Answered step by step

Verified Expert Solution

Question

1 Approved Answer

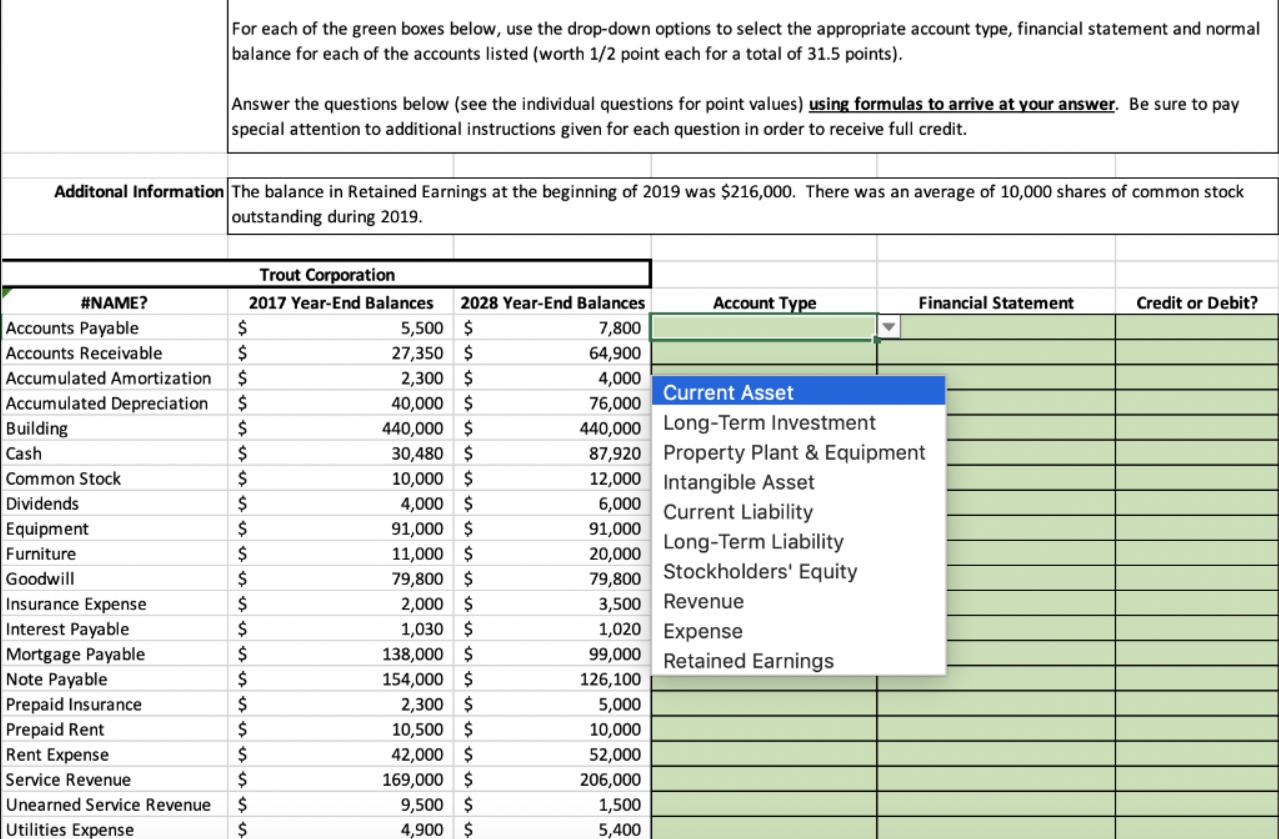

For each of the green boxes below, use the drop-down options to select the appropriate account type, financial statement and normal balance for each

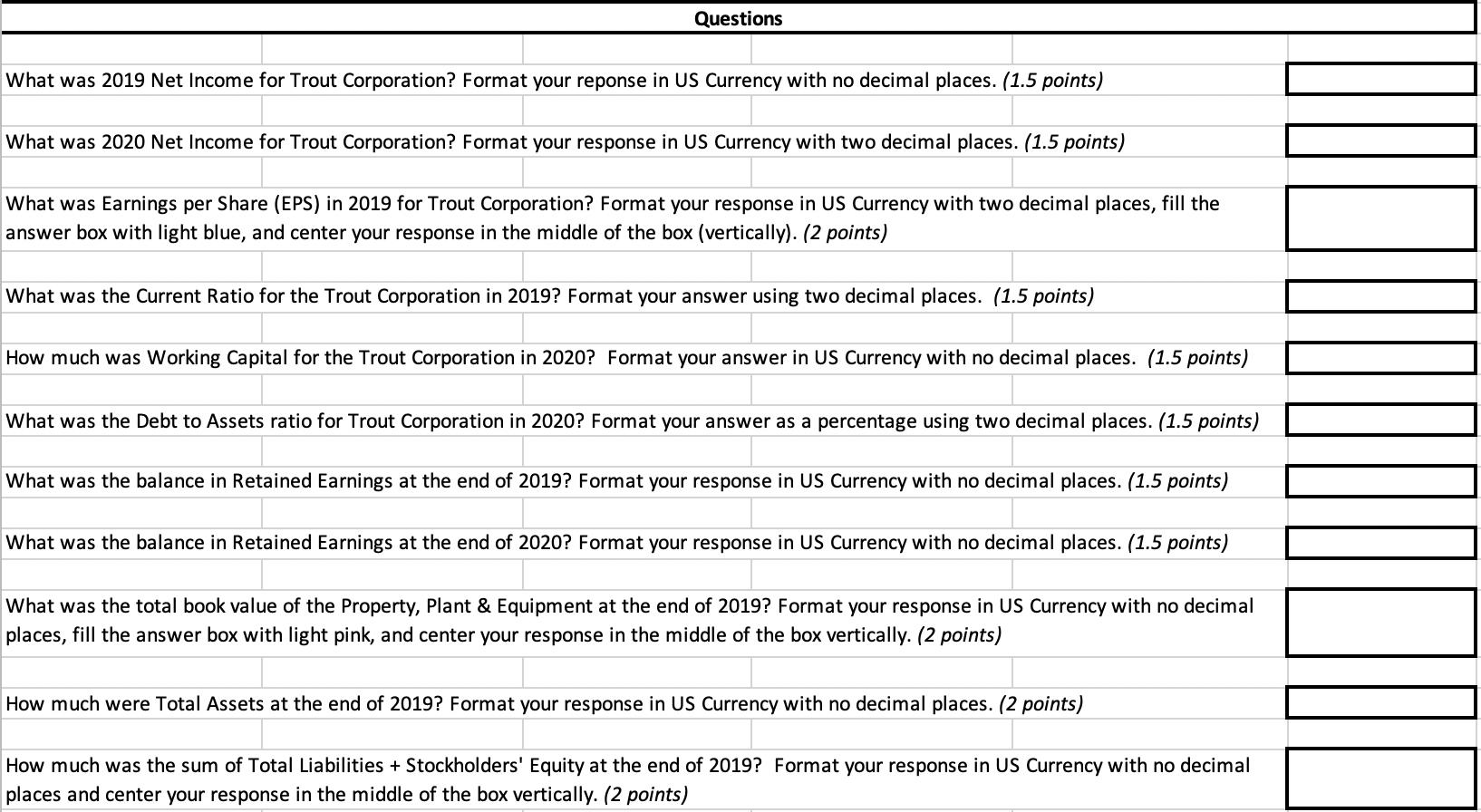

For each of the green boxes below, use the drop-down options to select the appropriate account type, financial statement and normal balance for each of the accounts listed (worth 1/2 point each for a total of 31.5 points). Answer the questions below (see the individual questions for point values) using formulas to arrive at your answer. Be sure to pay special attention to additional instructions given for each question in order to receive full credit. Additonal Information The balance in Retained Earnings at the beginning of 2019 was $216,000. There was an average of 10,000 shares of common stock outstanding during 2019. Trout Corporation #NAME? 2017 Year-End Balances 2028 Year-End Balances Account Type Financial Statement Credit or Debit? Accounts Payable Accounts Receivable 2$ 5,500 $ 7,800 $ 27,350 $ 64,900 2,300 $ 40,000 $ 440,000 $ 30,480 $ Accumulated Amortization 4,000 Current Asset Accumulated Depreciation Building 24 76,000 440,000 Long-Term Investment 87,920 Property Plant & Equipment 12,000 Intangible Asset 6,000 Current Liability Cash 2$ 10,000 $ 2$ Common Stock 4,000 91,000 $ 11,000 $ 79,800 $ Dividends 2$ Equipment 2$ 91,000 Long-Term Liability Stockholders' Equity Furniture 2$ 20,000 Goodwill 2$ 79,800 2,000 $ 1,030 $ 3,500 Revenue 1,020 Expense 99,000 Retained Earnings 2$ Insurance Expense Interest Payable 2$ Mortgage Payable Note Payable Prepaid Insurance 138,000 $ 2$ 154,000 $ 2,300 $ 10,500 $ 42,000 $ 169,000 $ 126,100 5,000 Prepaid Rent 10,000 2$ 2$ Rent Expense 52,000 Service Revenue 206,000 9,500 $ 4,900 $ Unearned Service Revenue 2$ 1,500 Utilities Expense 5,400 Questions What was 2019 Net Income for Trout Corporation? Format your reponse in US Currency with no decimal places. (1.5 points) What was 2020 Net Income for Trout Corporation? Format your response in US Currency with two decimal places. (1.5 points) What was Earnings per Share (EPS) in 2019 for Trout Corporation? Format your response in US Currency with two decimal places, fill the answer box with light blue, and center your response in the middle of the box (vertically). (2 points) What was the Current Ratio for the Trout Corporation in 2019? Format your answer using two decimal places. (1.5 points) How much was Working Capital for the Trout Corporation in 2020? Format your answer in US Currency with no decimal places. (1.5 points) What was the Debt to Assets ratio for Trout Corporation in 2020? Format your answer as a percentage using two decimal places. (1.5 points) What was the balance in Retained Earnings at the end of 2019? Format your response in US Currency with no decimal places. (1.5 points) What was the balance in Retained Earnings at the end of 2020? Format your response in US Currency with no decimal places. (1.5 points) What was the total book value of the Property, Plant & Equipment at the end of 2019? Format your response in US Currency with no decimal places, fill the answer box with light pink, and center your response in the middle of the box vertically. (2 points) How much were Total Assets at the end of 2019? Format your response in US Currency with no decimal places. (2 points) How much was the sum of Total Liabilities + Stockholders' Equity at the end of 2019? Format your response in US Currency with no decimal places and center your response in the middle of the box vertically. (2 points)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Account Type Financial Statements Credit or Debit Accounts Payable Current Liability Balance sheet Credit Accounts Receivables Current Assets Balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started