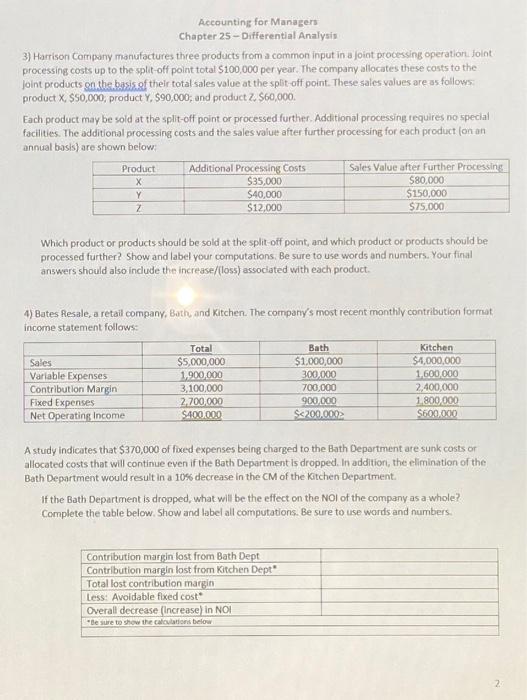

Accounting for Managers Chapter 25 - Differential Analysit 3) Harrison Cornpany manufactures three products from a common input in a joint processing operation foint processing costs up to the split-off point total $100,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: product X,$50,000, product Y,$90,000, and product 2,$60,000. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product fon an annual basis) are shown below: Which product or products should be sold at the split-off point, and which product or products should be processed further? Show and label your computations. Be sure to use words and numbers. Your final answers should also include the increase/(loss) associated with each product. 4) Bates Resale, a retail company, Bath, and Kitchen. The company's most recent monthly contribution format. income statement follows: A study indicates that $370,000 of foxed expenses being charged to the Bath Deportment are sunk costs or allocated costs that will continue even if the Bath Department is dropped. In addition, the elimination of the Bath Department would result in a 1056 decrease in the CM of the Kitchen Department. If the Bath Department is dropped, what will be the effect on the NOI of the company as a whole? Complete the table below. Show and habel all computations. Be sure to use words and numbers. Accounting for Managers Chapter 25 - Differential Analysit 3) Harrison Cornpany manufactures three products from a common input in a joint processing operation foint processing costs up to the split-off point total $100,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: product X,$50,000, product Y,$90,000, and product 2,$60,000. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product fon an annual basis) are shown below: Which product or products should be sold at the split-off point, and which product or products should be processed further? Show and label your computations. Be sure to use words and numbers. Your final answers should also include the increase/(loss) associated with each product. 4) Bates Resale, a retail company, Bath, and Kitchen. The company's most recent monthly contribution format. income statement follows: A study indicates that $370,000 of foxed expenses being charged to the Bath Deportment are sunk costs or allocated costs that will continue even if the Bath Department is dropped. In addition, the elimination of the Bath Department would result in a 1056 decrease in the CM of the Kitchen Department. If the Bath Department is dropped, what will be the effect on the NOI of the company as a whole? Complete the table below. Show and habel all computations. Be sure to use words and numbers