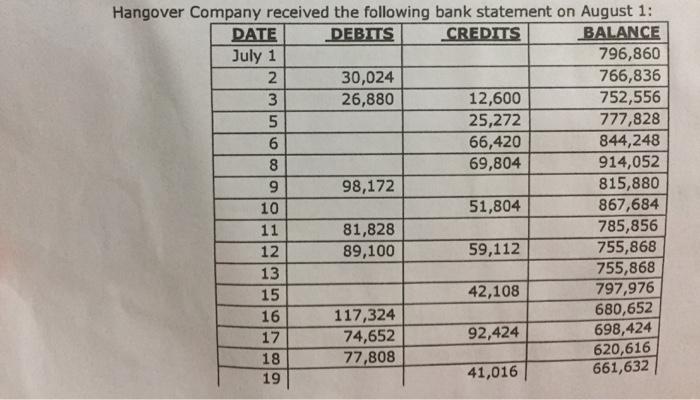

Hangover Company received the following bank statement on August 1: DEBITS CREDITS BALANCE DATE July 1 2 3 5 6 8 9 10 11

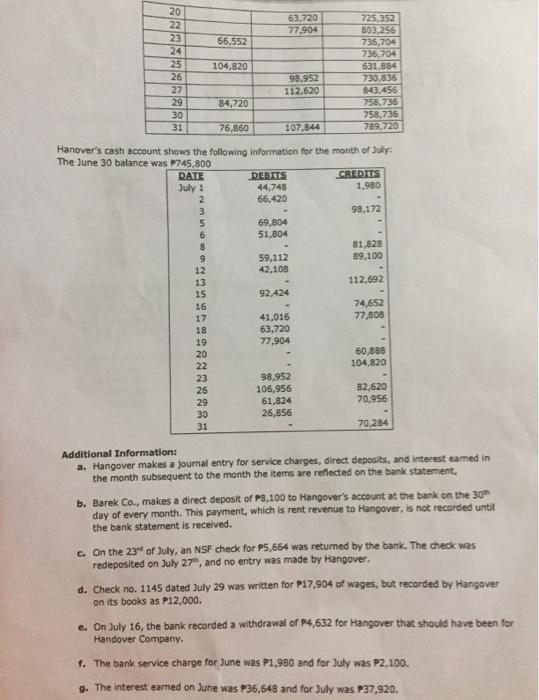

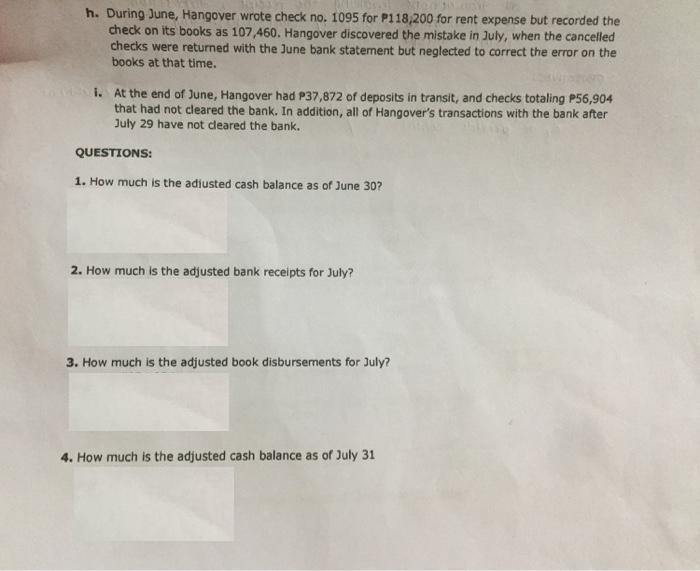

Hangover Company received the following bank statement on August 1: DEBITS CREDITS BALANCE DATE July 1 2 3 5 6 8 9 10 11 12 13 15 16 17 18 19 30,024 26,880 98,172 81,828 89,100 117,324 74,652 77,808 12,600 25,272 66,420 69,804 51,804 59,112 42,108 92,424 41,016 796,860 766,836 752,556 777,828 844,248 914,052 815,880 867,684 785,856 755,868 755,868 797,976 680,652 698,424 620,616 661,632 FURNEMINES July 1 2356860 9 12 13 15 16 17 18 19 20 222222 23 107,844 Hanover's cash account shows the following information for the month of July: The June 30 balance was 745,800 DATE 26 29 30 66,552 31 104,820 84,720 76,860 98,952 112,620 63,720 77,904 DEBITS 44,748 66,420 69,804 51,804 59,112 42,108 92,424 41,016 63,720 77,904 725,352 803,256 735,704 736,704 98,952 106,956 61,824 26,856 631.884 730,836 843,456 758,736 758,736 789,720 CREDITS 1,980 98,172 81,828 89,100 112,692 74,652 77,808 60,888 104,820 82,620 70,956 70,284 Additional Information: a. Hangover makes a journal entry for service charges, direct deposits, and interest earned in the month subsequent to the month the items are reflected on the bank statement, b. Barek Co., makes a direct deposit of PB,100 to Hangover's account at the bank on the 30th day of every month. This payment, which is rent revenue to Hangover, is not recorded until the bank statement is received. c. On the 23rd of July, an NSF check for P5,664 was returned by the bank. The check was redeposited on July 27th, and no entry was made by Hangover. d. Check no. 1145 dated July 29 was written for P17,904 of wages, but recorded by Hangover on its books as P12,000. e. On July 16, the bank recorded a withdrawal of P4,632 for Hangover that should have been for Handover Company. f. The bank service charge for June was P1,980 and for July was P2,100. g. The interest earned on June was P36,648 and for July was P37,920. h. During June, Hangover wrote check no. 1095 for P118,200 for rent expense but recorded the check on its books as 107,460. Hangover discovered the mistake in July, when the cancelled checks were returned with the June bank statement but neglected to correct the error on the books at that time. i. At the end of June, Hangover had P37,872 of deposits in transit, and checks totaling P56,904 that had not cleared the bank. In addition, all of Hangover's transactions with the bank after July 29 have not cleared the bank. QUESTIONS: 1. How much is the adjusted cash balance as of June 30? 2. How much is the adjusted bank receipts for July? 3. How much is the adjusted book disbursements for July? 4. How much is the adjusted cash balance as of July 31

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine the adjusted cash balance as of June 30 we need to prepare a bank reconciliation Begin by comparing the book balance to the bank balance Bank Balance as of June 30 Starting with the July ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started