Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Business Accounting (M20431) You have recently joined a renowned accountancy firm as a management consultant. Laura, a sole trader, is a new client who

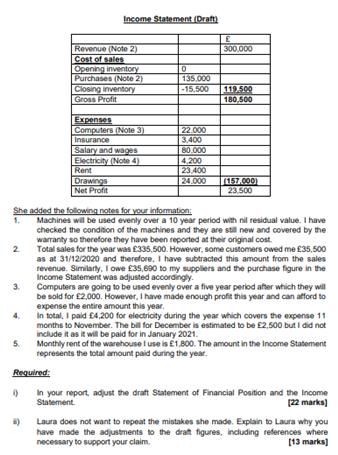

Business Accounting (M20431) You have recently joined a renowned accountancy firm as a management consultant. Laura, a sole trader, is a new client who receives various accounting and consultancy services from your firm. The manager of the firm asked you to prepare a report for Laura addressing the following issues: a) She had a successful first year of trading and has produced the following draft Statement of Financial Position and Income Statement for the year ending and as at 31/12/2020. She doesn't have accounting knowledge and asked your firm to take a look at it and finalise it after making any necessary adjustments: Non-current assets Machinery (Note 1) Current assets Inventories Statement of Financial Position (Draft) Trade receivables (Note 2) Cash Total assets CAPITAL AND LIABILITIES Capital invested on 01/01/2020 Current liabilities Trade payables Total equity and liabilities 15,500 35,500 40,300 Cost 140,000 91.300 231,300 132,300 35,690 167,990 2 3. 5. Income Statement (Draft) Revenue (Note 2) Cost of sales Opening inventory Purchases (Note 2) 6) Closing inventory Gross Profit Expenses Computers (Note 3) Insurance Salary and wages Electricity (Note 4) Rent Drawings Net Profit 0 135,000 -15,500 119.500 180,500 22.000 3,400 She added the following notes for your information: 1. Machines will be used evenly over a 10 year period with nil residual value. I have checked the condition of the machines and they are still new and covered by the warranty so therefore they have been reported at their original cost. 300,000 80.000 4,200 23,400 24.000 (157.000) 23,500 Total sales for the year was 335,500. However, some customers owed me 35,500 as at 31/12/2020 and therefore, I have subtracted this amount from the sales revenue. Similarly, I owe 35,690 to my suppliers and the purchase figure in the Income Statement was adjusted accordingly. Computers are going to be used evenly over a five year period after which they will be sold for 2,000. However, I have made enough profit this year and can afford to expense the entire amount this year. In total, 1 paid 4,200 for electricity during the year which covers the expense 11 months to November. The bill for December is estimated to be 2,500 but I did not include it as it will be paid for in January 2021. Monthly rent of the warehouse I use is 1,800. The amount in the Income Statement represents the total amount paid during the year. Required: () In your report, adjust the draft Statement of Financial Position and the Income Statement. [22 marks] Laura does not want to repeat the mistakes she made. Explain to Laura why you have made the adjustments to the draft figures, including references where necessary to support your claim. [13 marks]

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Adjusted Statement of Financial Position Noncurrent assets Cost Accumulated Depreciation Note 1 Machinery Note 1 140000 14000 126000 Current assets Inventories 15500 Trade receivables Note 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started