Answered step by step

Verified Expert Solution

Question

1 Approved Answer

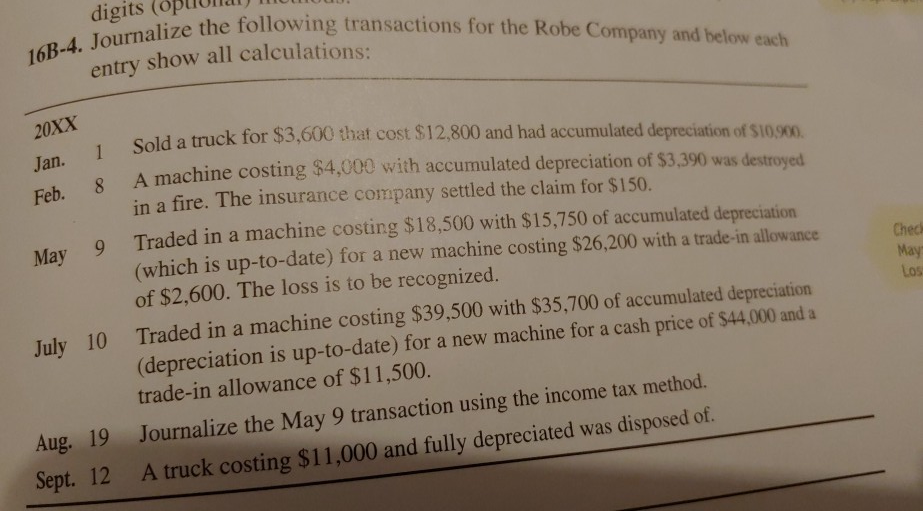

accounting for property plant equipment and intangible assets 16B-4. Journalize the following transactions for the Robe Company and below each entry show all calculations: digits

accounting for property plant equipment and intangible assets

16B-4. Journalize the following transactions for the Robe Company and below each entry show all calculations: digits 20XX Jan. 8 Feb. 9 Ched May Los Sold a truck for $3,600 that cost $12,800 and had accumulated depreciation of S10.800 A machine costing $4,000 with accumulated depreciation of $3,390 was destroyed in a fire. The insurance company settled the claim for $150. Traded in a machine costing $18,500 with $15,750 of accumulated depreciation May (which is up-to-date) for a new machine costing $26,200 with a trade-in allowance of $2,600. The loss is to be recognized. Traded in a machine costing $39,500 with $35,700 of accumulated depreciation (depreciation is up-to-date) for a new machine for a cash price of $44,000 and a trade-in allowance of $11,500. Aug. 19 Journalize the May 9 transaction using the income tax method. Sept. 12 A truck costing $11,000 and fully depreciated was disposed of. July 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started