Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is the information that the purchasers have given you: Gross salary of Mr. Buyer: $98,000 Gross salary of Mrs. Buyer: $46,000 Yearly municipal

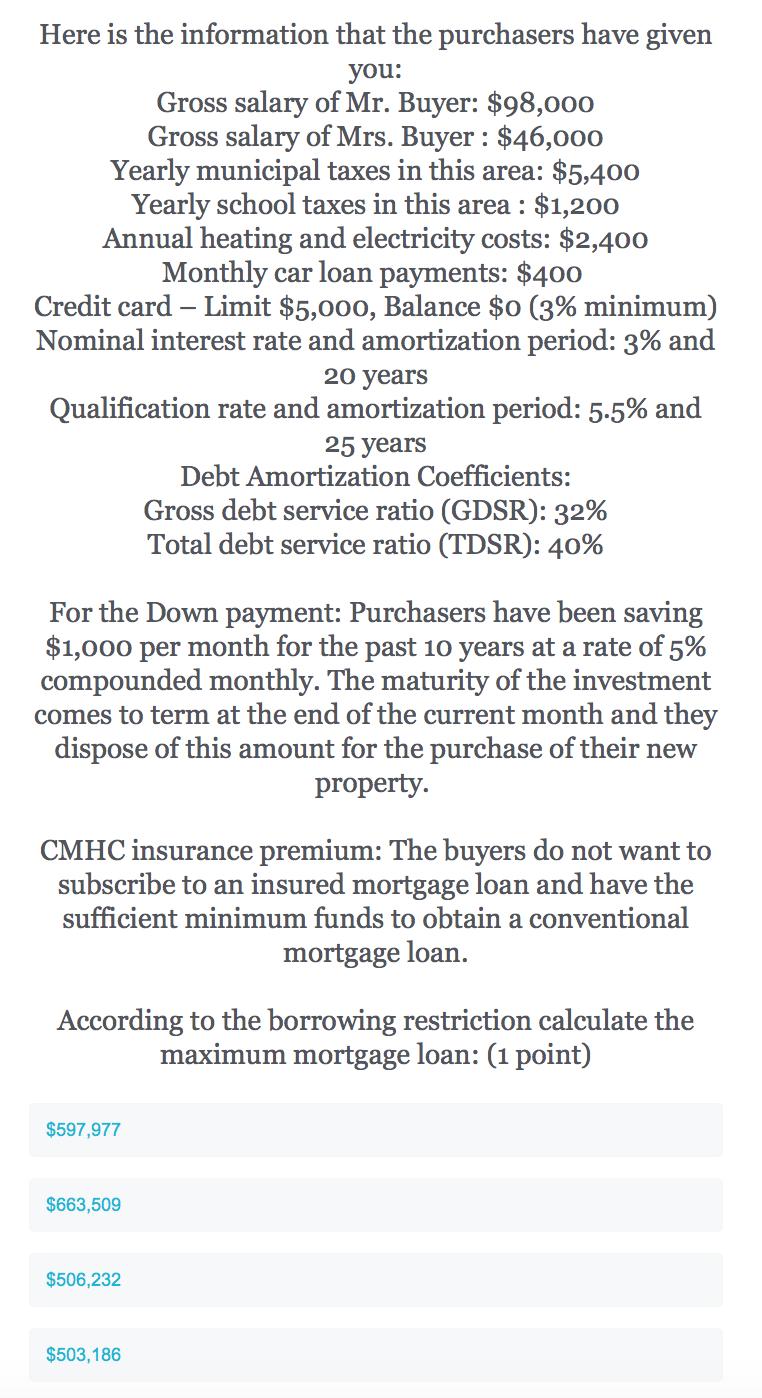

Here is the information that the purchasers have given you: Gross salary of Mr. Buyer: $98,000 Gross salary of Mrs. Buyer: $46,000 Yearly municipal taxes in this area: $5,400 Yearly school taxes in this area : $1,200 Annual heating and electricity costs: $2,400 Monthly car loan payments: $400 Credit card - Limit $5,000, Balance $0 (3% minimum) Nominal interest rate and amortization period: 3% and 20 years Qualification rate and amortization period: 5.5% and 25 years Debt Amortization Coefficients: Gross debt service ratio (GDSR): 32% Total debt service ratio (TDSR): 40% For the Down payment: Purchasers have been saving $1,000 per month for the past 10 years at a rate of 5% compounded monthly. The maturity of the investment comes to term at the end of the current month and they dispose of this amount for the purchase of their new property. CMHC insurance premium: The buyers do not want to subscribe to an insured mortgage loan and have the sufficient minimum funds to obtain a conventional mortgage loan. According to the borrowing restriction calculate the maximum mortgage loan: (1 point) $597,977 $663,509 $506,232 $503,186

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

506232 WORKINGS Gross salary of Mr Buyer 98000 Gross salary of Mrs Buyer 46000 Total gross income 98...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started