Answered step by step

Verified Expert Solution

Question

1 Approved Answer

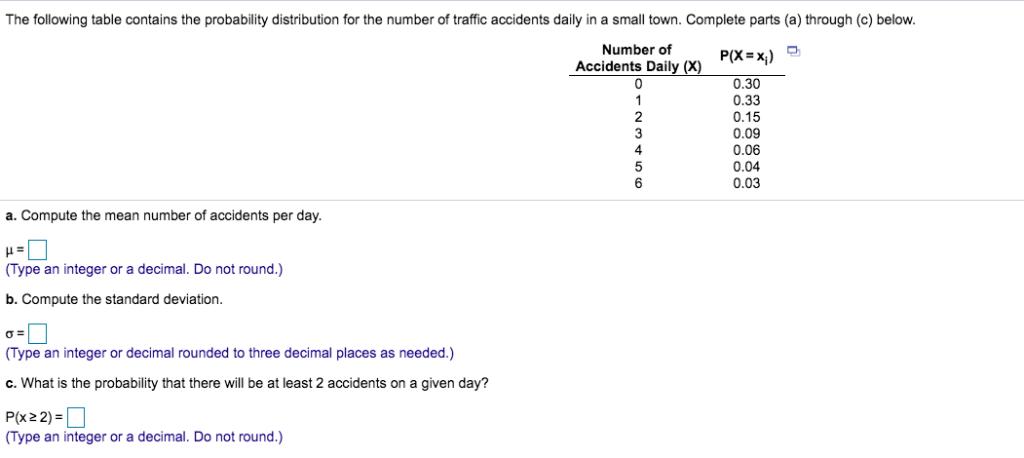

The following table contains the probability distribution for the number of traffic accidents daily in a small town. Complete parts (a) through (c) below.

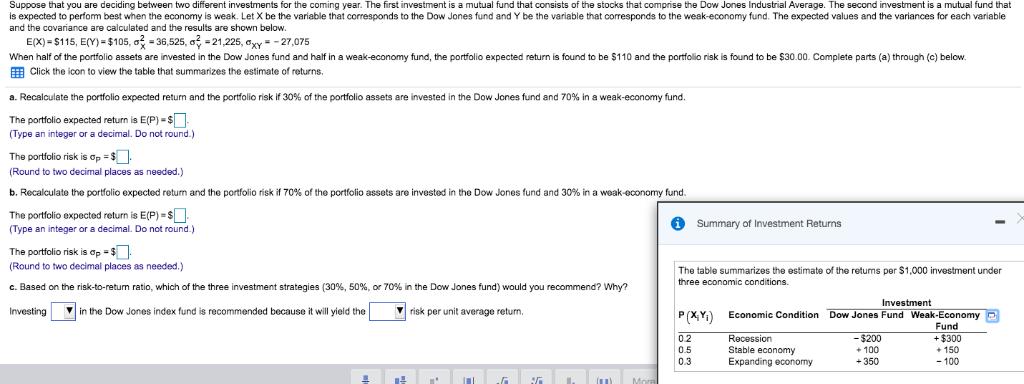

The following table contains the probability distribution for the number of traffic accidents daily in a small town. Complete parts (a) through (c) below. Number of P(X = x,) Accidents Daily (X) 0.30 0.33 0.15 0.09 0.06 4 0.04 0.03 6 a. Compute the mean number of accidents per day. (Type an integer or a decimal. Do not round.) b. Compute the standard deviation. (Type an integer or decimal rounded to three decimal places as needed.) c. What is the probability that there will be at least 2 accidents on a given day? P(x2 2) = (Type an integer or a decimal. Do not round.) Suppose that you are deciding between two different investments for the coming year. The first investment is a mutual fund that consists of the stocks that comprise the Dow Jones Industrial Average. The second investment is a mutual fund that is expected to perform best when the economy is weak. Let X be the variable that corresponds to the Dow Jones fund and Y be the variable that corresponds to the weak-economy fund. The expected values and the variances for each variable and the covariance are calculated and the results are shown below. E(X) = $115, E(Y) = $105, o - 36,525, o = 21,225, oyy = - 27,075 When half of the portfolio assets are invested in the Dow Jones fund and half in a weak-economy fund, the portfolio expected return is found to be $110 and the portfolio risk is found to be $30.00. Complete parts (a) through (c) below. E Click the icon to view the table that summarizes the estimate of returns. a. Recalculate the portfolio expected return and the portfolio risk if 30% of the portfolio assets are invested in the Dow Jones fund and 70% in a weak-economy fund. The portfolio expected return is E(P) =$ (Type an integer or a decimal. Do not round.) The portfolio risk is op $ (Round to two decimal places as needed.) b. Recalculate the portfolio expected retum and the portfolio risk if 70% of the portfolio assets are invested in the Dow Jones fund and 30% in a weak-economy fund. The portfolio expected return is E(P) = $ (Type an integer or a decimal. Do not round.) i Summary of Investment Returns The portfolio risk is ap -$ (Round to two decimal places as needed.) The table summarizes the estimate of the retums per $1,000 investment under three economic conditions. c. Based on the risk-to-retum ratio, which of the three investment strategies (30%, 50%, or 70% in the Dow Jones fund) would you recommend? Why? Investment Investing V in the Dow Jones index fund is recommended because it will yield the V risk per unit average return. P(X,Y) Economic Condition Dow Jones Fund Weak-Economy D Fund + $300 + 150 - 100 02 Recession - $200 0.5 Stable economy + 100 0.3 Expanding economy + 350

Step by Step Solution

★★★★★

3.26 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started