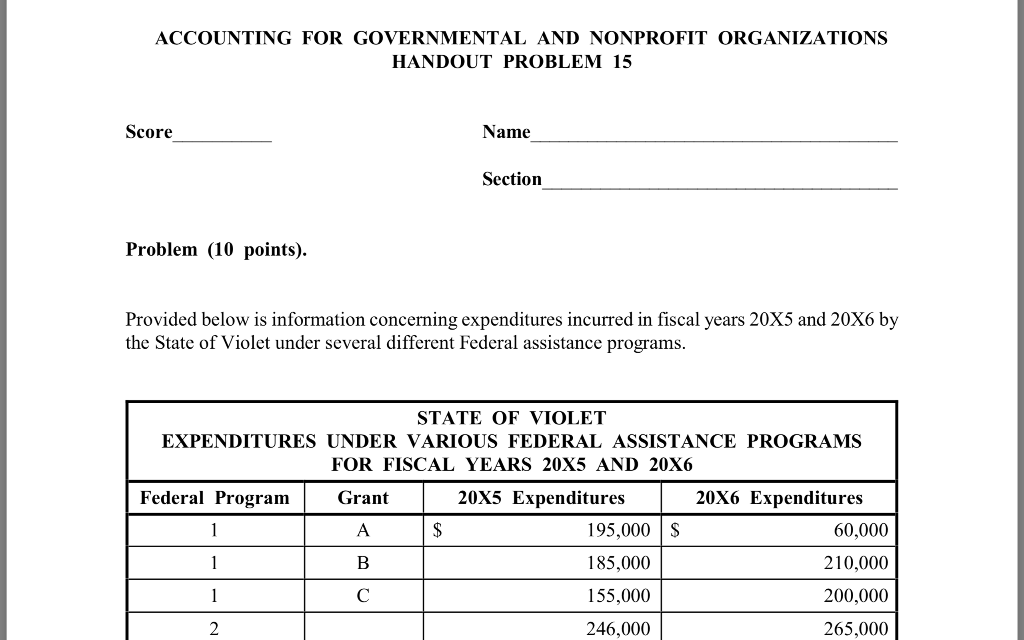

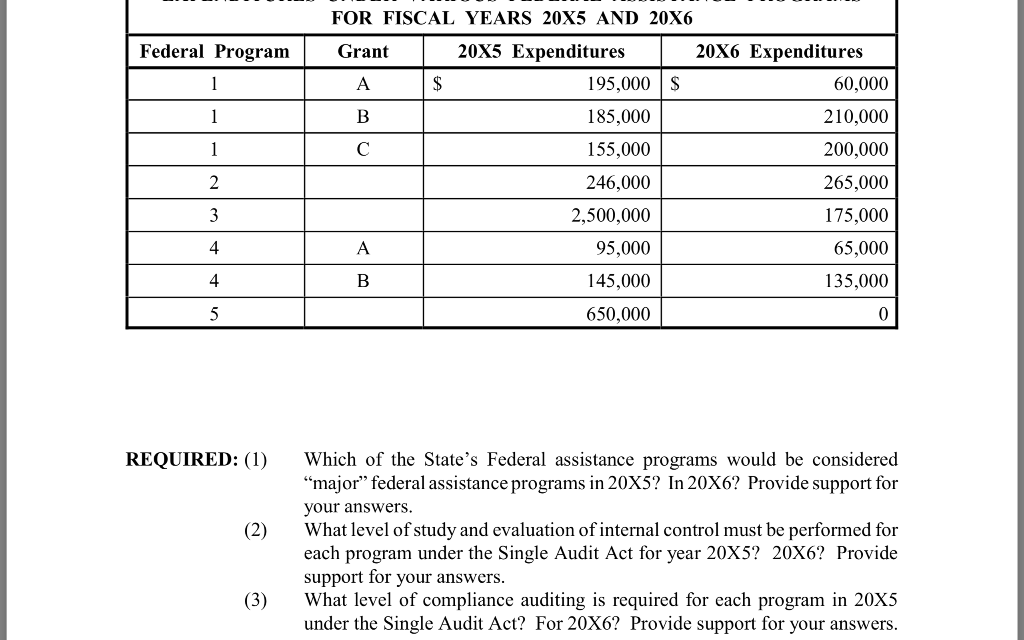

ACCOUNTING FOR GOVERNMENTAL AND NONPROFIT ORGANIZATIONS HANDOUT PROBLEM 15 Score Name Section Problem (10 points). Provided below is information concerning expenditures incurred in fiscal years 20X5 and 20X6 by the State of Violet under several different Federal assistance programs. STATE OF VIOLET EXPENDITURES UNDER VARIOUS FEDERAL ASSISTANCE PROGRAMS FOR FISCAL YEARS 20X5 AND 20X6 Federal Program 20X5 Expenditures 20X6 Expenditures Grant A $ 195,000 $ B 185,000 60,000 210,000 200,000 265,000 155,000 246,000 FOR FISCAL YEARS 20X5 AND 20X6 Federal Program $ Grant A B C 20X5 Expenditures 195,000 185,000 $ 1 1 2 20X6 Expenditures 60,000 210,000 200,000 265,000 175,000 155,000 4 4 5 A B 246,000 2,500,000 95,000 145,000 650,000 65,000 135,000 REQUIRED: (1) (2) Which of the State's Federal assistance programs would be considered "major federal assistance programs in 20X5? In 20X6? Provide support for your answers. What level of study and evaluation of internal control must be performed for each program under the Single Audit Act for year 20X5? 20X6? Provide support for your answers. What level of compliance auditing is required for each program in 20X5 under the Single Audit Act? For 20X6? Provide support for your answers. (3) ACCOUNTING FOR GOVERNMENTAL AND NONPROFIT ORGANIZATIONS HANDOUT PROBLEM 15 Score Name Section Problem (10 points). Provided below is information concerning expenditures incurred in fiscal years 20X5 and 20X6 by the State of Violet under several different Federal assistance programs. STATE OF VIOLET EXPENDITURES UNDER VARIOUS FEDERAL ASSISTANCE PROGRAMS FOR FISCAL YEARS 20X5 AND 20X6 Federal Program 20X5 Expenditures 20X6 Expenditures Grant A $ 195,000 $ B 185,000 60,000 210,000 200,000 265,000 155,000 246,000 FOR FISCAL YEARS 20X5 AND 20X6 Federal Program $ Grant A B C 20X5 Expenditures 195,000 185,000 $ 1 1 2 20X6 Expenditures 60,000 210,000 200,000 265,000 175,000 155,000 4 4 5 A B 246,000 2,500,000 95,000 145,000 650,000 65,000 135,000 REQUIRED: (1) (2) Which of the State's Federal assistance programs would be considered "major federal assistance programs in 20X5? In 20X6? Provide support for your answers. What level of study and evaluation of internal control must be performed for each program under the Single Audit Act for year 20X5? 20X6? Provide support for your answers. What level of compliance auditing is required for each program in 20X5 under the Single Audit Act? For 20X6? Provide support for your answers. (3)