Answered step by step

Verified Expert Solution

Question

1 Approved Answer

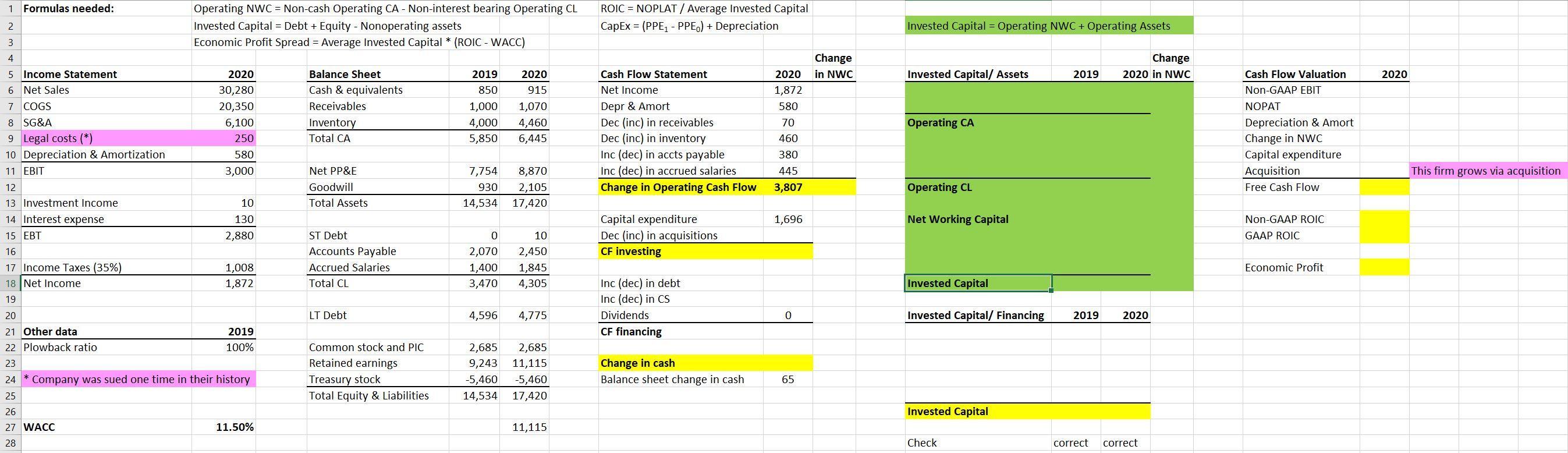

I need help finishing the cash flow statement, as well as the table in green and cash flow valuation. If possible, please help on formulas,

I need help finishing the cash flow statement, as well as the table in green and cash flow valuation. If possible, please help on formulas, by typing them and listing the cell in Excel I should put them in.

1 Formulas needed: 2 3 4 5 Income Statement 6 Net Sales 7 COGS 8 SG&A 9 Legal costs (*) 10 Depreciation & Amortization 11 EBIT Operating NWC = Non-cash Operating CA - Non-interest bearing Operating CL Invested Capital = Debt + Equity - Nonoperating assets Economic Profit Spread = Average Invested Capital * (ROIC - WACC) 25 26 27 WACC 28 2020 30,280 20,350 6,100 250 580 3,000 12 13 Investment Income 14 Interest expense 15 EBT 16 17 Income Taxes (35%) 18 Net Income 19 20 21 Other data 22 Plowback ratio 23 24 Company was sued one time in their history 10 130 2,880 1,008 1,872 2019 100% 11.50% Balance Sheet Cash & equivalents Receivables Inventory Total CA Net PP&E Goodwill Total Assets ST Debt Accounts Payable Accrued Salaries Total CL LT Debt Common stock and PIC Retained earnings Treasury stock Total Equity & Liabilities 2019 850 1,000 4,000 5,850 7,754 930 14,534 0 2,070 1,400 3,470 4,596 2,685 9,243 -5,460 14,534 2020 915 1,070 4,460 6,445 8,870 2,105 17,420 10 2,450 1,845 4,305 4,775 2,685 11,115 -5,460 17,420 11,115 ROIC = NOPLAT / Average Invested Capital CapEx = (PPE - PPE) + Depreciation Cash Flow Statement Net Income Depr & Amort Dec (inc) in receivables Dec (inc) in inventory Inc (dec) in accts payable Inc (dec) in accrued salaries Change in Operating Cash Flow Capital expenditure Dec (inc) in acquisitions CF investing Inc (dec) in debt Inc (dec) in CS Dividends CF financing Change in cash Balance sheet change in cash Change 2020 in NWC 1,872 580 70 460 380 445 3,807 1,696 0 65 Invested Capital = Operating NWC + Operating Assets Invested Capital/ Assets Operating CA Operating CL Net Working Capital Invested Capital Invested Capital/ Financing Invested Capital Check Change 2019 2020 in NWC 2019 2020 correct correct Cash Flow Valuation Non-GAAP EBIT NOPAT Depreciation & Amort Change in NWC Capital expenditure Acquisition Free Cash Flow Non-GAAP ROIC GAAP ROIC Economic Profit 2020 This firm grows via acquisition

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started