Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. From the following transactions, you are required to identify the account (s) to be debited nd credited and make the journal entry in

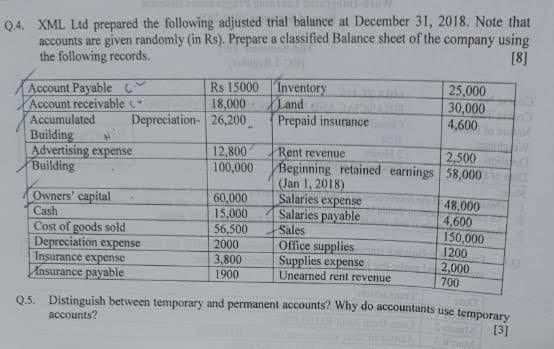

1. From the following transactions, you are required to identify the account (s) to be debited nd credited and make the journal entry in the specified format. (8] Transaction Initial investment by owners, Rs400,000 Loan from bank Rs100,000 Acquired store equipment for cash Rs15,000 Acquired inventory for cash Rs120000 Acquired inventory on credit Rs10,000. Acquired merchandise inventory for Rs10,000 cash plus 20,000 on credit Disposal of equipment for cash Rs1000 Returned inventory to supplier for full credit, Rs800 (Sequel to March 6) Paid cash to suppliers Rs4,000 Date March 1 March 2 March 3 March 4 March 5 March 6 March 7 March 8 March 9 March 10 Sales on credit, Rs160,000 March 10 Cost of merchandise inventory sold Rs1,00,000 Collections from account receivables Rs5,000 Paid rent expense in advance Rs6000 March 11 March 12 March 13 Recognize depreciation expense of, Rs100 April 12 Recognize the rent expense of Rs2,000 Q.2. Using the transactions given in question Nol (Q.1), you are required to post the journal entries to respective ledger account? (8] Q.3. What are the three types of business activities? Mention two specific features of each business activity? [31 Q4. XML Ltd prepared the following adjusted trial balance at December 31, 2018. Note that accounts are given randomly (in Rs). Prepare a classified Balance sheet of the company using the following records. [8] 25,000 30,000 4,600 Rs 15000 Inventory Account Payable Account receivable Accumulated Building Advertising expenise Building 18,000 Land Depreciation- 26,200 Prepaid insurance 12,800 100,000 Rent revenue Beginning retained earnings 58,000 (Jan 1, 2018) Salaries expense Salaries payable Sales Office supplies Supplies expense Unearned rent revenue 2,500 60,000 15,000 Owners' capital 48,000 4,600 150,000 1200 2,000 700 Cash Cost of goods sold Depreciation expense Insurance expense Ansurance payable 56,500 2000 3,800 1900 0.5. Distinguish between temporary and permanent accounts? Why do accountants use temporary accounts? [3]

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started