Accounting for business

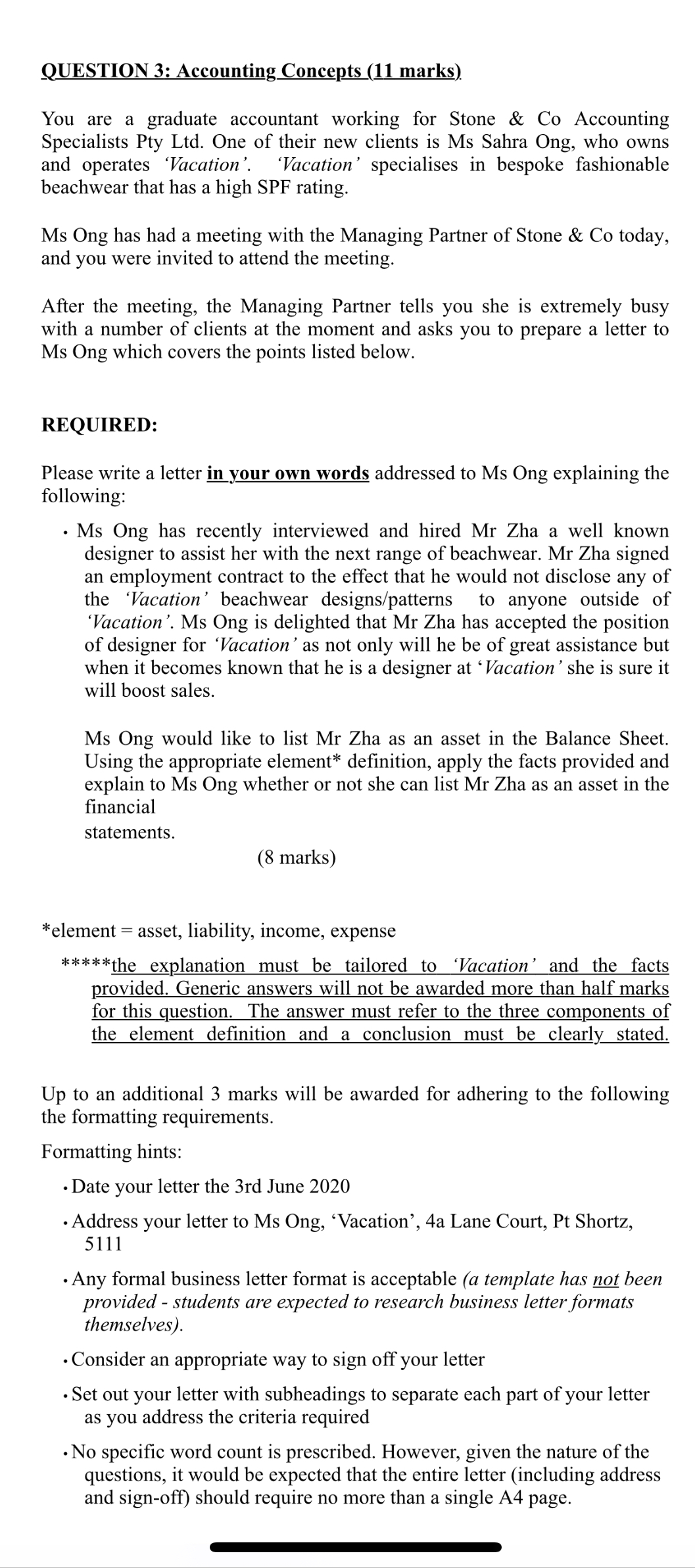

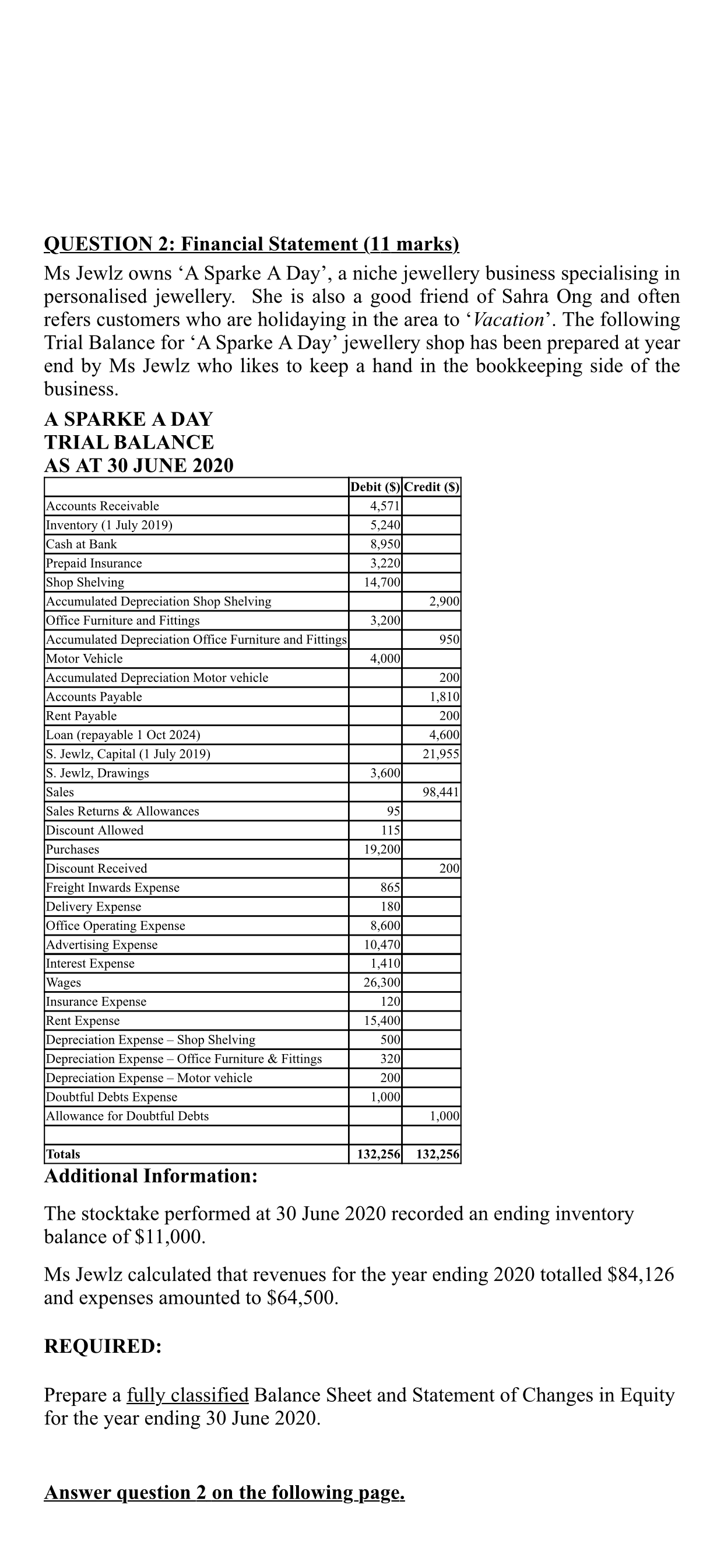

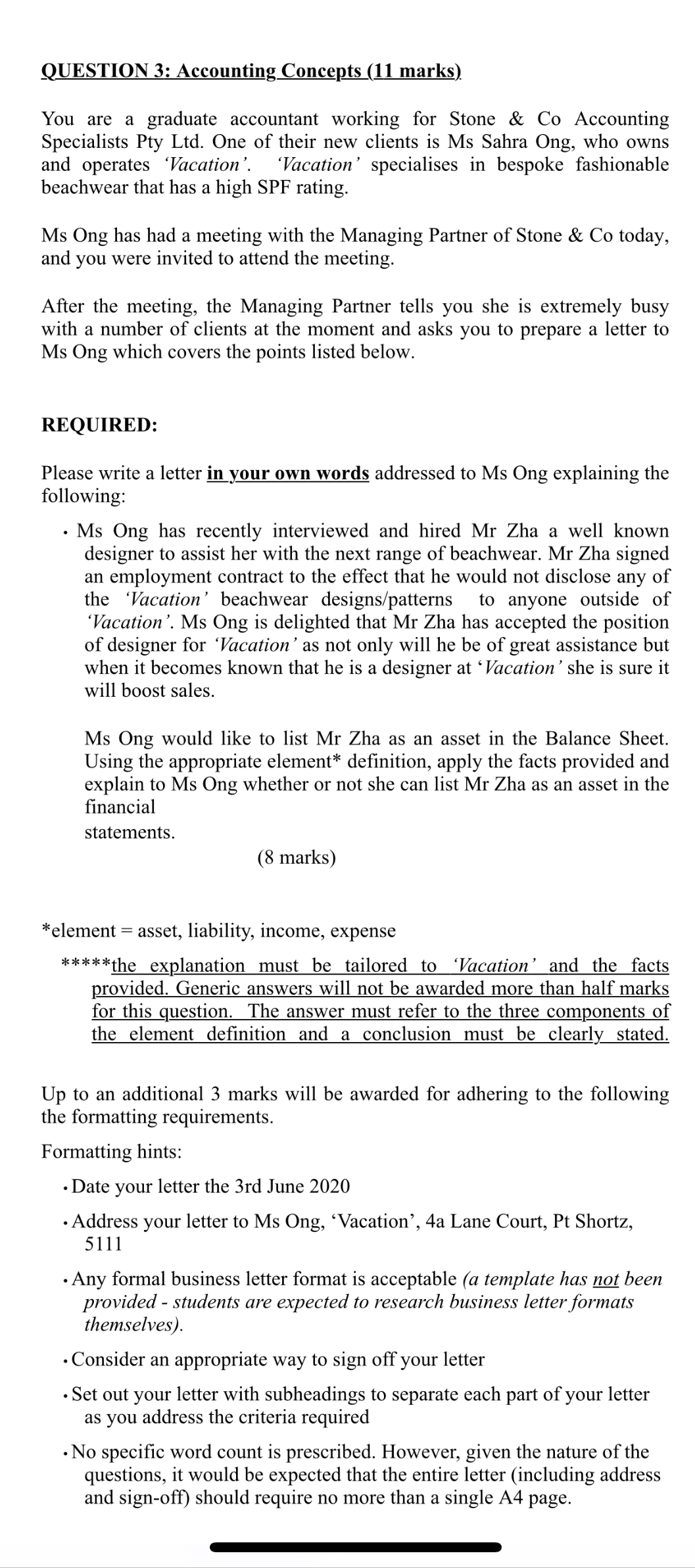

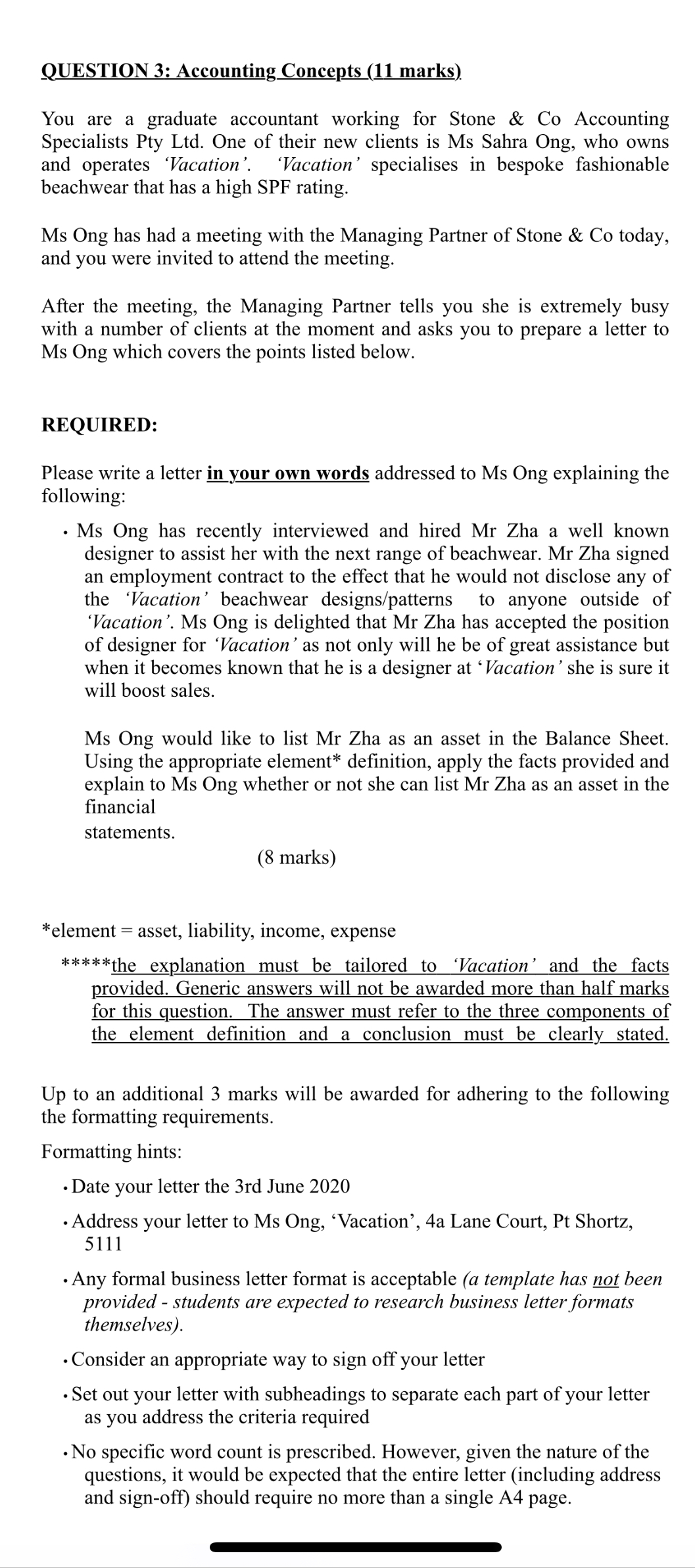

QUESTION 2: Financial Statement (11 marks) Ms Jewlz owns 'A Sparke A Day', a niche jewellery business specialising in personalised jewellery. She is also a good friend of Sahra Ong and often refers customers who are holidaying in the area to 'Vacation'. The following Trial Balance for 'A Sparke A Day' jewellery shop has been prepared at year end by Ms Jewiz who likes to keep a hand in the bookkeeping side of the business. A SPARKE A DAY TRIAL BALANCE AS AT 30 JUNE 2020 Debit ($) Credit ($) Accounts Receivable 4,571 Inventory (1 July 2019) 5,240 Cash at Bank ,950 Prepaid Insurance 3,220 Shop Shelving 14,700 Accumulated Depreciation Shop Shelving 2,900 Office Furniture and Fittings 3,200 Accumulated Depreciation Office Furniture and Fittings 950 Motor Vehicle 4.000 Accumulated Depreciation Motor vehicle 200 punts Payable 1,810 Rent Payable 200 Loan (repayable 1 Oct 2024) .600 S. Jewlz, Capital (1 July 2019) 21,955 S. Jewlz, Drawing 3,600 Sales 98.441 Sales Returns & Allowances 95 Discount Allowed 1 15 Purchases 9,200 Discount Received 200 Freight Inwards Expense 365 Delivery Expense 180 Office Operating Expense 8,600 Advertising Expense 0,470 Interest Expense 1,410 Wages 26,300 Insurance Expense 120 Rent Expense 15,400 Depreciation Expense - Shop Shelving 500 Depreciation Expense - Office Furniture & Fittings 320 Depreciation Expense - Motor vehicle 200 Doubtful Debts Expense 1,000 Allowance for Doubtful Debts 1.000 Totals 132,256 132,256 Additional Information: The stocktake performed at 30 June 2020 recorded an ending inventory balance of $11,000. Ms Jewlz calculated that revenues for the year ending 2020 totalled $84, 126 and expenses amounted to $64,500. REQUIRED: Prepare a fully classified Balance Sheet and Statement of Changes in Equity for the year ending 30 June 2020. Answer question 2 on the following page.QUESTION 3: Accounting Concepts01 marks) You are a graduate accountant working for Stone & Co Accounting Specialists Pty Ltd. One of their new clients is Ms Sabra Ong, who owns and operates 'VEication'. 'Vacation' specialises in bespoke fashionable beachwear that has a high SPF rating. Ms Ong has had a meeting with the Managing Partner of Stone & Co today, and you were invited to attend the meeting. Aer the meeting, the Managing Partner tells you she is extremely busy with a number of clients at the moment and asks you to prepare a letter to Ms Ong which covers the points listed below. REQUIRED: Please write a letter in your own words addressed to Ms Ong explaining the following: - Ms Ong has recently interviewed and hired Mr Zha a well known designer to assist her with the next range of beachwear. Mr Zha signed an employment contract to the effect that he would not disclose any of the 'Vacation' beachwear designs/patterns to anyone outside of 'Vacation '. Ms Orig is delighted that Mr Zha has accepted the position of designer for Vacation ' as not only will he be of great assistance but when it becomes known that he is a designer at ' Vacation ' she is sure it will boost sales. Ms Ong would like to list Mr Zha as an asset in the Balance Sheet. Using the appropriate element\" denition, apply the facts provided and explain to Ms Ong whether or not she can list Mr Zha as an asset in the nancial statements. (8 marks) *element = asset, liability, income, expense *****the explanation must be tailored to 'thation' and the facts provided. Generic answers will not be awarded more than half marks for this question. The answer must refer to the three components of the element denition and a conclusion must be clearly stated. Up to an additional 3 marks will be awarded for adhering to the following the formatting requirements. Formatting hints: - Date your letter the 3rd June 2020 - Address your letter to Ms Ong, 'Vacation', 4a Lane Court, Pt Shortz, 5111 - Any formal business letter format is acceptable (0 template has 110: been provided - students are expected to research business letter formats themselves). - Consider an appropriate way to sign off your letter - Set out your letter with subheadings to separate each part of your letter as you address the criteria required -No specic word count is prescribed. However, given the nature of the questions, it would be expected that the entire letter (including address and sign-off) should require no more than a single A4 page