Answered step by step

Verified Expert Solution

Question

1 Approved Answer

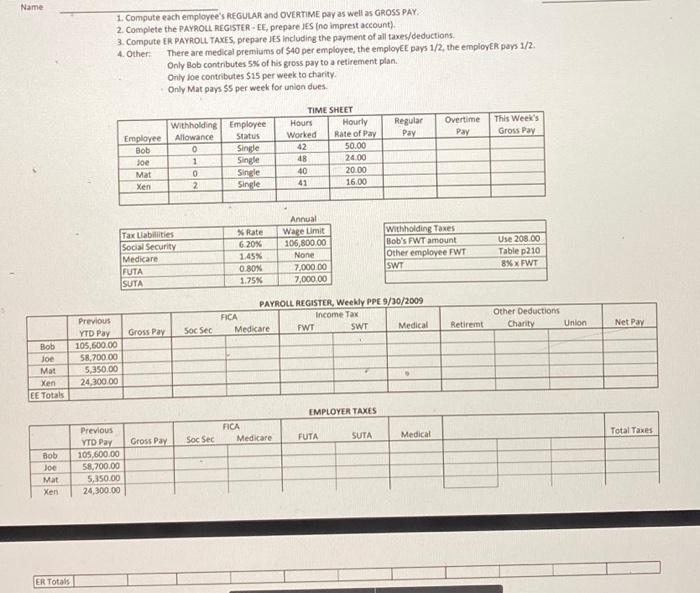

Name Bob Joe Mat Xen EE Totals Bob Joe Mat Xen ER Totals 1. Compute each employee's REGULAR and OVERTIME pay as well as

Name Bob Joe Mat Xen EE Totals Bob Joe Mat Xen ER Totals 1. Compute each employee's REGULAR and OVERTIME pay as well as GROSS PAY. 2. Complete the PAYROLL REGISTER-EE, prepare JES (no imprest account). 3. Compute ER PAYROLL TAXES, prepare JES including the payment of all taxes/deductions. 4. Other: Previous YTD Pay 105,600.00 58,700.00 5,350.00 24,300.00 Previous YTD Pay 105,600.00 58,700.00 5,350.00 24,300.00 Employee Bob 200 Mat Xen FUTA SUTA There are medical premiums of $40 per employee, the employEE pays 1/2, the employER pays 1/2. Only Bob contributes 5% of his gross pay to a retirement plan. Only Joe contributes $15 per week to charity. Only Mat pays $5 per week for union dues. Tax Liabilities Social Security Medicare Gross Pay Withholding Allowance 0 1 0 2 Gross Pay Soc Sec Soc Sec Employee Status Single Single Single Single % Rate 6.20% 1.45% 0.80% 1.75% FICA Medicare FICA TIME SHEET Medicare Hours Worked 42 48 40 41 Annual Wage Limit 106,800.00 None 7,000.00 7,000.00 PAYROLL REGISTER, Weekly PPE 9/30/2009 Income Tax FWT Hourly Rate of Pay 50.00 24.00 20.00 16.00 FUTA SWT EMPLOYER TAXES Regular Pay SUTA Withholding Taxes Bob's FWT amount. Other employee FWT SWT Medical Overtime Pay Medical Retiremt This Week's Gross Pay Use 208.00 Table p210 8% x FWT Other Deductions Charity Union Net Pay Total Taxes

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To compute the required information and present it in table format we need to organize the given data and perform the necessary calculations Lets brea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started