Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCOUNTING FOR GOVERNMENTAL AND NONPROFIT ORGANIZATIONS On January 1, 20X5, Wheatland County decided to create an investment pool that will include the Town of Saratoga,

ACCOUNTING FOR GOVERNMENTAL AND NONPROFIT ORGANIZATIONS

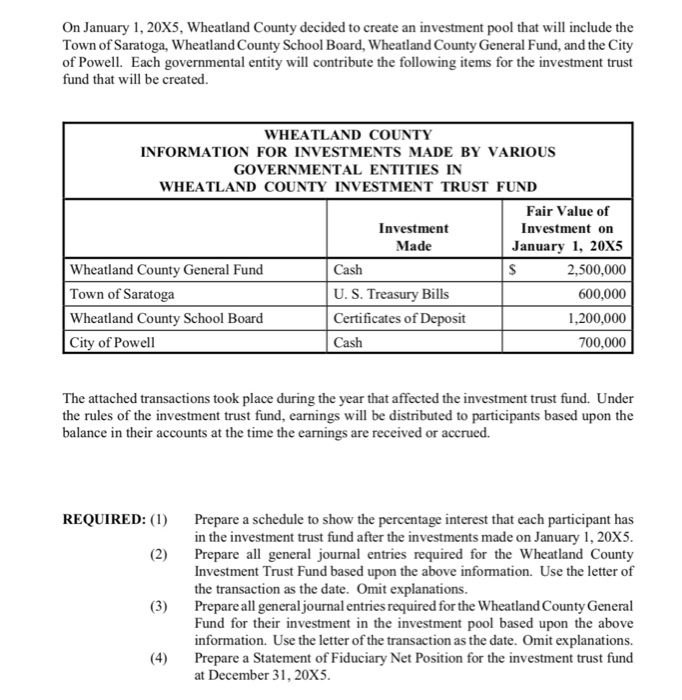

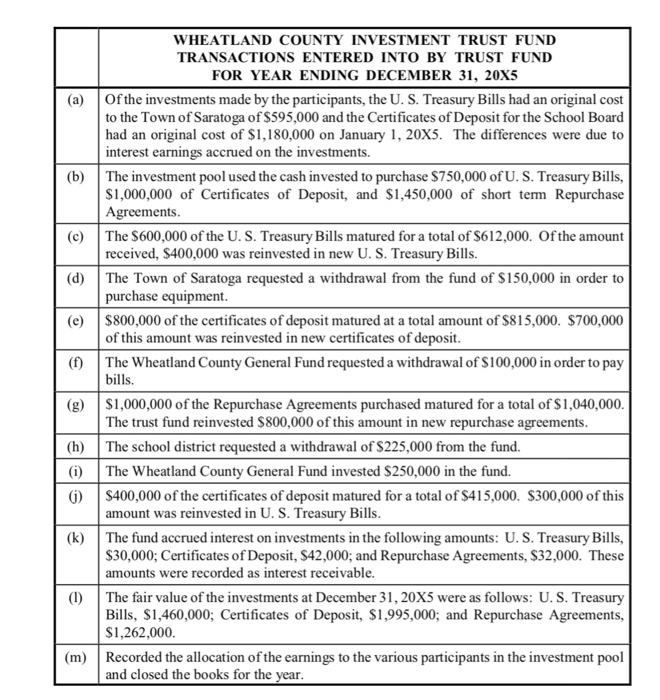

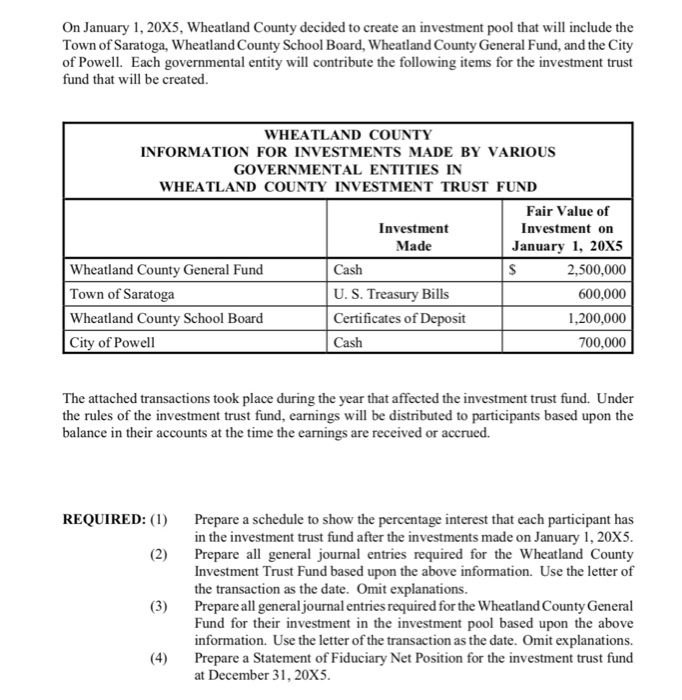

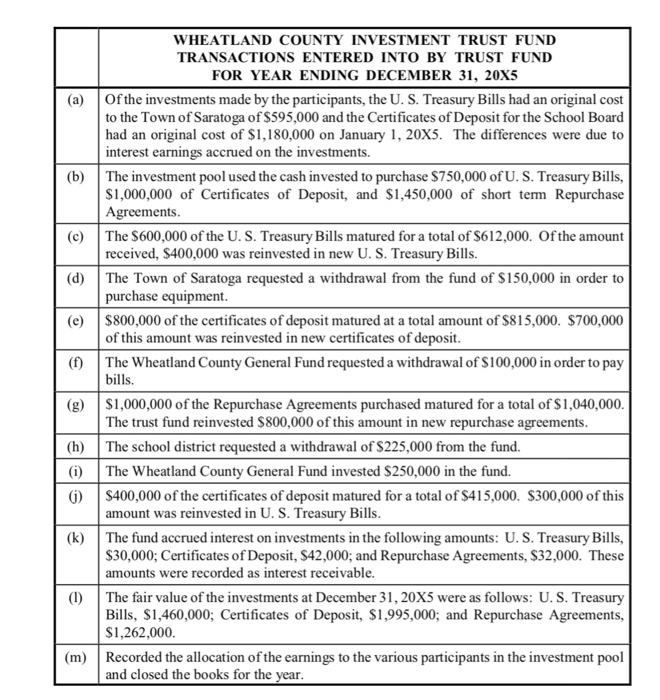

On January 1, 20X5, Wheatland County decided to create an investment pool that will include the Town of Saratoga, Wheatland County School Board, Wheatland County General Fund, and the City of Powell. Each governmental entity will contribute the following items for the investment trust fund that will be created. WHEATLAND COUNTY INFORMATION FOR INVESTMENTS MADE BY VARIOUS GOVERNMENTAL ENTITIES IN WHEATLAND COUNTY INVESTMENT TRUST FUND Fair Value of Investment on Investment Made Wheatland County General Fund Town of Saratoga Wheatland County School Board City of Powell Cash U. S. Treasury Bills Certificates of Deposit Cash January 1, 20X5 2,500,000 600,000 1,200,000 700,000 The attached transactions took place during the year that affected the investment trust fund. Under the rules of the investment trust fund, earnings will be distributed to participants based upon the balance in their accounts at the time the earnings are received or accrued. REQUIRED: () Prepare a schedule to show the percentage interest that each participant has in the investment trust fund after the investments made on January 1, 20X5 Prepare all general journal entries required for the Wheatland County Investment Trust Fund based upon the above information. Use the letter of the transaction as the date. Omit explanations. Prepare all general journal entries required for the Wheatland County General Fund for their investment in the investment pool based upon the above information. Use the letter of the transaction as the date. Omit explanations. Prepare a Statement of Fiduciary Net Position for the investment trust fund at December 31, 20X5. (2) (3) (4) WHEATLAND COUNTY INVESTMENT TRUST FUND TRANSACTIONS ENTERED INTO BY TRUST FUND FOR YEAR ENDING DECEMBER 31, 20X5 (a) Ofthe investments made by the participants, the U. S. Treasury Bills had an original cost to the Town of Saratoga of $595,000 and the Certificates of Deposit for the School Board had an original cost of $1,180,000 on January 1, 20XS. The differences were due to interest earnings accrued on the investments. (b) The investment pool used the cash invested to purchase $750,000 of U. S. Treasury Bills, S1,000,000 of Certificates of Deposit, and $1,450,000 of short term Repurchase (c) The S600,000 of the U. S. Treasury Bills matured for a total of $612,000. Of the amount (d) The Town of Saratoga requested a withdrawal from the fund of $150,000 in order to (e) $800,000 of the certificates of deposit matured at a total amount of $815,000. $700,000 (f)The Wheatland County General Fund requested a withdrawal of $100,000 in order to pay (g)S1,000,000 of the Repurchase Agreements purchased matured for a total of $1,040,000 Agreements received, $400,000 was reinvested in new U. S. Treasury Bills. purchase equipment of this amount was reinvested in new certificates of deposit bills. The trust fund reinvested $800,000 of this amount in new repurchase agreements (h) The school district requested a withdrawal of $225,000 from the fund. (i) The Wheatland County General Fund invested $250,000 in the fund. G) $400,000 of the certificates of deposit matured for a total of $415,000. $300,000 of this amount was reinvested in U. S. Treasury Bills (k) The fund accrued interest on investments in the following amounts: U. S. Treasury Bills, S30,000; Certificates of Deposit, S42,000; and Repurchase Agreements, $32,000. These amounts were recorded as interest receivable (1) The fair value of the investments at December 31, 20X5 were as follows: U. S. Treasury Bills, S1,460,000; Certificates of Deposit, $1,995,000; and Repurchase Agreements, S1,262,000. (m)Recorded the allocation of the earnings to the various participants in the investment pool and closed the books for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started