Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following questions about the pro-forma income statement prepared in accordance with AASB 1056. (a) Is the entity a defined contribution or a

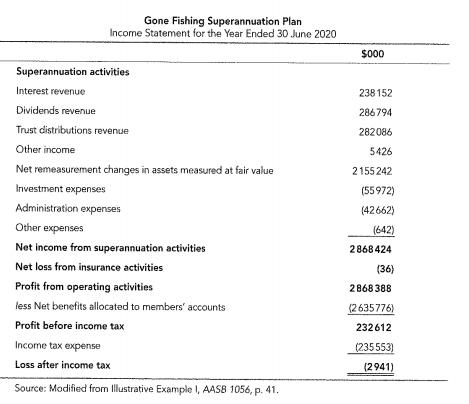

Answer the following questions about the pro-forma income statement prepared in accordance with AASB 1056. (a) Is the entity a defined contribution or a defined benefit superannuation entity? Explain. (b) Why does AASB 1056 require superannuation entities and approved deposit funds to prepare an income statement rather than a single statement of comprehensive income? (c) The net benefit allocated to members' accounts of $2635776 is shown as a loss. Explain why this allocation, which increases members' accrued benefits, is recognised as a loss. (LOS) Gone Fishing Superannuation Plan Income Statement for the Year Ended 30 June 2020 Superannuation activities Interest revenue Dividends revenue Trust distributions revenue Other income Net remeasurement changes in assets measured at fair value Investment expenses Administration expenses Other expenses Net income from superannuation activities Net loss from insurance activities Profit from operating activities less Net benefits allocated to members' accounts Profit before income tax Income tax expense Loss after income tax Source: Modified from Illustrative Example I, AASB 1056, p. 41. $000 238152 286794 282086 5426 2155242 (55972) (42662) (642) 2868424 (36) 2868388 (2635776) 232612 (235553) (2941)

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Is the entity a defined contribution or a defined benefit super ann uation entity Explain ANS WER ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started