnings - 31 March 2022 & 6,928,000 & 2,560,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started